- Home

- News

- Analyst Insight: Defra’s provisional arable areas, what can we expect from winter barley and OSR production?

Analyst Insight: Defra’s provisional arable areas, what can we expect from winter barley and OSR production?

Thursday, 19 August 2021

Market commentary

- UK feed wheat futures (Nov-21) gained £5.00/t yesterday, closing at £193.75/t. Gains were made on concerns of wheat availability in major exporters, specifically Russia.

- Egypt’s GASC purchased 180Kt of wheat yesterday from Romania and Ukraine. Romanian wheat remains the most competitive origin. The lowest offer was for 60Kt at $294.99/t (FOB) plus $34.43/t for freight. This is $35.68/t higher than the Romanian wheat offer at the previous GASC tender on 2 August.

- The Pro Farmer Midwest tour continues, finding maize yields and soyabean pod counts in Illinois to be above the three-year average and ahead of last year.

- Rains are expected in the Midwest too. This has caused soyabean price falls (Nov-21) for 2 days consecutively, as crop prospects improve. Values also fell in early trading this morning.

Defra’s provisional arable areas, what can we expect from winter barley and OSR production?

This morning, Defra released their provisional arable crop areas for England, as at 1 June.

With improved conditions in Autumn 2020 for drilling, the Defra figures confirm a return to an arguably more balanced cereal cropping picture for harvest 2021.

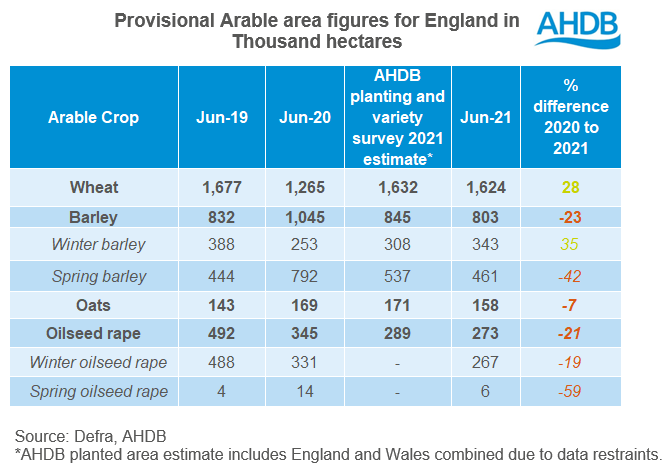

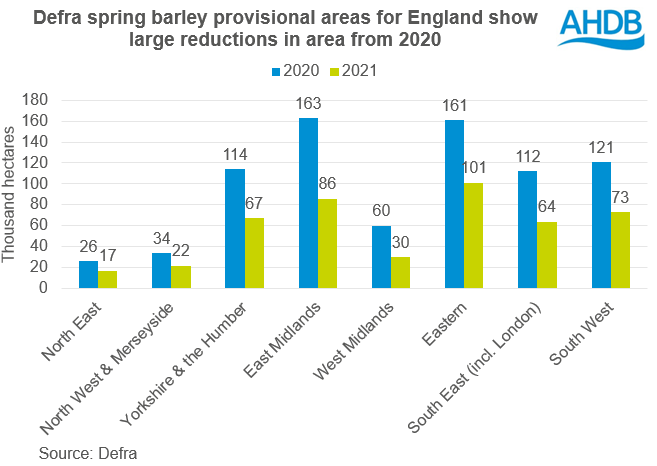

The key standout difference in this release, are the barley figures. With spring barley area down 42% from 2020 and winter barley area up 35%. these increases and decreases from 2020 are shown to be more extreme than forecasted in the AHDB planted area figures.

The headline figures are below:

For wheat, the Defra figures confirm the forecast of increases in wheat area across all regions. The largest increase has been seen in the East and West Midlands, up 38% and 35% respectively. The Eastern region by far remains the largest producing region according to the figures, accounting for 29% of the total English area.

For spring barley, the Defra survey presented sharper cuts to area than seen in the AHDB planting and variety survey. This included the Eastern Region (down 37% from 2020) and East Midlands (down 47% from 2020).

How does 2021 production now look for winter barley and winter oilseed rape?

Barley

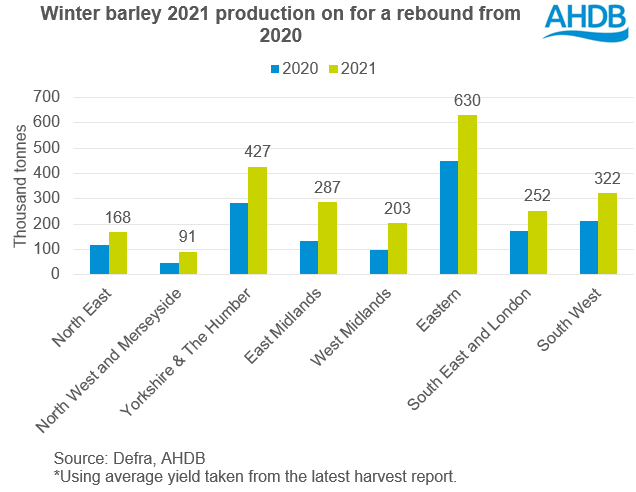

Winter barley harvest was 88% complete as of 12 August. Using average yields from the latest AHDB harvest report, we can estimate production of winter barley for 2021. The next harvest report will be published tomorrow.

Defra’s area figures show increases across the board in winter barley area. Average yields are pegged between 6.8t/ha and 7.2t/ha. This is broadly in line with the five-year and ten-year averages.

Using the middle of this average, English winter barley production would be2.4Mt, up 59% from last year but down 1% from the 5-year average (2015-2020).

OSR

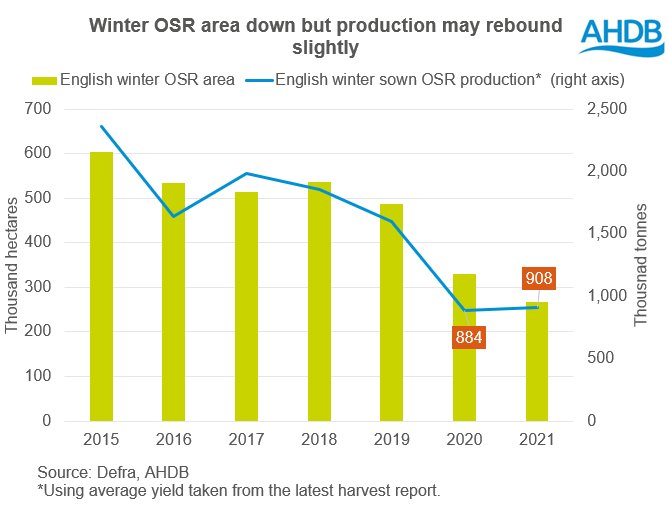

The Oilseed rape harvest is not as far along as winter barley. Though from the 61% harvested to 12 August, yields are currently estimated between 3.2 to 3.6t/ha.

Using the middle of the average yield range, winter oilseed production looks to be up 3% from last year. This is despite a fall in area by 19%.

So, what does this mean for UK availability?

For wheat, this confirmation of increasing area remains positive. The global picture for wheat supply and demand looks tighter, due to concerns around the Russian, Canadian and US crops. Therefore, it is likely domestic supply will be key this season. Monitoring cereal quality closely will be important in the coming weeks to see if samples meet specification. If we do see issues with domestic quality as harvest progresses, we could see milling premiums stretch out further.

Over the past few weeks, we have looked at demand for barley and commented on what may look to be another strong year for demand. This should see barley remain in the feed ration as expected, if the discount to wheat remains strong. An increase in winter barley area and production looks positive, however this is met by falling spring barley area year-on-year. The question remains how tight supply and demand this season might be. Should wheat prices climb further, we could see a tightening of demand and supply for barley as barley remains in the ration.

Finally for oilseed rape, production for winter oilseed rape looks to be positive. Despite area reductions, initial yield estimates present a more positive production outlook. However, global rapeseed supply remains tight. Wider support from challenges to the Canadian canola and EU rapeseed crops continue to support prices, a key point to watch in the coming weeks.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.