Feed report: 29 September 2021

Wednesday, 29 September 2021

By Megan Hesketh

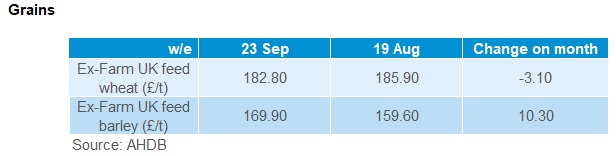

With UK harvest 2021 nearing completion, we saw a small fall in ex-farm UK feed wheat prices across the month. Though overall, global wheat supply concerns and strong global wheat demand has kept UK grains prices elevated.

Ex-farm barley prices notably rose across September, gaining on global wheat and barley supply concerns. The discount to wheat has reduced substantially over the past month, down from £26.30/t (19 Aug) to £12.90/t (23 Sep). Barley demand in animal rations has been relatively high in the ten months to July (inclusive) and was expected to remain strong until the discount to wheat closed in. Competitiveness against maize also plays a part in the inclusion rate.

What factors are supporting global wheat prices? Well, news of tight supplies from the top exporters (Russia, the EU and Canada) continue to support prices. However, quality milling wheat remains the greatest concern, particularly across the EU. French wheat is struggling to meet specific weight milling requirements, pushing Paris milling wheat futures higher as a result.

With strong demand from countries across the Middle East and Asia, global wheat supply and demand remains tight.

The market now looks to southern hemisphere crops to ease the tight global balance. Australian harvest is due to begin in November.

September did see an easing of maize supply concerns. US harvest began and the USDA improved US maize production projections. Though quality and quantity are not yet determined across the US, or the EU yet. This remains a watchpoint for future price direction.

What does UK grain look like? With UK harvest closing off, the provisional GB cereal quality survey results show milling wheat varieties are struggling to meet specific weight requirements. This could mean more feed wheat availability, but UK 2021/22 wheat supply and demand is expected to remain finely balanced.

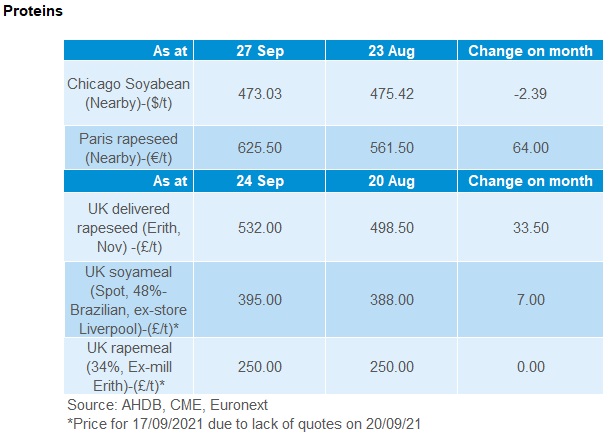

With a tight EU rapeseed supply and demand outlook, Paris rapeseed futures have been reaching record levels.

Global supply concerns have been driving price gains this month. Statistics Canada trimmed their canola (rapeseed) forecast in September (down 6.7Mt to 12.78Mt). Canada is the world’s biggest rapeseed producer, and this will be the smallest crop since 2008 if realised. This will reduce global rapeseed availability for export, impacting supply to the EU.

The EU crop was also trimmed this month, adding to a tight EU supply and demand picture.

A bumper Australia 2021/22 canola (rapeseed) crop is expected, at a record of 5.04Mt (up 11.33% from 2020/21). Australian harvest (October) could ease EU prices slightly, as a key import origin for biofuels. Though fundamentally, EU supply and demand will remain tight.

For soyabeans, global prices have remained steady, closing slightly lower over the month. US soyabean harvest progress has been pressuring global prices. US production is forecast at 119.04Mt, up 960Kt from August estimates and up 5.8% from 2020/21 according to the USDA.

Hurricane Ida’s disruption to US Gulf Coast exports, also pressured soyabeans prices in September. We saw some Chinese purchasing swap to Brazilian origin, on concerns of shipping delays. Chinese purchasing of US soyabeans for 2021/22 delivery has provided some price support though, despite negative hog margins. Another watchpoint for forward demand.

Large crops are anticipated in South America too. Brazil is expected to harvest a record 143.75Mt, according to Refinitiv. This is up 5.8% from 2020/21. Planting is due to begin in October.

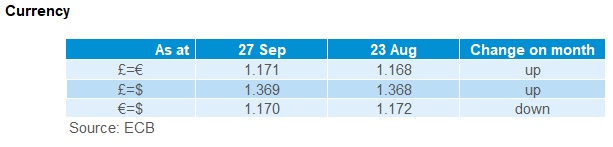

Sterling strengthened against the euro and dollar this month, despite fuel shortages and the ongoing energy crisis. As the UK economy recovers from the pandemic, quantitative easing and low interest rate measures remain.

The euro took a hit at the end of September, due to unclear German election results resulting in a fragmented parliament.

US economic indicators look more positive. However, with a ‘risk-on’ attitude in the market near the end of September, the US dollar lost out on demand to sterling.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.