Market Report - 20 September 2021

Monday, 20 September 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

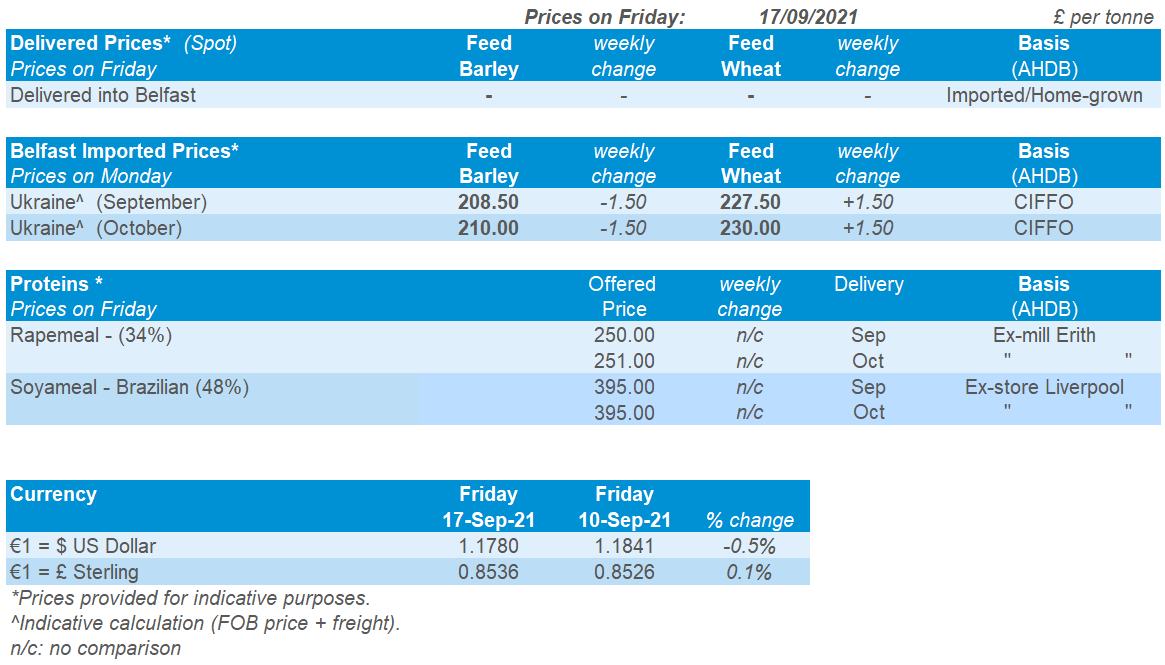

Grains

Wheat

Maize

Barley

Further reductions to the global wheat crop this season are offering support to prices. There is particularly strong support for milling crops, with quality under question worldwide.

The market awaits further news on the maize harvest in the Northern Hemisphere. Argentine planting is underway with expectations for a greater area, but the prospects of a La Niña still looms.

Barley has been well supported by rises in the wheat market. However, pressure from maize could become apparent if supply looks good as the Northern Hemisphere harvest progresses.

Global grain markets

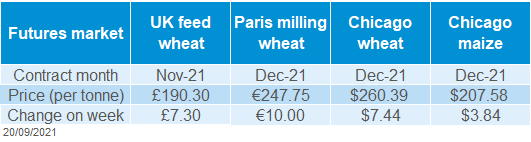

Global grain futures

Most major grain futures contracts saw an uplift last week, Friday-to-Friday. This said, the rises were at the start of the week and prices flattened out, or even dropped off, towards the end. This was particularly prevalent in Chicago wheat and maize futures. Chicago wheat futures (Dec-21) rose $9.01/t Friday to Thursday, and then dropped $1.57/t on Friday to close at $260.39/t.

The Paris milling wheat Dec-21 contract saw a weekly rise of €10.00/t to close Friday at €247.75/t. This followed a 630Kt cut to the French 2021 soft wheat production estimate to 36.06Mt, by France’s farm ministry on Tuesday.

Also, French quality was downgraded by FranceAgriMer. Protein content is generally maintained at a good level. However, Hagberg Falling Number (HFN) and specific weights have suffered. Just 52% of test samples are recording a HFN of ≥240s compared with the 5-year average of 90%. Also, less than a third of wheat (exc. durum) is meeting the minimum milling requirement of 76kg/hl. In response, China altered its export specification to allow shipments of wheat at 75kg/hl. Saudi Arabia and Algeria are said to have also tweaked export specs.

Stratégie Grains dropped its estimates for total EU-27 grains production. Although the wheat and maize harvests are still expected to be larger than 2020.

- Soft wheat: down 2.4Mt, at 129.1Mt

- Barley: down 700Kt, at 52.3Mt

- Maize: down 1.4Mt, at 64.9Mt

Statistics Canada also cut its wheat production estimates further, now forecasting all wheat production at 21.7Mt. However, with the Ukrainian wheat harvest now complete, the agricultural ministry has estimated wheat production at 33.0Mt, up from 24.9Mt last year. Overall grain production in Ukraine is now estimated at a record 80.6Mt, up from 65.0Mt last year. Total grain exports could reach 60.7Mt for 2021/22, up 16.0Mt year-on-year.

UK focus

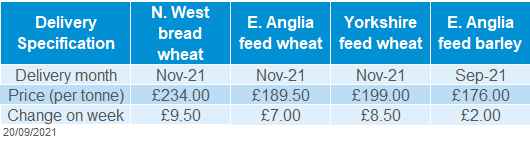

Delivered cereals

Within the UK, harvest is coming to an end and the first set of Cereal Quality Survey (CQS) results are now available. The data shows that milling wheat varieties grown in the UK are also struggling to meet specific weight requirements. The average specific weight of UK Flour Millers Group 1 varieties, at 75.4kg/hl, is the lowest since 2012 (70.7 kg/hl). Protein content and Hagberg Falling Number (HFN) are generally meeting specification. However, averaging 286s, the HFN is the lowest start to the Cereal Quality Survey results since 2017.

Only 23% of samples are meeting a “typical” Group 1 specification (specific weight ≥76kg/hl, HFN ≥250s, protein ≥13.0%), which is down nine percentage points from last year’s final results.

This has been reflected in the premiums achieved for bread wheat this season. Milling wheat delivered into the North-West (Nov-21) was £234.00/t on Thursday, up £9.50/t from the previous week. This premium over UK feed wheat futures (Nov-21) was £43.50/t (on Thursday, when quoted), up from £41.50/t the previous Thursday (9 September).

CQS results for barley show the average nitrogen content of spring barley samples, at 1.45%, is down 0.38 percentage points from the first survey results last year. Also, the average specific weights across both winter and spring samples are down year-on-year. However, both could be attributed to a high volume of Scottish samples included, which were not seen this time last season.

For the full set of results visit the Cereal Quality Survey page on our website.

Oilseeds

Rapeseed

Soyabeans

Prices strengthened last week as the market digested a smaller Canadian crop. EU supply and demand remain tight, with added concerns on global trade levels supporting prices.

Despite increased US production, global supply and demand still looks tight. Chinese purchasing is increasing, though US shipping issues remain short-term. The 70-80% chance of another La Niña remains closely watched.

Global oilseed markets

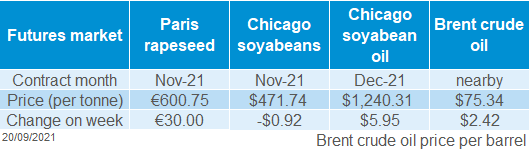

Global oilseed futures

Chicago soyabean futures (Nov-21) fell just $0.92/t last week, to close at $471.74/t on Friday.

Prices felt some pressure last week from concerns that US Gulf Coast shipping delays may remain into October. On Wednesday, the USDA announced cancellations of 132Kt to China and 196Kt to an unknown destination. China then purchased four to six bulk cargoes of Brazilian soyabeans (for shipment in Oct and Nov). This was an unusual purchase as Brazilian prices are higher than US prices. According to Refinitiv, China imported 9.04Mt of Brazilian soyabeans in August. This is up 10.9% from August 2020.

The US harvest is expected to be advancing on favourable weather, adding to price pressure. US soyabeans were 38% dropping leaves (maturing) as at 12 September, ahead of the 5-year average of 29%.

However, Chinese demand provided price support on Thursday through the weekly data on US export sales. This kept weekly price movement near unchanged. Net US sales for 2021/22 totalled 1.26Mt in the week ending 9 September, including 945Kt to China and 163Kt to unknown destinations. On Friday, the USDA also confirmed a flash sale of 132Kt to China for the 2021/22 season.

Strong US crush helped to curb pressure on prices last week. NOPA members (handling 95% of US soyabeans) crushed 4.3Mt of soybeans in August, a three-month high. This was up 2.4% from July, but 3.8% below August 2020. According to Refinitiv, the market expected the crush to fall.

Malaysian palm oil also lost ground last week as India rose its fortnightly import tariff. This made the vegetable oil less competitive against rapeseed oil and sunflower oil.

Rapeseed focus

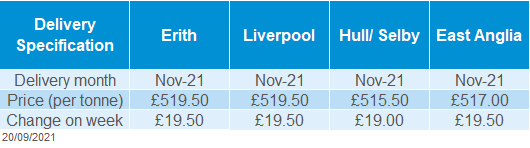

UK delivered oilseed prices

Paris rapeseed futures (Nov-21) gained €30.00/t last week, closing on Friday at €600.75/t, a new contract high.

Statistics Canada trimmed its canola forecast last week to the lowest crop since 2008, driving the market up. The forecast is now 12.78Mt, down 6.7Mt from 2020/21. Changes were down to recent yield models using satellite imagery.

GB delivered prices followed movements in Paris futures, up £19.50/t to £519.50/t (Nov-21 delivery, Erith). With prices at contract highs and rapeseed planting underway for harvest 2021, will we see an area rebound next year in the UK?

The French 2022 rapeseed area is set to rise 15-20% year-on-year to 1.12-1.17Mha. This would be below the 5-year average of 1.36Mha. Despite conditions being ‘not favourable enough for planting’ as dry weather persists, Ukrainian farmers are currently planting winter rapeseed crops according to UkrAgroConsult.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.