Provisional look at England’s wheat production: Grain market daily

Wednesday, 1 September 2021

Market Commentary

- UK wheat futures (Nov-21) closed yesterday at £194.25/t, down £1.50/t on Friday’s close. The May-22 contract closed at £199.25/, down £2.35/t on Friday’s close.

- Chicago wheat, maize and soyabeans all closed lower yesterday. Damage to export facilities on the US Gulf coast from Hurricane Ida has added pressure with the potential for increased US stocks. This is causing concerns for potential disruption to shipments.

- Russian consultancy SovEcon cut its 2021 wheat crop estimate to 75.4Mt, down from 76.2Mt. With the Russian harvest 75% complete, the Siberian crop is the only big unknown now (SovEcon).

Provisional look at England’s wheat production

The UK’s wheat harvest progress was pegged at 46%, in the week ending 24 August. Further, national yields are estimated at 8.0-8.4t/ha as of 24 August 2021.

As harvest progresses, yield information improves. This allows us to quantify regional production.

The current data available

Megan’s analysis a couple of weeks back offered insight into winter barley and oilseed rape production, using provisional arable crop areas (as at 1 June) released by Defra.

I am going to use this Defra data and the latest yield information in the harvest progress report, to estimate wheat production.

Proportionally yield representation

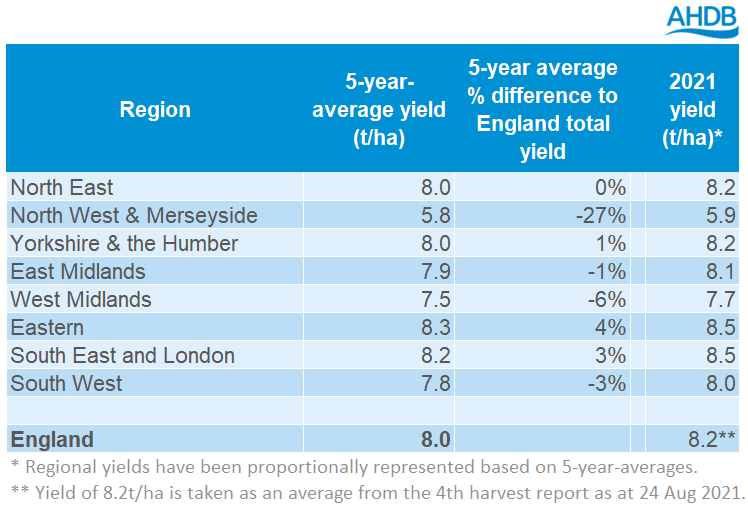

National yields are currently pegged at 8.2t/ha. However, not every region in the England will achieve this. To get an estimate of regional production values, I am going to proportionally apply the national yield on a regional basis by using 5-year-averages.

As you can see in the table above, based on 5-year-averages regions such as the North West and West Midlands are typically below the English average.

What does this mean for England’s production?

Now we have regional estimates of yields, we can estimate production.

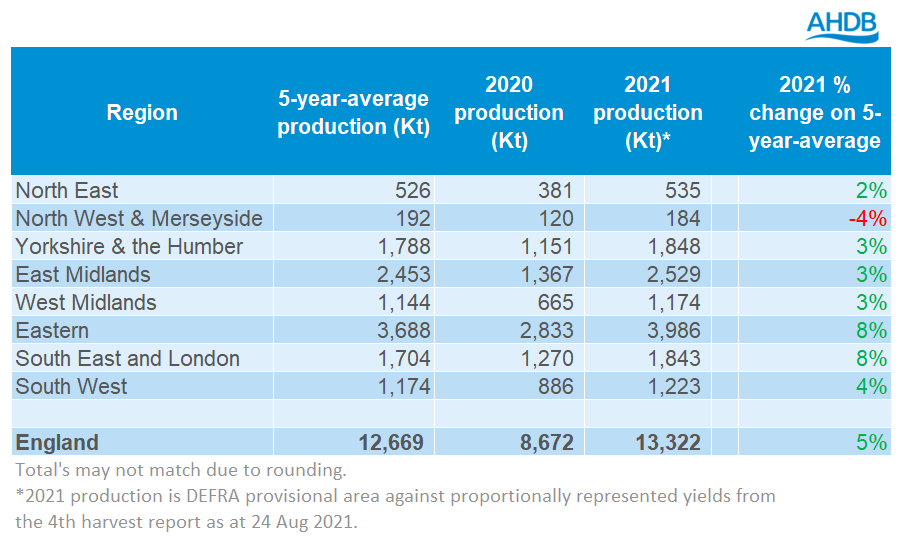

Using this methodology, England’s wheat production is currently estimated at c.13.3Mt. This would be a 54% year-on-year increase on 2020 and a 5% increase on the 5-year-average.

The largest annual increase is estimated in the East Midlands, where production could rebound to 2.5Mt, an 85% increase year-on-year.

Another key piece of information is the North West. This is the only English region where production in 2021 could be below the 5-year-average.

Production is estimated at 184Kt, this would be 4% below the 5-year-average. This could have implications for delivered premiums in this region especially with concerns over global wheat quality.

Furthermore, Yorkshire & the Humber and the West Midlands will play a role in setting North West Premiums, and these regions are estimated to both increase 3% on 5-year-averages.

Conclusion

This is only a provisional forecast, based on the information that we currently have in our harvest progress report and Defra provisional data, therefore this is subject to change.

We will continue to update the industry on GB harvest progression. The AHDB’s fifth harvest report is expected to be released Friday 10th September.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.