Natural gas prices remain volatile: Grain market daily

Thursday, 15 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £277.15/t yesterday, marginally up (£0.05/t) from Tuesday’s close. The Nov-23 contract closed at £263.45/t, up £0.70/t over the same period.

- Grain exports from Ukraine are increasing, with 1.5Mt exported so far this month (by the end of 13 September).

- In August, the UK CPIH inflation rate increased by 8.6% on the year, down from 8.8% in July. A fall in petrol station pump prices was the main contributor to the decline from July.

- Paris rapeseed futures (Nov-22) dropped €14.50/t from Tuesday’s close, settling at €592.00/t yesterday. Rapeseed prices tracked the wider oilseed complex, with markets pressured by global demand concerns as a result of a possible economic slowdown.

- The sixth and final GB harvest report is out tomorrow.

Natural gas prices remain volatile: Grain market daily

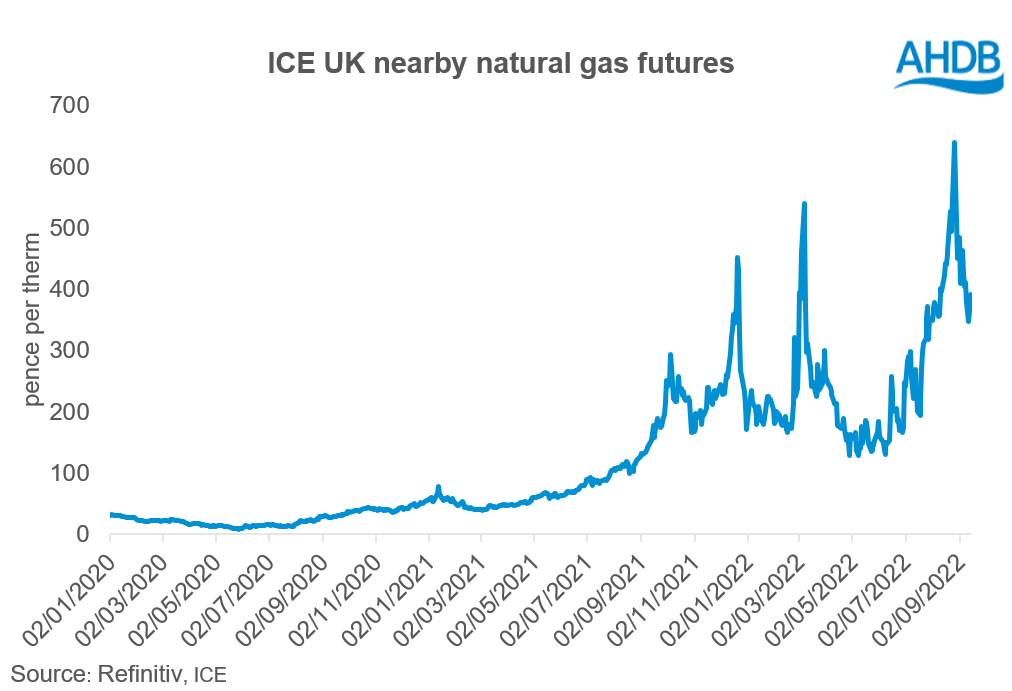

As has been well reported, natural gas prices have risen significantly this year, driven by a tightening in supplies from Russia as well as strong EU demand. On 26 August nearby ICE UK natural gas futures closed at the highest price on record at 640.36p/therm. While natural gas prices have come down since then, they remain historically high.

Earlier this week, natural gas prices dipped to levels last seen at the end of July, on the back of talks around possible EU interventions and gas storage continuing to be filled. Despite speculation, the EU announced yesterday that it will not cap Russian gas prices, leading to prices climbing once again. Yesterday, nearby UK natural gas futures closed at 408.20p/therm, 247% higher than the same point in 2021. Volatility is likely to remain in natural gas prices, driven partly by uncertainty around when the Nord Stream 1 pipeline will reopen.

Natural gas makes up around 60-80% of fertiliser production costs in Europe. The rising cost of gas has led to some fertiliser manufacturers pausing production, including CF Industries halting ammonia production at its Billingham site at the end of August.

The pausing of production at the Billingham plant means the UK now has a greater reliance on imported urea and liquid UAN (urea ammonium nitrate) products for fertiliser production.

With concerns over the UKs economic situation, the sterling has weakened further against both the euro and dollar in recent weeks. While a weaker pound makes us more competitive on the export market, it also makes imports more expensive. With a new reliance on imported ammonia for domestic fertiliser production, this adds further uncertainty to UK fertiliser markets.

Continued volatility in natural gas prices, both here and on the continent, as well as weakening currency, will continue to influence fertiliser prices and could squeeze grower margins further. Resources such as the nitrogen fertiliser adjustment calculator and analysis on different application strategies can help growers assess fertiliser applications in these current times.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.