IGC forecast record global grains production in 2021/22: Feed market report

Wednesday, 31 March 2021

By Thomma Shepherd

Grains

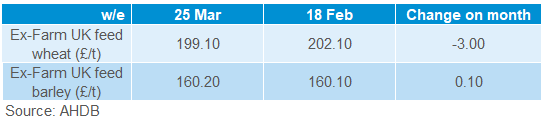

UK ex-farm wheat prices backed off in March, following a weakening in global grain markets. UK spot feed wheat was quoted at £199.10/t, down £3.00/t from last month (18 Feb-25 Mar), in the week ending 25 March. However, barley prices have remained relatively stable, gaining £0.10/t over the same period. The feed barley discount to feed wheat continued to slowly narrow, quoted at £38.90/t, compared to £42.00/t on 18 Feb.

As the UK will likely be a net importer next season, prices on the continent will go a long way to setting UK prices. A recent EU report showed that crop conditions in the EU are largely seen as positive, both against last year’s poor crops and against longer-term trends. It remains too early to give a true yield indication.

Globally, major exporters have had improved weather conditions, and many have upped their crop production estimates. This has helped lift supply concerns and has been a key contributor of the recent decline in global prices.

Improved conditions also led to the International Grains Council (IGC) forecasting record global grain production in 2021/22. Production of total grains is forecast at 2,287Mt, up 63Mt on 2020/21 production. Increases were seen in forecasts for wheat, maize and soyabeans. However, it is anticipated that this increased production will be absorbed by increased consumption.

Markets now wait for the much-anticipated USDA stocks and acreage reports, out on 31 March. How bullish or bearish this report is perceived will largely set market sentiment in the short term.

Proteins

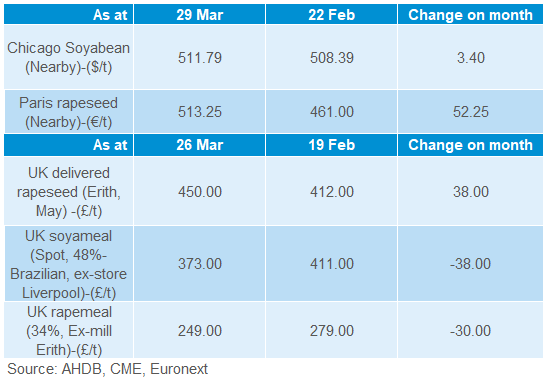

Nearby Chicago soyabean futures have gained $3.40/t over the past month (22 Feb-29 Mar), closing on Monday 29 March, at $511.79/t. Paris rapeseed futures have rallied aggressively, between 22 February and 29 March. Nearby prices gained €52.25/t over this period to close at €513.25/t. The move was led by a rally in Canadian canola prices and tight supply in the EU.

UK prices have followed the global rapeseed rally. Rapeseed, delivered Erith (May-20), firmed by £38.00/t between 19 February and 26 March. However, over the same period UK 48% Brazilian soyameal (spot, ex-store Liverpool) lost £38.00/t, quoted at £371.00/t on 26 March. UK 34% rapemeal (spot, ex-mill Erith) also weakened, down £30.00/t to £2490.00/t on 26 March.

Currency

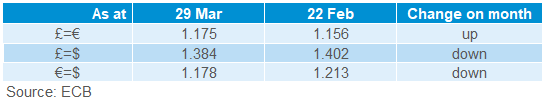

Between 22 February and 29 March, sterling gained 1.66% against the Euro, closing on 29 March at £1 = €1.175. Strength in sterling has been driven by a successful vaccination campaign in the UK, as well as the ever-increasing risk of a third wave in the EU. Sterling has weakened by 1.27% against the dollar, closing at £1 = $1.384 on 29 March. With international markets stabilising, the dollar has become more attractive.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.