Strong January performance for red meat and dairy

Thursday, 4 March 2021

January has seen a strong performance from red meat and dairy – a continuation of its Christmas success.

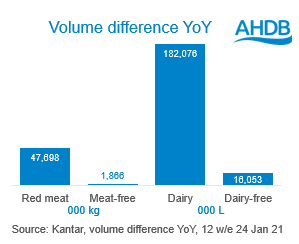

Retail volumes for total red meat were up 15.1% in the 4 w/e 24 January 2021 according to Kantar and dairy also showed a strong performance, up 11.8% in volume compared with last January. Both meat and dairy are growing through increased volume per trip, showing that shoppers are keeping cupboards and fridges well-stocked during the third national lockdown.

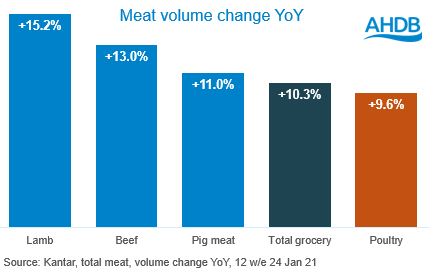

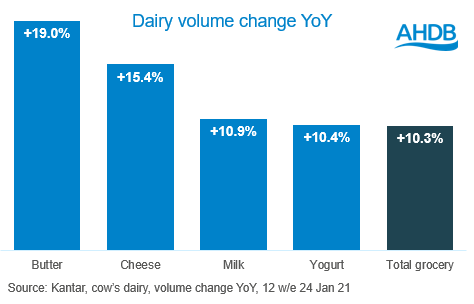

Over the last 12 weeks, we have seen the total grocery market grow by 12.4% in value and 10.3% in volume, with all red meat and dairy categories performing more strongly than the overall market in terms of volumes.

Red Meat

Primary red meat saw volume growth of 18.1%, with much of the growth driven by shoppers buying red meat more frequently as closure of foodservice has led to more in-home cooking. We also see an increase in household penetration, showing that new shoppers are being attracted to the category.

Beef mince continues to be a strong family favourite, driving the most growth for the beef market, but other cuts, such as roasting joints, steaks and burgers, are also proving popular as shoppers look for variety in their meal choices. For more detail on the red meat markets, see our monthly dashboards.

Meat-free* also performed well in the last three months, with 13.3% volume growth, with 95% of volumes bought this January being bought by shoppers who also bought meat-free products last January. Many shoppers are including meat-free within their repertoire without cutting out meat, as 62% of shopping baskets containing meat-free also contained a meat product.

AHDB research shows that only 20% of households in Britain contain one or more conscious meat reducer, whereas 38% of households have bought a meat-free product in the last year. Meat-free remains a small category, at less than 2% of the size of meat, fish and poultry.

Dairy

All areas of dairy saw double-digit volume growth in the 12 w/e 24 January. Fresh cream was the fastest-growing – up 21% – but milk growth contributed the most to volume uplift – up 131m litres – and accounted for 72% of total dairy growth. Milk growth is being driven by shoppers increasing the amount they buy per shop – up 11% to 3.1 litres per trip on average.

Shoppers are exploring different varieties of cheese as we are seeing a lot of growth coming from British regional cheeses as well as speciality and continental. This is partially driven by consumers cooking more meals from scratch at home and using cheese as a main component.

Dairy alternatives grew by 23% – most of this growth was driven by milk alternatives. When comparing the size of the categories, dairy alternatives are 5% of the size of cow dairy, showing that dairy alternatives are still a niche purchase, with only 28% of shoppers buying a dairy alternative product, compared with 99.6% for cow’s milk dairy.

Opportunities and challenges

- Opportunities remain for the retail sector as consumers look for ingredients to make economical and tasty meals at home. Recipe inspiration throughout the shopper journey can help consumers to feel confident to try a wider variety of meals and encourage new ways of using products to help maintain interest.

- Many consumers are purchasing small treats, turning to food during the current social restrictions. The use of dairy in home baking and desserts presents an opportunity here.

- The data shows a strong start for the meat and dairy sectors in retail for 2021. However, the closure of the foodservice sector still presents a challenge. The Agri-Market Outlook details our predictions for how this will play out through 2021.

* Meat-free definition defined by AHDB (includes meat alternatives and selected vegetarian/vegan ranges. Excludes pizzas).

Related Content

Topics:

Sectors: