Insight into UK wheat crop as harvest nears close: Grain market daily

Friday, 10 September 2021

Market commentary

- Grain prices fell again yesterday after USDA area data showed potential for larger US maize and soyabean crops in tonight’s USDA report. Nov-21 UK feed wheat futures lost £2.65/t to £183.20/t.

- However, the recent fall in prices seems to have brought buyers back to the market. Saudi Arabia, the Philippines, Jordan and Tunisia all issued new tenders for wheat this week.

- Importantly for the EU, Saudi Arabia lowered the specific weight required to 76kg/hl. Provisional quality data from France shows just 30% of the crop exceeds this threshold, compared to 98% last year (FranceAgriMer).

- Paris rapeseed futures also fell due to the potential for a larger US soyabean crop, a drop in crude oil prices and expectations for higher palm oil production. The Nov-21 contract fell €11.50/t to €570.00/t (approx. £488/t).

Insight into UK wheat crop as harvest nears close

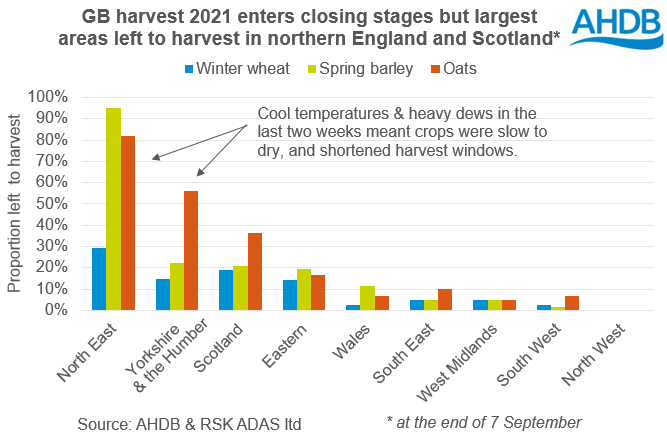

By the end of Tuesday (7 September), the GB winter wheat harvest was 90% complete. AHDB’s fifth harvest report of 2021 shows the rate of progress increased rapidly over the past two weeks. The largest remaining areas (as a proportion) are in the north of England and Scotland.

Meanwhile, spring barley harvest is 85% complete. This is some 12-percentage points ahead of the five-year average. For oats, harvesting of winter oats is now complete and the focus is on spring varieties. The combined progress of both winter and spring varieties stands at 77%, slightly back on the five-year average (82%).

With so much more of the crop gathered, we now have a much better idea of yields.

- The national winter wheat yield is now pegged around 8.1 – 3 t/ha. This is a slightly tighter range than in our last report (8.0-8.4t/ha) when harvest was 46% complete, but the mid-point is unchanged. It is still above the 5-year (2016-2020) average of 8.0t/ha.

- Spring barley yield reports are good. Early harvested crops are yielding ahead of the five-year average (5.7t/ha) at 5.8-6.2t/ha.

- Both winter and spring oat yields currently range from 4.8-8.5t/ha.

Insight into the UK wheat crop

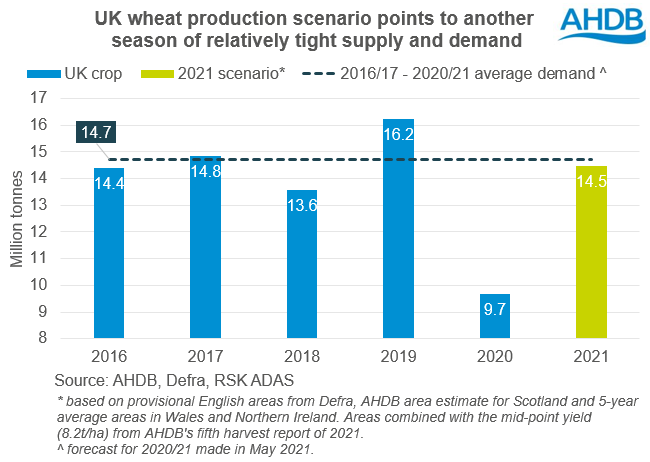

This information supports the English wheat production scenario Anthony produced earlier in September. He used the mid-point yield from the previous harvest report (8.2t/ha) and the provisional areas from Defra to estimate the English crop at around 13.3Mt.

The AHDB Planting and Variety survey estimated the Scottish wheat area at 111Kha. We can use this area figure, plus the average Defra areas over the past five years for Wales (22Kha) and Northern Ireland (8Kha) to estimate the UK area. Using the combined area, and the mid-point of the yield range in the latest harvest report (8.2t/ha), we can get an insight into the potential UK crop size.

This method suggests a UK wheat crop in the region of 14.5Mt in 2021. This would be a marked increase from the small crop (9.7Mt) harvested in 2020.

However, in the past five seasons, UK wheat consumption has averaged 14.7Mt per season. This includes the May forecast for 2020/21 so may change slightly when the updated figures are released at the end of this month.

What's more, demand from the bioethanol sector is likely to rise this season following the introduction of E10. All things considered, the UK seems to be looking at another tightly supplied season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.