Unwrapping Christmas, but not as we know it

Thursday, 10 December 2020

With England under a new, more stringent tiering system from the 3rd December, the ‘normal’ run-up to Christmas seems very distant. In this article we look at how COVID-19 and government restrictions could affect sales of meat, dairy and potatoes.

What is happening this year and why?

Christmas is the largest seasonal celebration of the year. Understandably, grocery spend is at its highest during this period. The four weeks of Christmas 2019 were worth £1.6 bn more than an average month in the year, accounting for 9% of total grocery sales (Kantar Total Grocery, 4 w/e 29 December 2019).

As a result of the COVID-19 pandemic, half of consumers believe it is unlikely they will have a ‘normal’ Christmas this year (Kantar August 2020). According to Kantar, large gatherings may be less commonplace than many might think, with instances of three people or fewer at Christmas growing in recent years. Views on restrictions vary with 42% of consumers have said that governmental restrictions would not affect their Christmas, and 50% of consumers wouldn’t mind if restrictions, such as the rule of six or a ban on household mixing, are enforced over the Christmas period (YouGov, October 2020).

What could a COVID-19 Christmas look like?

The government have now announced that from 23-27 December 2020 people may form a Christmas bubble of up to three households. This will apply across all four home nations, with additional travel time allocated for people in Northern Ireland. This would allow for larger gatherings across these dates, although the bubbles must be consistent. This means you couldn’t see one set of relatives one day and another the next, which could put a brake on the total number of larger gatherings.

Separately, tiering arrangements have been made, with the majority of regions in England set to be put into tiers 2 and 3. According to the BBC, 32 million people would be placed under tier 2, with a further 23 million under the highest, tier 3, restrictions. Only 1% of the population are thought to be going into tier 1, the lightest restrictions. The tiering is to be reviewed on 16th December.

Tier 1 restrictions

Tier 1 governmental restrictions allow the rule of six both indoors and outdoors. Foodservice outlets can also reopen, with an extended curfew of 11pm allowing for an hour of ‘drinking-up’ time.

Indulgence could be on the cards this Christmas, as 77% of grocery shoppers believe it is important to have a good Christmas after the events of 2020 (Mintel UK Supermarkets Report, November 2020). This could see consumers flocking to foodservice operators in these areas. However, this is only a very small part of the UK, and as many consumers are still hesitant to eat out, the impact is likely to be minimal.

Across all tiers, 43% of consumers have become more price conscious as household income is reduced due to the furlough scheme and the rising level of unemployment. To understand how a more price conscious consumer affects product choice, please see our article here.

Tier 2 restrictions

Under tier 2, which covers the biggest portion of the population, household mixing is prevented. However, pubs and restaurants can open (albeit with an 11pm closing time) and serve food but may only serve alcohol with a meal. Additionally, people may only gather with people from their households in foodservice establishments.

This means that people will not be allowed to have guests in the home, and the guidance for some foodservice outlets (particularly those less centred around food) will mean that many will struggle to open. There will also be significant loss of revenue from pre-Christmas events as households cannot mix.

Tier 3 restrictions

Under tier 3, household mixing is prevented, and foodservice must remain closed except for delivery and takeaways. For foodservice outlets who will almost entirely miss out on the lucrative pre-Christmas period, the impact will be substantial and potentially devastating to an already weakened industry.

Impact of restrictions

Occasions with guests present over the Christmas period were worth £390m in 2019. If household mixing remains restricted throughout the Christmas period, this source of income could elude the grocery market, with traditional Christmas categories taking the brunt of this (Kantar prediction based on December 2019 data). A key AHDB category set to lose out if restrictions are not eased is red meat. In particular, fresh bacon joints and chilled sausage meat, as these are more likely to be consumed when we have guests visit at Christmas. The three-household stipulation over the five days immediately around Christmas will hopefully ease some of the potential losses.

In the 4-week run up to Christmas 2019, 1.3 billion out-of-home main meal occasions took place. If 75% of these meal occasions were consumed in home this Christmas due to governmental restrictions, the grocery market would stand to gain £2 billion in sales (Kantar prediction based on December 2019 data). This significant boost in grocery sales will hopefully offset potential losses from traditional Christmas categories and could benefit red meat products such as smaller roasting joints, which are suited to more limited gatherings.

It is difficult to predict how consumers will act. Not everyone is being affected in the same way, with some looking to scale back while others are expecting to splash out. However, it has been predicted that with smaller occasions, less items would be expected to feature at Christmas dinner. This could have a significant impact on impulse and sharing food categories. For instance, in some households, party favourites such as cheese boards could be streamlined or absent completely. In contrast, smaller gatherings could encourage the consumption of luxury indulgent items, driving demand for dairy goods like cheese (IGD Retail analysis).

Finally, with less guests present, we predict Christmas meal preparation time is likely to reduce, with less people to feed and less emphasis on cooking everything from scratch. Therefore, convenience products could prosper. For instance, frozen potatoes, prepared vegetables, and smaller non-traditional cuts or joints of meat may benefit as they are considered convenient short-cuts compared to a traditional whole-bird or larger joint (Kantar prediction based on December 2019 data).

How do AHDB categories usually perform?

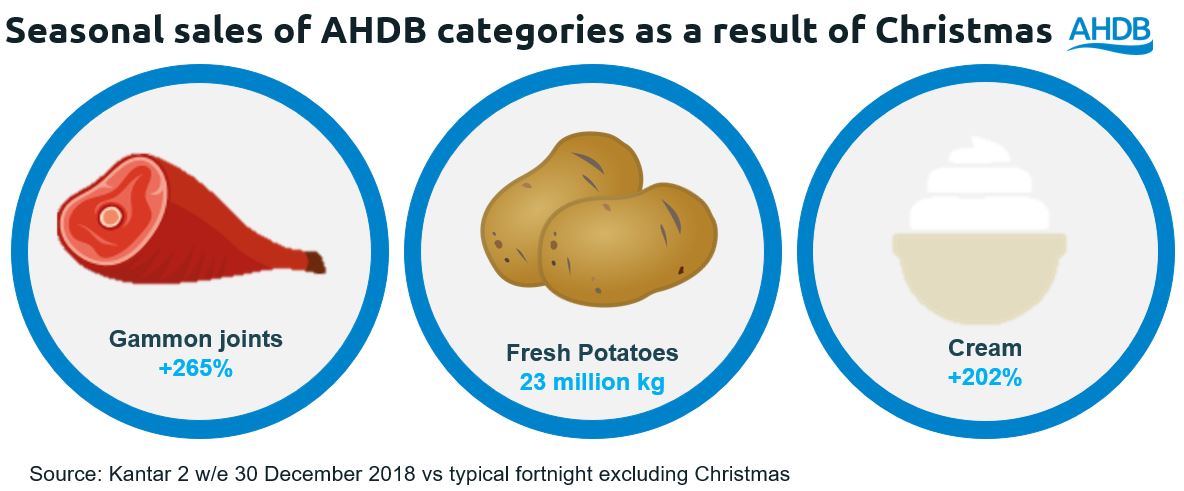

Christmas is the biggest seasonal event for total Meat, Fish and Poultry sales. For instance, under ‘normal’ circumstances, some red meat products receive seasonal uplifts in sales. For example, in 2-week run up to Christmas 2018, gammon saw an uplift of 265% (Kantar 2 w/e 30 December 2018).

Additionally, at Christmas, consumers often look for indulgence-related products, driving increased demand for popular staples like cheese, butter, and cream. For instance, in 2018, 11% of total cream was sold in the 2-week run up to Christmas, a seasonal uplift of 202% (Kantar 2 w/e 30 December 2018).

Furthermore, Christmas generates a seasonal uplift in sales of both fresh and pre-prepared potato products. The performance of fresh potato sales is linked to events that involve roast dinners such as Christmas. Kantar identified that in the 2 weeks leading up to Christmas, sales of fresh potatoes increased to 23 million kg (Kantar 2 w/e 30 December 2018).

To further understand the importance of seasonal events and how they affect sales of meat, dairy and potatoes, please check out the AHDB eventing report.

The outlook for Christmas?

The British public have been subject to COVID-19 restrictions for the majority of 2020, and this is set to continue. It is safe to say that Christmas this year will be slightly different to normal, there will be both opportunity in retail as demand shifts away from foodservice, and challenges for those who supply the eating out market.

AHDB will be analysing the overall Christmas performance of red meat, dairy and potatoes sectors and have some results by the end of January 2021.