Global new crop wheat conditions improve: Grain market daily

Tuesday, 23 March 2021

Market Commentary

- UK Wheat futures were relatively stable yesterday. May-21 gained £0.25/t to close at £197.75/t, while Nov-21 lost £0.25/t to close at £165.50/t. Sterling weakened for a second consecutive session against the Euro and is down again this morning, trading below £1= €1.16 at the time of writing.

- Chicago wheat futures also saw very little movement, the May-21 contract closed down $0.09/t at $230.24. The Dec-21 closed down $0.37/t at $229.81/t.

- As at 21 March, EU soft wheat exports had reached 19.34Mt so far for the 2020/21 season, this is down from 24.65Mt the same time last year.

- Heavy rains in Brazil are continuing to hamper the planting of their Safrinha maize crop, currently at 86% planted, 10 percentage points behind the historical average for this time of year.

Global new crop wheat conditions improve

Wheat markets are sliding currently, off the back of improved production forecasts some major exporting countries. There has also been a lack of fresh bullish news to continue supporting prices. Markets will likely now wait for the next USDA world supply and demand estimate, on 09 April.

US

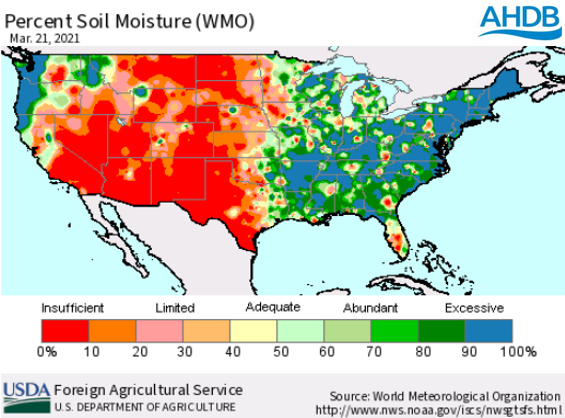

Recent rain and snow across the US plains has helped alleviate dryness concerns. A key watch point will be the US crop progress reports released weekly from 05 April giving crop condition scores for the 18 largest wheat producing states. However, some states publish their own ratings giving an earlier indication of conditions. On 21 March, Oklahoma has 62% rated good to excellent compared to 57% on 14 March. Kansas currently has 45% rated good to excellent, up 7% on the week.

EU

Last week, James went over current crop conditions in the EU, up to 08 March. Much of Europe has got away with very limited winter kill this year. There are few drought concerns and ample rainfall in parts have helped replenish water reservoirs, although slightly hampering spring drilling. Because of this, MARS have increased their 2021 EU wheat yield forecast to 5.67t/ha, up from 5.5t/ha in 2020. If realised, this would be 3.5% higher than the previous 5-year average of 5.47t/ha.

Russia

Last Wednesday, SovEcon raised their forecast for Russian wheat production in 2021/22 by 3.1Mt, to 79.3Mt. Recent favourable weather has meant that SovEcon reduced their winter kill estimation to 9.9%, from 16%. This said, there is still snow to thaw in Russia so the state of some crops is still unknown.

Ukraine

The Ukrainian government have announced total grain production for harvest 2021 could reach 75Mt, well ahead of 65.5Mt in 2020. Ukraine’s poor 2020 harvest has seen a reduction in grain exports. In 2020/21 it is expected exports will reach 45.4Mt, compared to 57Mt in 2019. However, this forecast bounce in production means exports could reach 53Mt in 2021/22.

Looking ahead

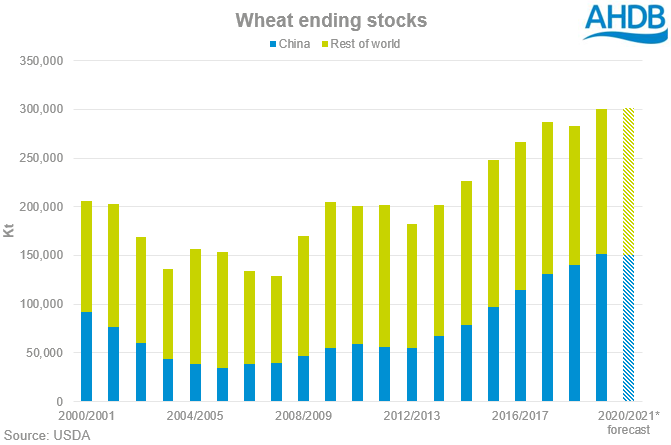

If we continue to see production estimates increased in these countries, this could put pressure on global markets. The USDA are currently forecasting record global wheat ending stocks for the 2020/21 season. However, it is important to remember that a lot of this supply is tied up inside China and not accessible on the global market.

With an increasing global production, and on-paper comfortable stocks, we could see supply worries for 2021/22 ease. Of course, there is still a long way to go until harvest and poor weather could seriously impact the yield potential of these crops.

Publications to watch out for

- US Crop Progress Reports – weekly from 05 April

- EU MARS bulletin – 26 April

- Canada Field Crop Area Survey – 27 April

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.