Grain prices pressured as COVID-19 disrupts demand: Feed market report

Wednesday, 29 April 2020

By Alex Cook

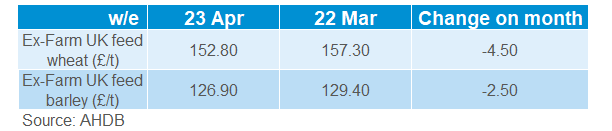

Grains

Domestic wheat prices overall remained relatively firm throughout April, despite pressures from the coronavirus pandemic. One of the main factors negatively affecting markets has been falling demand for maize from the US ethanol industry. This has pulled down US wheat prices. However, European wheat markets have seen increases over recent weeks as some Black Sea countries moved to impose wheat export restrictions.

The closure of many food service outlets both here in the UK and globally has affected the demand for wheat. A knock-on effect on demand for meat has also been seen, especially due to many events, including the Euro-2020 football championships, being postponed. This has pressured grain prices to fall due to the increased supply of grain available.

The April USDA supply and demand estimates detailed an increase to ending stocks for both wheat and maize, as a result of reduced consumption figures (see above). As mentioned previously, reduced demand for US maize from its ethanol sector has impacted global grain markets. This unexpected additional supply of maize will add to the global surplus of grain available for animal feed throughout this year, which will keep pressure on feed grain prices.

Current watch points for feed grain markets include:

South America: Southern parts of Brazil have been without rainfall for much of April, this dryness has also affected Northern parts of Argentina. Though it is a little too early to tell if there will be an effect on maize yields, it remains a watch-point nonetheless as any downward revisions to production figures will offer support to prices.

Black Sea: Dry conditions have persisted for much of Ukraine and parts of Southern Russia. Crop conditions are relatively unfavourable as a result. There has been some rainfall in recent days, but the volume has been below required levels. The UK imports large amounts of feed grain from Black Sea regions, so reductions to final production figures could lead to increases in imported grain prices.

US: Planting of maize and soyabean crops is underway, and usually finishes in the later weeks of May. Conditions are currently favourable and large areas of both are expected. Some maize area could be switched into soyabeans, covered below. However, plentiful stocks of maize are likely to remain in the US.

Looking at the UK, one developing issue throughout April was the lack of rainfall. The brighter weather enabled many growers to get on well with spring planting. However, the start to the silage season is beginning to see some effect from the dry weather. As of 27 April, seasonal grass growth data (kg DM/ha) dipped below the previous two years after trailing just 2018. There is rainfall expected in the near short term, which should alleviate some worries.

As we move into unprecedented territory with coronavirus, the UK grain trade has come together to provide advice on the steps to take when loading grain on farm, into port, or receiving deliveries of inputs. The coronavirus guidance for combinable crop deliveries and collections is available here.

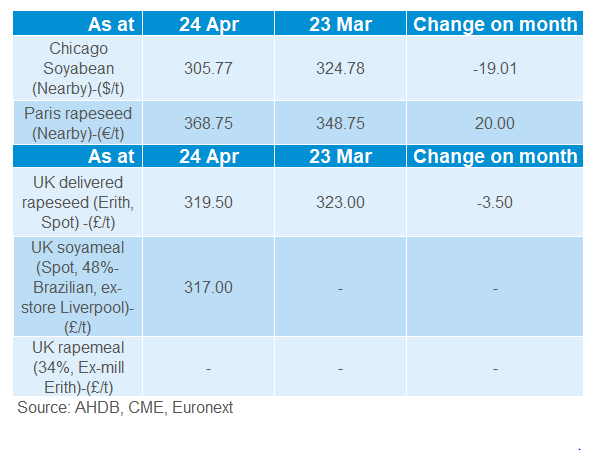

Proteins

Global oilseed prices continued their downward trajectory from March, pressured by the fall in demand for transport fuel. The International Energy Agency (IAE) expected demand for oil in April fall to levels not seen since 1995. There are knock-on effects on the vegetable oil sector, as some supply is used to create biodiesel. In March, the temporary closure of some bioethanol plants in the US affected the supply of the by-product dried distiller grains (DDG), a common feed alternative, this increased demand for soya meal.

In April, we have seen soya meal prices fall back from high prices seen in March. As the UK is a net-importer of soya meal and other high protein feed, the declines have helped some livestock producers and feed manufacturers. On 27 March, delivered (48% Pro) soya meal was quoted at £375.00/t for May (ex-store Liverpool). As of 24 April, the same price had declined £58.00/t and was quoted at £317.00/t. This is covered in more detail here.

An important watchpoint for the next few weeks is the US planting figures. The forecasted soyabean planted area is 33.8Mha, up 10% on last year when heavy rainfall limited the area. However, the reduction to maize demand for bioethanol mean some farmers could increase their soyabean acreage at the expense of maize. As of 27 April, 8% of the US soyabean crop has been planted, vs the 4% five year average for this point.

Soyabean markets look well supplied for the remainder of the season, benefitting from a bumper crop in South America. The USDA estimate global end of season stocks at 100.5Mt. With demand affected by coronavirus for the foreseeable period, protein meal markets could be affected by this supply available throughout this calendar year.

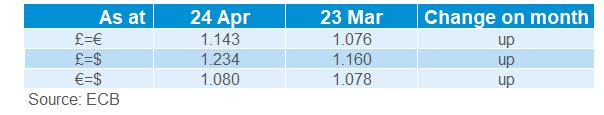

Currency

Currency markets have seen periods of recovery throughout April due to economic stimulus packages from the US, UK and other leading countries. From our last report (23 Mar - 27 Apr), sterling gained 6.5% against the euro.

However, it is likely that the pressures from the coronavirus pandemic will remain for the foreseeable period. Further impacts on logistics and subsequent oil demand may also be seen. With markets currently in a volatile state, it is now more important than ever to keep up to date with the latest news.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: