Consumers turning to flexitarian meals due to cost concerns

Thursday, 13 June 2024

It will be no surprise that our dietary preferences change over time, and these are influenced by many factors, such as health and differing lifestyles balanced alongside economic considerations. So how have our eating habits changed since the Covid pandemic and what are the main concerns driving our dietary decisions?

Typically, 56.9% of main meals eaten at home contain meat, fish or poultry, this is in comparison to vegetarian meals (including eggs or dairy) at 24.8% and plant-based meals at 18.3%. (Kantar Usage, Total main meal occasions, 52 w/e 18 February 2024)

The total number of meals eaten within the home has decreased by -2% year on year due to more people returning to the office, consumers eating on the go or treating themselves to a meal out. When looking closer at the types of meals eaten within the home, we can see that meat-based meals have declined by just -1.2%, compared to vegetarian meals at -2.4% and vegan meals at -0.8% year on year. (Kantar Usage, Total main meal occasions, 52 w/e 18 February 2024)

Flexitarians increasingly influenced by price

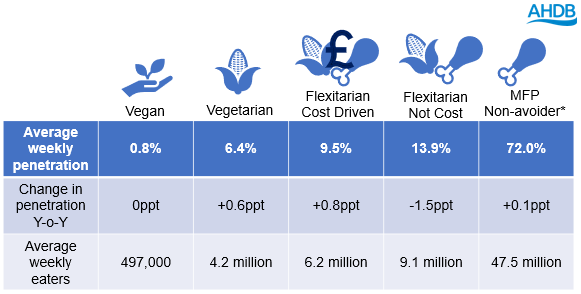

In terms of the latest trends within the GB population, consumers are increasingly likely to be a ‘Meat, Fish or Poultry (MFP) Non-Avoider’* (72%) or a Flexitarian**(23.4%). As a result of the rise in food prices since 2021 and impact on cost of living, the data below from Kantar Usage has been split into two flexitarian categories: 1) flexitarians due to the cost of red meat and 2) flexitarians for other reasons unrelated to (not) cost. This data highlights more consumers have become flexitarian driven by cost at +0.8 ppt rather than flexitarians not concerned by costs which have declined by -1.5 ppt year on year.

This data highlights that flexitarians driven by cost are likely to be older families or retirees on a lower income, who claim their red meat consumption was motivated by enjoyment with a strong emphasis on treating. This is in comparison to flexitarians that are not cost driven as they enjoy a variety of meals, who are typically over 55 years, have more disposable income and compared to the other group are more likely to consume red meat because it quick to prepare and convenience is key for them.

Source: Kantar Usage 52 w/e 18 February 2024 vs previous year, *MFP Non-Avoider – panellists who do not declare themselves as reducing their red meat consumption, vegetarian or vegan and ** Flexitarian - a panellist who has identified that they are reducing their Red Meat consumption.

Other dietary trends

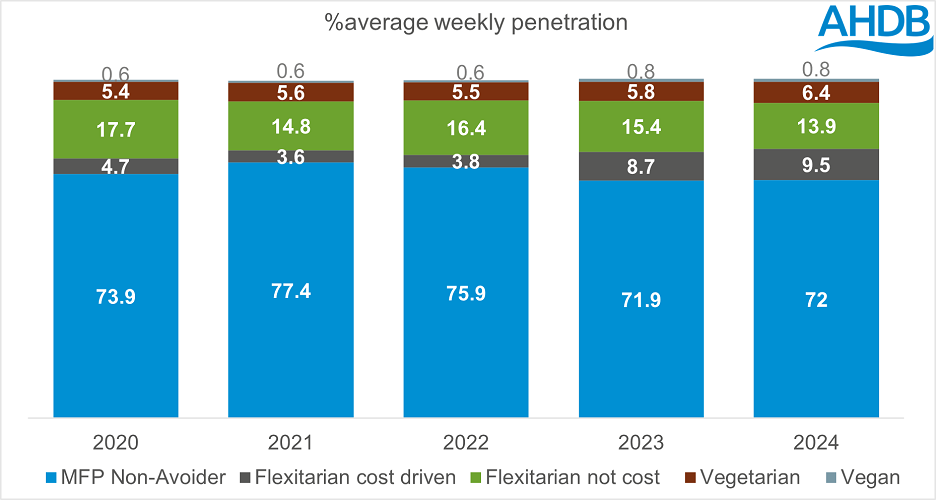

The number of consumers eating meat, fish or poultry (MFP Non-avoider) remains consistent with last year at 72% of GB population. There has been a slight increase in vegetarians from 5.8% to 6.4% penetration, whilst the number of vegans has remained the same at 0.8%.

Source: Kantar Usage, Total occasions, 52 w/e 18 February 2024 versus previous four years

Meal choices

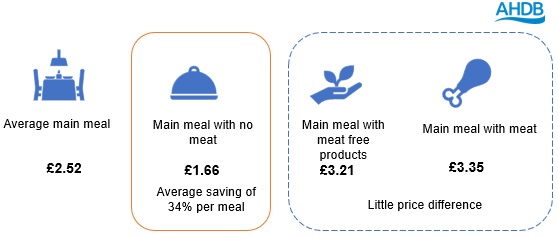

Source: Kantar Usage, 12 w/e 21 January 2024, Average spend per occasion for total main meals

As highlighted in the table above, main meals with meat-free substitutes are significantly higher in price £3.21 versus a meal with no meat £1.66 – average 34% saving per meal. Meat-free and dairy-free products were also 3.3% and 18.4% more expensive than their animal counterparts (Kantar, 3 w/e 21 Jan 2024: Nielsen 4 w/e 27 Jan 2024). In addition, Kantar Usage highlight that meat-free meals are picked by consumers as they are perceived by some as healthier and more practical across both lunch and dinner occasions, whilst meat-based meals score higher for consumer enjoyment and for being filling.

In 2023, meat-free lunchtimes were noticeably about ‘naturally meat free’ choices, such as cheese, vegetables, fruit and crisps, whilst for evening meals, there was a move towards more convenience-based foods like ambient noodles, cooking sauces and frozen vegetables.

Opportunities for red meat and dairy

Lunchtime – sandwiches remain the most popular meal, as they are quick and easy to prepare. This provides an opportunity for tasty, versatile options that include butter, cheese, ham and bacon. Yoghurts are another great lunchtime option for all ages, as they’re a good source of calcium and satisfy the consumer want for a ‘sweet treat’.

Evening meal – Italian meals are currently the most popular evening meal, providing an opportunity to boost the use of mince, bacon, cheese and milk within these family friendly dishes to enhance taste for all to enjoy. Indian meals are also proving popular, which presents opportunities for lamb-based dishes and yoghurt and creme fraiche as accompaniments.

Summary

It is fair to conclude that cost and convenience have been higher considerations for many consumers regarding their dietary changes in 2023. Based on this evidence, there is still the desire for flexitarians to regularly consume red meat, whether this is for a tasty treat or as a meal that is quick to prepare. As cost becomes less of a concern in the future, there will be a role to reassure consumers around the reputational topics such as health and sustainability, which campaigns like AHDB’s Let’s Eat Balanced can support.

If you would like to know more about this topic, please sign up for our webinar on 27th June 2024.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.