Rapeseed prices strong, UK set for area expansion? Grain market daily

Wednesday, 15 September 2021

Market commentary

- UK feed wheat futures Nov-21, found some support yesterday, closing at £186.00/t. This was a gain of £3.00/t on the day. So far today, the contract has continued to gain.

- UK values have followed strength in the Paris milling wheat futures market. The Dec-21 Paris milling wheat futures contract gained €4.00/t yesterday, closing at €244.00/t. Reduced expectations of the French wheat crop.

- This morning, FranceAgriMer cut its expectation of French soft wheat exports outside the EU to 9.6Mt, down from 10.5Mt in July. Alongside this, the outlook for ending stocks was cut by 0.8Mt, to 2.9Mt.

Rapeseed prices strong, UK set for area expansion?

One market which has arguably seen more support than others over the last six months is oilseeds. This tightness started with strong Chinese buying of soyabeans. This was exacerbated by small South American crops and has continued with problems for rapeseed crops globally.

As of this morning, Paris rapeseed futures (Nov-21) are worth €587.00/t. This is €212.10/t more than the average of the five prior November contracts, at this stage in the season. Furthermore, Nov-22 Paris rapeseed futures are currently worth €487.25/t. This is €110.50/t ahead of the five-year average of forward November contracts.

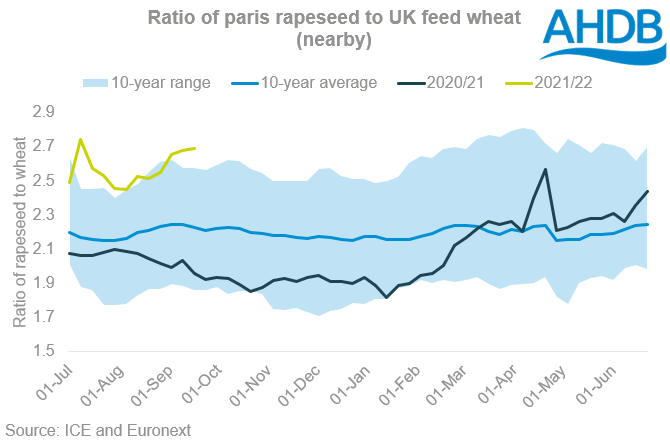

One key factor to watch for both the UK and EU this season will be how much the support in rapeseed prices drives an expansion in rapeseed area. One possible indicator we can use to determine if we will see an area increase is the ratio of rapeseed to wheat prices.

The relationship between the ratio and rapeseed area is minimal to say the least. This is due to many external factors in recent years. That said, at yesterday’s close nearby Paris rapeseed futures were worth almost 2.7 times UK feed wheat futures (nearby), in sterling terms. This is the strongest position for the ratio, at this time of the season, over the last ten years. This would, in turn, support the suggestion of an expansion in rapeseed area this autumn.

Rapeseed price support looks set to stay in the short to medium-term. Last week’s USDA supply and demand estimates cut rapeseed stocks-to-use to just 5.2%. The relative positions of other oilseeds improved. But stocks-to-use tightened for soyabean oil which has been a key driver of markets lately.

Further, Statistics Canada cut its production outlook yesterday. Rapeseed production is now forecast to reach 12.8Mt in 2021, 1.2Mt less than the USDA forecast. With global supplies of oilseeds and vegetable oils tight, continued support seems likely. Much of the focus now will be on South American soyabeans and Australian Rapeseed.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.