Analyst insight: Where will wheat go in tomorrow’s WASDE?

Thursday, 9 September 2021

Market commentary

- Nov-21 London feed wheat continued to drop for an eighth consecutive day. Yesterday, the contract closed at £185.85/t, down £1.80/t from the previous close.

- Yesterday saw the release of the Canadian crop stocks estimates as of 31 July 2021. This showed all wheat stocks at 5.7Mt versus trade estimates of 4.2-5.2Mt. Canola stocks were also pegged higher than trade estimates at 1.8Mt versus 0.9-1.5Mt.

- US corn remains under pressure as trade awaits tomorrow’s USDA report. The Dec-21 Chicago corn contract has lost $5.41/t since last weeks close (Friday) to close yesterday at $200.89/t.

Where will wheat go in tomorrow’s WASDE?

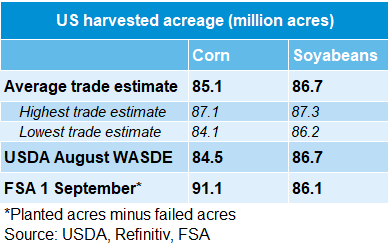

Tomorrow, at 5pm (UK time), the September USDA world agricultural supply and demand estimates (WASDE) report will be released. Expectation is for revisions to the US corn and soyabeans acreage, yields and subsequently production. Average trade estimates are for increased acreage for both crops. However, yesterday saw the Farm Service Agency (FSA) accidentally release US plantings data early. These figures differ somewhat from trade expectations, with a bearish tone for corn and marginal change for soyabeans. The FSA numbers are based on planted acres minus failed acres and are therefore relatively comparable to trade estimates.

This will be a key watch point in tomorrow’s report.

But what about wheat?

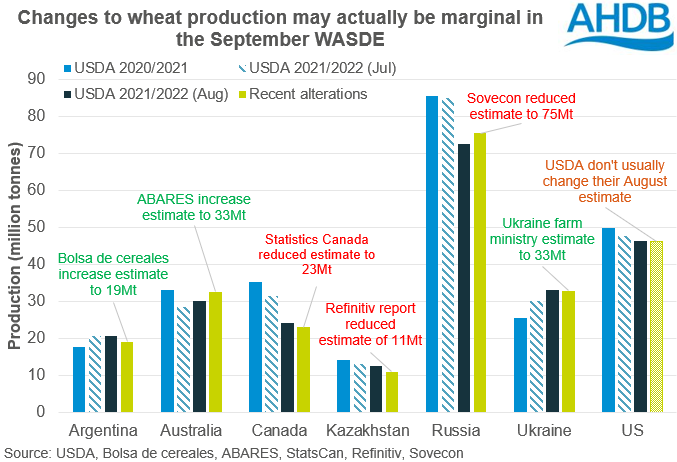

Wheat markets have also been under pressure in recent weeks. There is a little more uncertainty around what the report might say though. Many key wheat producing countries have changed their forecasts since the August USDA supply estimates report.

Reductions

Downward revisions to Canada, Russia, and Kazakhstan could be expected. There has been no hiding from the dryness news coming from Canada. Russia and Kazakhstan have also been experiencing drought conditions, negatively impacting wheat production potential.

- Canada: Statistics Canada confirmed a significantly reduced crop in their 30 August release, suggesting a 22.9Mt crop could be on the cards for 2021/22. This is down 12.2Mt from 2020/21.

- Russia: Russian agricultural consultancy firm, Sovecon, recently cut a further 800Kt from their wheat estimate. This pegs production at 75.4Mt.

- Kazakhstan: Kazakhstan have also experienced downwards revisions from Refinitiv crop estimates. Production is now pegged at 11.0Mt.

Increases

In contrast, other key producers have seen upward revisions. Australia, Argentina, and the Ukraine have all experienced decent growing conditions boosting production prospects.

- Australia: This week, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), increased their wheat production estimates by 4.8Mt. This pegs Australian wheat production at 32.6Mt.

- Argentina: Bolsa de cereales have recently updated their wheat production estimates to 19.0Mt, from 17.0Mt in their previous estimate.

- Ukraine: Ukraine’s ministry of farms has pegged domestic wheat production at 32.8Mt. This is above the 30.5Mt reported by UkrAgroConsult in August.

What might the USDA say?

It is highly unlikely that the USDA will alter the US wheat figures based on historical reports, but could they change the estimates for those countries mentioned previously?

The graph above shows the USDA’s previous estimates alongside the recent altered estimates from reporters within own countries. It shows that realistically there is little room for large alterations. We can see there could be scope for some tweaks to increase Australian production slightly. At the same time, they could reduce Canadian production further. However, other moves are already factored in. For example, Bolsa de cereales may have increased their Argentine estimates but this still sits below that of the USDA in the August report. Similarly, Sovecon has cut Russian production estimates in recent weeks, but this remains above the August WASDE estimate.

Conclusion

There is unlikely to be any shakers in tomorrow’s release for wheat markets. The alterations to wheat production that could come are likely to already be factored into markets. Any direction would likely come from corn markets. But this is only if there are some major changes for this crop.

The Chinese supply and demand picture will be another key watch point, but this is a discussion for another day.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.