UK milling wheat premiums up and away? Grain market daily

Friday, 27 August 2021

Market Commentary

- Nov-21 UK feed wheat futures closed yesterday at £196.10/t, up £2.75/t from Wednesdays close. This follows Paris wheat futures as quality and supply concerns push prices higher (read more below).

- Paris rapeseed (Dec-21) futures slipped €0.50/t from Wednesday to Thursdays close. On the week, the Dec-21 contract gained €12.75/t to close yesterday at €576.75/t.

- This follows a similar trend to US Soyabeans (Nov-21) which closed yesterday at $487.26/t, down $2.39/t from Wednesday. Soyabean futures have slipped further this morning on the back of rain in the Midwest, improving growing conditions.

- The UK wheat harvest still lags behind 2020 (64% complete) and the five-year average (2016-2020 – 57% complete), at 46% complete to 24 August. FranceAgriMer also report a slow French harvest with just 5% of wheat cut in the week ending 23 August due to further rain. This brings France’s total wheat harvest to 96% complete.

Milling wheat premiums up and away?

Global wheat supply has seen some drastic cuts in recent forecasts. But there are also questions about the quality of the wheat, not just quantity.

In the UK, we are generally net importers of milling wheat and our key import origins are Canada and the EU. Canada’s crops have suffered from drought, and we await production estimates from Statistics Canada due out on Monday, but yesterday the IGC cut 4.0Mt from its Canadian production estimate, at 24.5Mt.

The IGC estimate is down 10.7Mt year-on-year and almost in line with that of the USDA (24.0Mt). The IGC also cut their EU-27 wheat production estimate, pegging it lower than that of the USDA, at 137.6Mt. Although, this does sit higher than the EU commissions EU-27 production estimate of 135.1Mt also updated yesterday.

Germany and France, both key import origins for UK wheat supply, have seen harvest delays this year. Initial indications of wheat quality in both countries suggest low specific weights, a key measure for milling wheat.

As a result of quality concerns and diminishing global supply, Paris milling wheat futures have jumped since early July. From 1 July to yesterdays close, the Dec-21 contract has risen €38.00/t. This has helped support UK feed wheat futures (Nov-21), gaining £23.30/t in the same time frame.

Will this keep milling wheat premiums supported?

With milling wheat from key import origins looking tight, and prices on the continent supported, unsurprisingly our physical milling wheat prices have been strong.

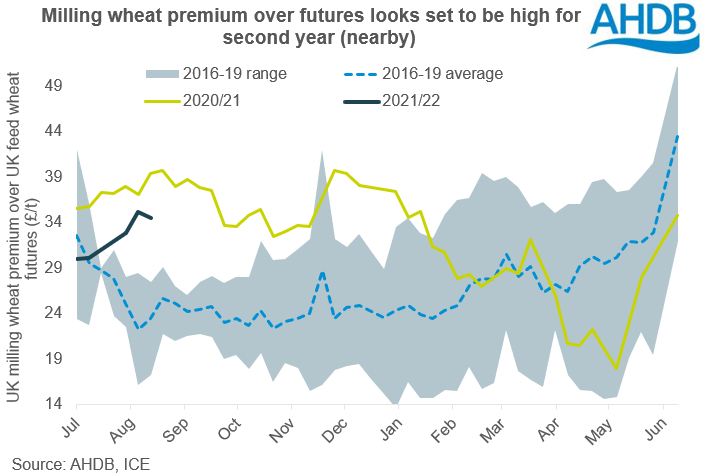

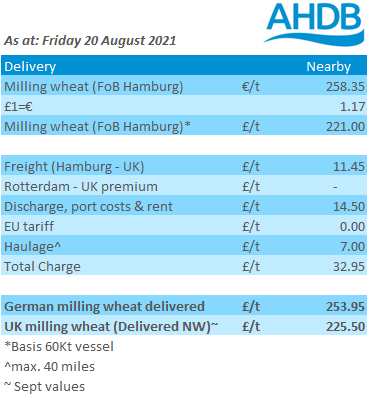

Last Friday, bread wheat delivered to the North West (nearby) was quoted at £225.50/t, £22.00/t higher than the same time last year. This said, the premium over feed wheat (nearby futures) was slightly lower than the same time last year.

Premiums last year were stretched due to the lack of winter milling wheat plantings in Autumn 2019. In comparison to the previous 5-year average (2015/16-2019/20) premiums over feed wheat are still elevated.

Today’s AHDB harvest progress report shows that winter wheat harvest still lags 2020 completion at 46% cut up to 24 August. The report also suggests milling wheat quality has slipped. Hagberg falling number (HFN) ranges between 250s and 300s, down from 260s-380s last week. Crucially, this still meets the threshold for high quality UK milling wheat (HFN greater than 250s). This said, similarly to those on the continent, the specific weights recorded are coming in slightly low at 73-77kg/hl. The requirement for full spec UK milling wheat is 76kg/hl.

With feed wheat futures supported it could squeeze the milling wheat premium. However, with potential quality issues in key producing countries, and a relatively unknown milling crop here in the UK, we could see some further support. Based on last Friday’s delivered survey, we can see we are still some way off the price ceiling for domestic milling wheat.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.