Rapeseed prices rally, where next? Grain market daily

Tuesday, 2 March 2021

Market commentary

- UK wheat futures are relatively unchanged Friday to Monday. May-21 lost £0.10/t to close at £206.90/t and Nov-21 remained unchanged at £170.50/t.

- Over the same period, Chicago wheat and maize futures (May21) both lost $3.68/t and $3.64/t respectively. This was the lowest maize has traded in over two weeks, due to fund selling.

- Russian Consultancy SovEcon have raised their wheat export forecast to 39.1Mt, up 1.2Mt from the previous estimate. This increase is due to fast export pace prior to the 15 Feb wheat export tax.

- Australian wheat production is expected to total 25Mt in the 2021/22 season, down 25% from the current season. Rains caused by the La Niña have reduced acreage and yields.

Rapeseed prices rally, where next?

Last Friday, delivered rapeseed prices (May 21, Erith) were quoted at £429.50/t up £17.50/t on the week. This is the highest delivered rapeseed price into Erith for May delivery since January 2011. In contrast to this, new crop delivered prices (Nov 21) were quoted at a £56.50/t discount and had only gained £4.00/t on the week.

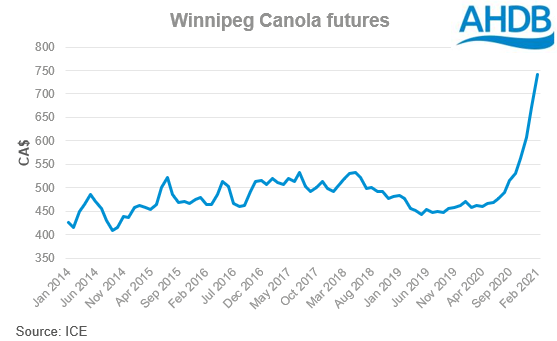

The market had been volatile over the week. Rising Canadian canola prices and a firming of crude oil and vegetable oil prices are providing the UK price with support. Since 04 January, Winnipeg canola futures (May 21) have rallied by CA$113.00/t. Over the same time, Erith delivered rapeseed prices for May 21 delivery have firmed by £30.50/t.

What has caused this rally?

Canada’s supplies for the 2020/21 season are estimated at 22.0Mt, 9% lower than last season. This due to a reduction in carry-in and a 5% production decrease. In Statistic Canada’s December stocks report, stocks were 24% lower than in December 2019. With Canadian exports forecast to increase by 8.5% and domestic crushing to increase by 1%, this leaves just a 0.7Mt carry over, 78% small than last year. The result? Canada’s stocks to use ratio is now pegged at 3%, versus 15% last year. With small European rapeseed crops and strong demand for world vegetable oil and protein meal, largely due to China’s rebuild of their pig herd, this has tightened world supply considerably.

Where could new crop prices go?

Looking forward to new crop, for both UK and Canada, prices are well behind old crop and have not rallied as strongly. Since the start of the year, Winnipeg Erith delivered rapeseed for November has only increased by £7.50/t to £373.00/t.

Canada’s new crop supply situation would seem even tighter than old crop. They are looking at increased production on the year (20.15Mt), due to increased area forecast and higher yield estimations. However, this increase in production is offset by sharply lower carry in stocks, meaning total supply is currently forecast at 20.95Mt, 1.0Mt lower than in 2020.

So what could this mean for the UK?

While the UK does not rely on Canadian canola, due to the majority of it being genetically modified, their position as a major global exporter ensures any tightening outlook on their supply will offer a bullish tone to the market. We have already seen a tightening outlook for EU27 and Ukrainian rapeseed supply for new crop. With the UK looking to need to price at import parity into new crop, this could well provide support going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.