Analyst Insight: UK wheat balance tight, could high imports continue?

Thursday, 23 September 2021

Market commentary

- UK feed wheat (Nov-21) gained £3.65/t yesterday, to close at £192.00/t

- Global wheat contracts rose yesterday on supply worries, with rumours that Russia may raise their export tax further. If export taxes rise, this could lead to further cuts in Russian exports, trimming global availability

- Chicago maize (Dec 21) also gained ground yesterday, climbing $3.35/t to $206.88/t. The market gained strength from fund activity following gains in financial markets and crude oil prices. Offsetting pressure from the US harvest

- Fresh news on reducing US biofuel blending requirements for 2020 (to 17.1 billion gallons) and 2021 (to 18.6 billion gallons), was released by Refinitiv last night. The 2022 level is suggested to be 20.8 billion gallons. Reductions to 2020 and 2021 mandates would be retroactive. Chicago maize prices (Dec-21) have been trading down today in response

Grain Market Outlook Conference 2021

Session 2: Carbon in the grain and oilseed supply chain.

Net-zero targets are fast approaching in the UK. For many, there are ongoing conversations around how individual companies can address carbon in their supply chains. For the cereals and oilseeds industry together, we believe it is important to start conversation of how carbon emissions can be addressed collectively.

In the second session at the Grain Market Outlook Conference, we are inviting a discussion around the future of reducing carbon emissions in the UK grain and oilseed supply chain.

We will hear from a panel of speakers around how they are addressing carbon through their organisations. It will also be a chance for wider discussion around responsibility and opportunities in the supply chain.

From the session, we aim to address how the industry is currently preparing for carbon emission reduction. As well as provide an opportunity to ask, what does the industry now need to tackle carbon emissions going forward?

Claudia Heidecke, a policy expert from the Thuenen Institute in Germany, will also contribute to the discussion. Claudia will discuss how Germany is tackling the issue of carbon, as well as opportunities and issues faced with change.

Near the end of the session, there will be an opportunity for a Q&A with the panel.

Our speakers:

- Claudia Heidecke – Policy expert, Thuenen Institute, Germany

- David Mathias – Cereals Director, Warburtons

- Sophie Throup – Head of Agriculture, Fisheries and Sustainable Sourcing, Morrisons

- Jack Watts – Agri-Food Policy Delivery Manager, NFU

Analyst Insight: UK wheat balance tight, could high imports continue?

The final 2020/21 UK cereals supply and demand estimate has been released today, with full datasets to the end of June now available.

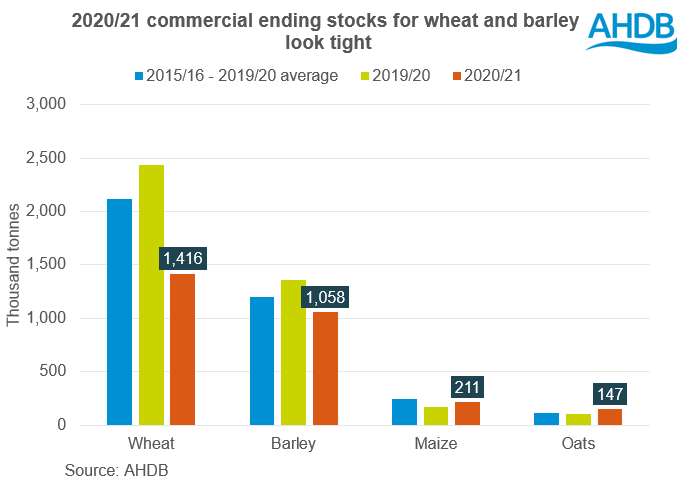

Overall, commercial ending stocks look tight for wheat and barley as we entered the 2021/22 season.

A key headline figure was total UK imported wheat at 2.43Mt, 331Kt higher than forecasts in May and up 130% from 2019/20.

With UK production sub-10Mt, this may be no surprise to trade and was primarily driven by increased use of imported wheat in the human and industrial (H&I) sector.

Despite this, wheat availability was still down year-on-year leading to a fall in ending stocks.

Barley availability in 2020/21 increased year-on-year, with production up 1% to 8.12Mt and imports up 26% to 88Kt.Total domestic consumption rose 18% year-on-year, to 7.29Mt.

This was mostly driven by increased animal feed demand. Barley ending stocks finished tighter than previous years too.

Maize saw an increase in domestic consumption, up by 18% year-on-year, at 2.55Mt. This was mainly driven by a rise in animal feed demand. Maize imports were up 20% year-on-year to 2.86Mt, near 2018/19 levels.

For more information, follow the link to the latest balance sheet

Read more on how we continually develop the balance sheets

Where now for UK wheat supply and demand?

2021/22 wheat production is expected to recover. With autumn 2020 weather allowing a move back to winter cropping, expectations are for a wheat crop in the region of 14.5Mt. Though as mentioned above, stocks are low entering this season.

With higher production, we may see animal feed ration inclusions rise from 2019/20. Barley inclusion is expected to remain strong should the discount to wheat hold, though it is important to remember the UK barley picture also looks tight.

This year, there is also E10 ethanol demand to consider for feed wheat. So, supply and demand could remain tight for UK 2021/22 wheat.

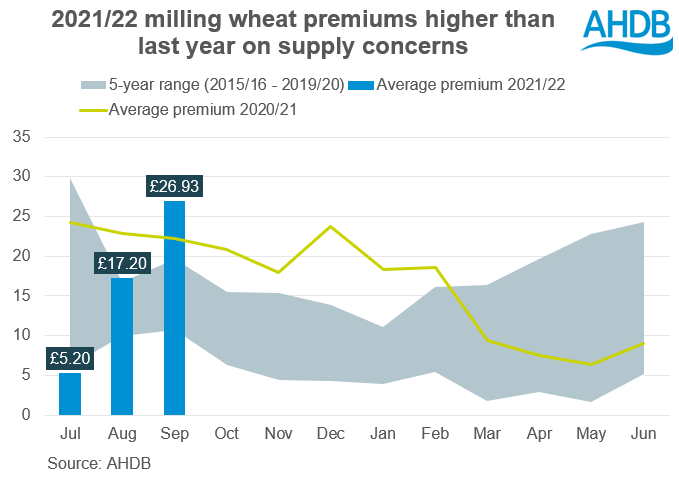

One key watch point is wheat quality. The release of the provisional GB cereal quality survey (CQS) report shows domestic milling wheat varieties have detailed low specific weights (results to 7 Sept), due to inclement summer weather.

Currently, just 48% of samples are reaching 76 kg/hl specific weight. Just 23% of the UK flour millers Group 1 varieties met the high-quality specification for UK milling wheat (specific weight ≥76kg/hl, HFN ≥250s, protein ≥13.0%). This is down from 32% in 2020’s final results.

Global milling wheat is also tight. Canada have suffered hot and dry conditions, cutting their spring wheat crop. In the EU too, wet weather has caused quality issues.

Provisional quality data from FranceAgriMer reports just 30% of the French wheat exceeds the specific weight of 76kg/hl. This is compared to 98% last year.

As a result, we are seeing high protein premiums in the UK.

Premiums could stretch out further too, should UK quality results worsen, or global milling wheat supply looks tighter still.

As James discussed yesterday, tight global milling wheat supply has been supporting Paris futures prices despite being in need of competitive pricing to reach high export projections. One to watch going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.