Who are the UK’s major pork trading partners?

Wednesday, 19 June 2024

Key points

- UK pig meat production is up 0.6% year on year for the period January–April

- Imports of pig meat are up 3% year on year despite weaker domestic consumption

- The EU27 accounts for over 99% of UK import volume

- Exports of pig meat are down 3% year on year with economies struggling with high inflation

- Offal shipments remain at a higher volume than any other product category

- New trade agreements provide further export opportunities

Overview

For the year to date (Jan–Apr), the UK produced 306,400 tonnes of pig meat, according to Defra data. Despite lower slaughter throughputs in 2024, higher average carcase weights have resulted in production volumes growing 0.6% year on year.

Global demand for pork appears to remain subdued with many economies still struggling with high inflation and consumers more wary around spending habits. Alongside this stands geopolitical uncertainly due to several imminent high-profile elections. Total pig meat exports (including offal) from the UK stood just short of 100,500 tonnes in the first four months of the year, a 3% decline compared to the same period last year. On the contrary, UK imports of pig meat (including offal) are up 3% year on year, despite weaker domestic consumption.

Imports

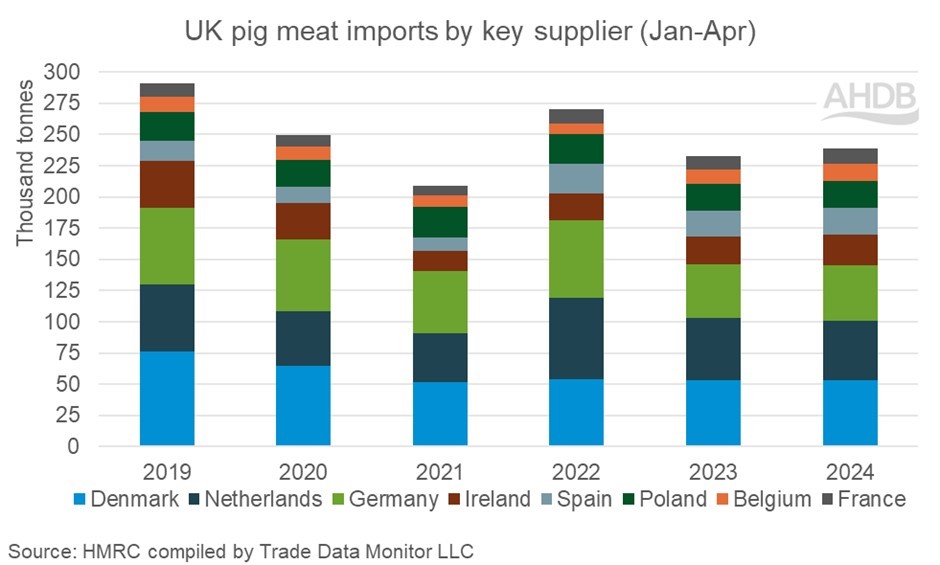

Although overall import volumes have increased to 251,500 tonnes so far this year, the growth has not been reflected across all product categories. Over 99% of UK imports are sourced from within the EU27. Fresh/frozen pork is the largest category, with 106,600 tonnes received from the EU27 for the year to date, up 4% on 2023. Denmark and Germany hold the largest market shares at 25% and 23%, respectively. Strong growth has also been recorded in sausage volume, up 7% on 2023, where Germany (28%) and Poland (18%) account for the largest shipments. Processed pig meat has seen volume decline since 2022, with Germany recording the largest loss in shipments. However, Poland and Ireland maintain their market share at 30% and 24%, respectively. Bacon imports have also been in decline for the last two years, but the largest shipments continue to be sourced from the Netherlands (57%) and Denmark (33%).

Exports

Similar to imports, the overall export volume change is not reflected in all product categories. The decline in UK pig meat exports is predominantly driven by a fall in shipments of fresh/frozen pork, although bacon volumes have also weakened year on year. The top four destinations for UK product remain the same year on year (EU27, China, Philippines and the USA), but an increase in shipped volume to South Africa has changed the fifth place, knocking South Korea down to sixth.

Offal

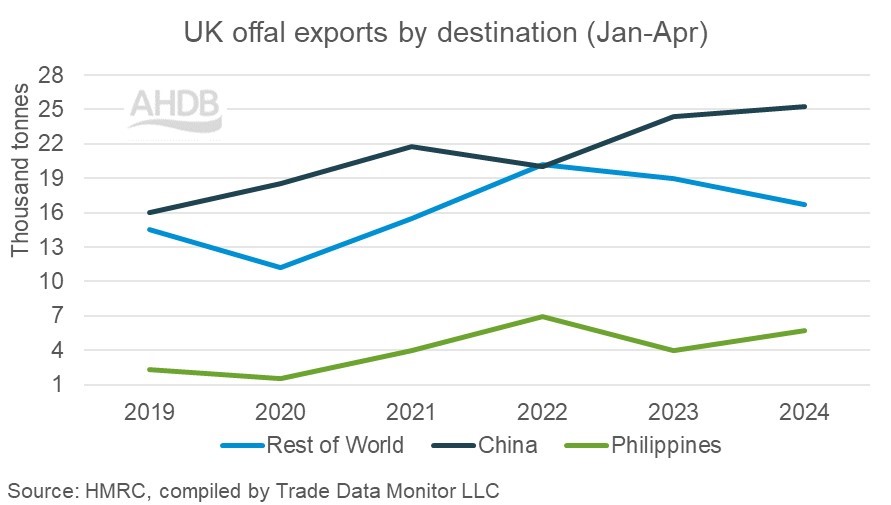

Exports of offal have been steadily increasing in recent years, predominantly driven by increased demand in South East Asia and improved market access, with Mexico and Vietnam added to our list of partners earlier this year. For the last two years, volumes of offal exported have been higher than that of fresh/frozen pork, totalling 47,700 tonnes so far this year. This trade provides a vital solution to some of the carcase balance issues we face and helps support domestic pig prices by giving value to every part of a pig.

China is the largest customer of UK offal, holding a 53% market share. Shipments to China have been increasing year on year, with volumes up 4% in Jan–Apr 2024. The Philippines is another important destination for offal, holding a 12% market share. The Philippines National Economic and Development Authority (NEDA) has recently agreed to extend the reduced tariff rate on pork to 2028, keeping this as a lucrative market for UK exporters.

Fresh/Frozen

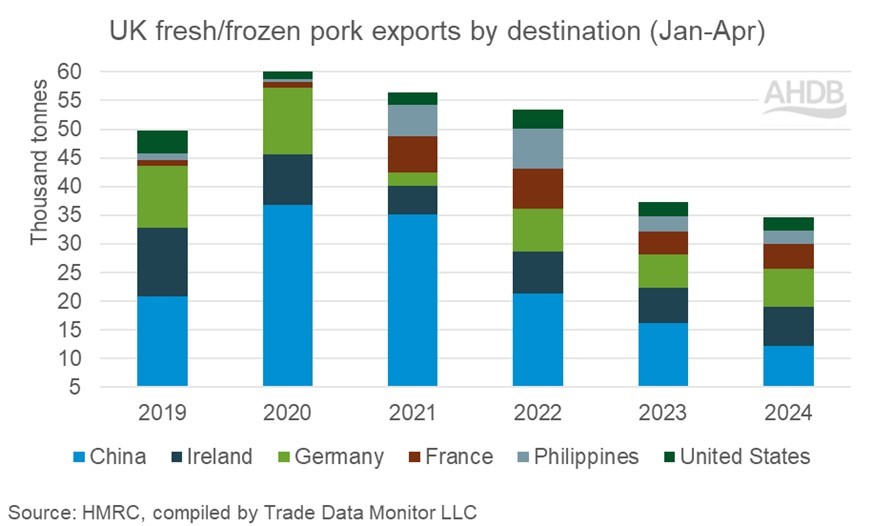

The fresh/frozen pork category is now the second-largest category of exported pig meat at 41,600 tonnes in the first four months of 2024, a 7% decline year on year. The EU27 takes a 49% share of the volume within this category, with Ireland, Germany and France all key destinations on the continent. It is predominantly fresh or chilled carcases and half carcases as well as boneless cuts, especially bellies that head into the EU27.

China also takes a significant volume of fresh/frozen pork, with a 30% market share. The majority of these shipments are made up of frozen bone-in product. Meanwhile the Philippines and USA also hold a good share of category volume at 6% and 5%, respectively. As with China, these shipments are mainly frozen bone-in product, especially fore-ends and loins for the USA.

Processed, bacon and sausage

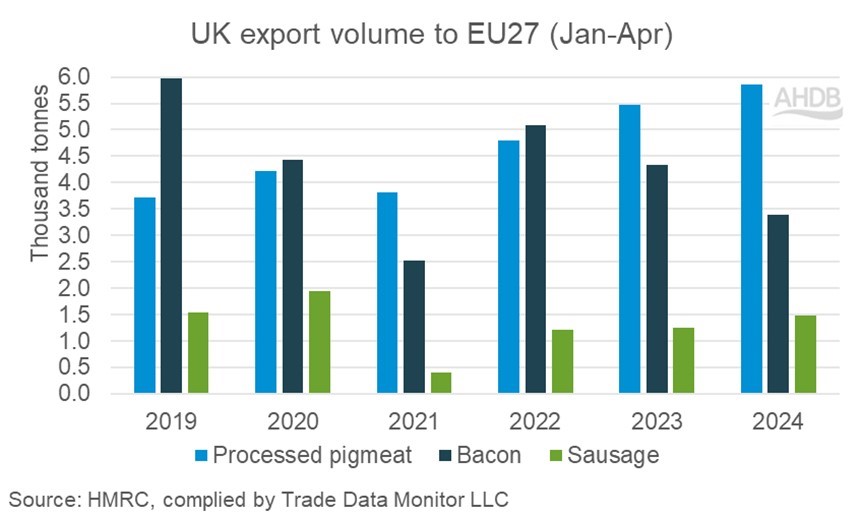

Export volumes of processed pigmeat, bacon and sausage are much smaller, with 5,900 tonnes, 3,600 tonnes and 1,700 tonnes, respectively, shipped in the year to date. Shipments of bacon have been in decline for the last two years; meanwhile processed pig meat and sausage have recorded year-on-year growth.

The EU27 is our key trading partner for these products. For all three product categories, Ireland and Spain sit in the top five destination countries. France is also key for both processed pig meat and bacon, while Italy is a key destination for sausage.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.