What has been happening to natural gas and fertiliser prices? Grain market daily

Friday, 14 October 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £282.55/t yesterday, down £0.80/t from Wednesday’s close. The Nov-23 contract fell just £0.10/t over the same period, closing at £272.00/t.

- Chicago wheat futures (Dec-22) gained $3.67/t yesterday, closing at $327.81/t. This was due concerns over the renewal of the Black Sea grain corridor.

- UK feed wheat futures did not follow the Paris and Chicago market higher as the pound strengthened against both the dollar (+2.0%) and euro (+1.3%) yesterday.

- Paris rapeseed futures (Nov-22) closed yesterday at €633.75/t, gaining €0.75/t from Wednesday’s close.

What has been happening to natural gas and fertiliser prices?

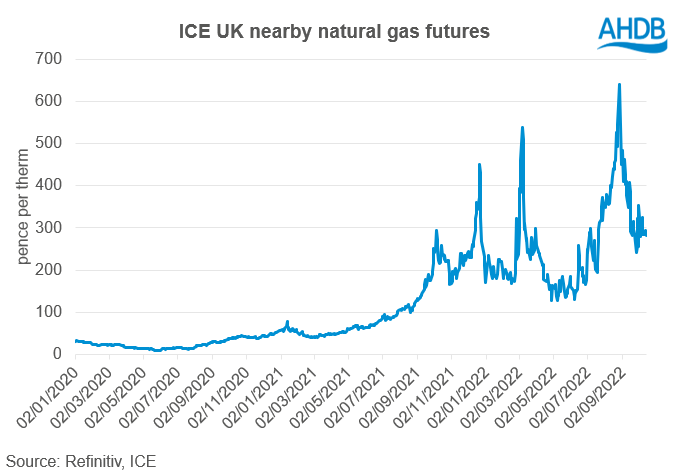

Nearby ICE Natural gas prices are still at historically high levels, finding underlying support from tightened gas supplies from Russia, and EU demand going into the colder months. With natural gas making up 60-80% of European fertiliser production costs, high prices have caused CF Industries to close their Billingham plant. As a result, there has been increased reliance on imported fertiliser to fulfil the UK’s fertiliser demand.

Natural gas markets were supported when damage caused leaks in the Nord Stream 1 pipeline at the end of September. Since our last update prices have dropped from 408.20p/therm (14 September) to close at 281.37p/therm yesterday. This is still 19.4% above the same day in 2021 and remains historically high. The recent pressure on prices has been from large U.S. inventories and lower demand, increases in European storage and consistent flows from Norway reducing supply concerns. So far this week prices have tracked sideways.

Fertiliser price update

In September imported Ammonium Nitrate (AN) increased by 5% to £870/tonne compared to August and has increased by 120% compared to September 2021’s price of £395/tonne.

This annual price increase is going to squeeze 2023 margins. However, anecdotal comments suggest the dry weather we had before harvest reduced fertiliser application. This allowed fertiliser to be held back for this year where farms have storage. Further to that, some growers have already purchased some of this season’s (2022/23) fertiliser when prices were slightly cheaper at the end of the 2021/22 marketing year.

With these current high fertiliser prices though it’s expected that there will be marginally less applied to harvest 23 crops with farmers trying to reduce input costs. With volatility and the weakening of sterling this will make imports more expensive which could dampen fertiliser demand.

However, with these historically high fertiliser prices we do have historically high grain prices. At the end of the day, it’s a balancing act to managing input costs and the price you receive at the farm gate for your grain. The nitrogen fertiliser adjustment calculator can help adjust your fertiliser to a new ‘economic optimum’ or the point at which the value of extra grain produced is not worth the cost of the extra nitrogen applied.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.