EU crop conditions fair, so far: Grain market daily

Tuesday, 16 March 2021

Market commentary

- UK feed wheat (May-21) futures fell for the fifth consecutive day yesterday, to close at £202.60/t. The gap between old crop and new crop prices also narrowed further yesterday. The Nov-21 contract closed unchanged at £170.00/t. The UK market followed moves in the Paris milling wheat futures.

- In the latest UK average ex-farm prices (Corn Returns), spot feed wheat gained £0.40/t to £204.50/t. Feed barley remains at a strong discount of £43.30/t to feed wheat, at £161.20/t. Looking ahead at April and May delivery, ex-farm feed wheat prices were flat at £206.30/t, suggesting limited demand.

EU crop conditions fair, so far

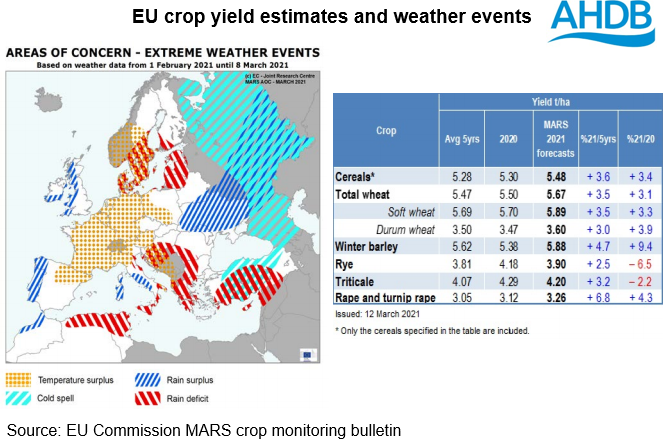

Yesterday, the EU Commission published its latest crop condition bulletin. The report covers the EU crop situation through to 8 March. With the UK likely be a net importer of both wheat and rapeseed next season. As such, conditions in the EU will go a long way to setting UK prices.

Conditions in the EU are largely seen as positive, both against last year’s poor crops and against longer-term trends. But, it remains too early to give a true yield indication.

In France, crops had a good start to the season. That said, recent wet conditions and low temperatures are thought to have had some limited impact on yield potential nationally. Rapeseed conditions are a bigger concern, with weevil pressure high.

For Germany, crops are considered to be in a “fair” condition. Soil moisture levels in Germany benefitted from a large swing in temperatures; snow cover on crops melted rapidly to improve soil moisture. The German association of Farm Cooperatives’ latest estimates peg wheat production up 0.9% on last year at 22.3Mt. Meanwhile, the rapeseed crop is seen falling by 0.7%, to 3.48Mt.

East European crops are generally seen to be in fair to good condition. As with much of Europe, weather patterns were mixed over winter. But, snow cover was generally adequate, and has helped to replenish soil moisture levels.

European Russia and Ukraine are also expected to have seen limited impacts from frost damage through to 8 March. However, some snow melt occurred after 8 March. This melt and the subsequent low temperatures could still have a negative effect on crops.

Strong crops will be needed in the EU in 2021/22 season. The increased interest in EU wheat exports this season has seen carry out stocks forecasts reduced. The latest USDA supply and demand estimates peg EU wheat stocks down 3.7Mt from 20219/20, at 10.6Mt. Whilst the EU commission balance sheets suggest ending stocks will be the tightest since 2018/19, it should be noted that these forecasts have not been updated since 25 February. Since then we have seen strong EU competition in global wheat tenders, which may tighten the current forecast further.

European trade association Coceral estimate EU-27 wheat production at 126.6Mt, up 7.9Mt on the year. While conditions currently support the view of larger crops in the EU, there is still plenty of time before the forecast is realised. Conditions will need monitoring closely for their impact on market sentiment.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.