Shoppers scale back this Christmas

Tuesday, 4 February 2020

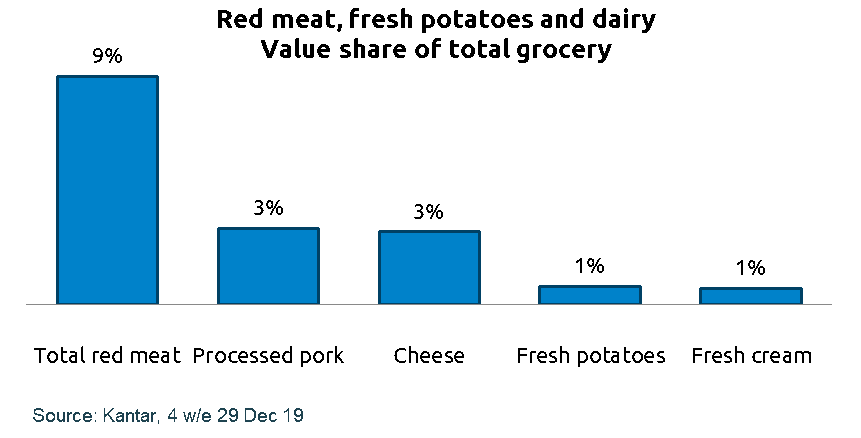

Belt-tightening behaviours meant Christmas 2019 saw the slowest rate of growth over the festive period in four years. Despite this, the four weeks of Christmas are still worth £1.6bn more than the average month, accounting for 9% of grocery sales throughout the year.

The festive season is even more important for red meat and dairy and they make a significant contribution to the grocery market during this period.

In this article, we take a look at the performance of AHDB categories, as well as the opportunities, at this all-important time of year.

Grocery: Weakening confidence impacting consumer spending

It was a cautious Christmas in 2019. Amid a slowing global economy and uncertainties around Brexit, consumer confidence was low, spurring the return of belt-tightening behaviours. Prior to the festivities, 1 in 4 people said they were planning to spend less on their festive food and drink. This was evident, with only 0.2% value growth for grocery in the 12 w/e 29 December – driven by inflation rather than people buying more items. As well as spending less, people also shopped around less, meaning supermarkets had to stand out to get people through the doors.

The discounters continued to gain share this Christmas – not only because of their low-cost positioning. Well-known brands that appealed to cautious consumers also helped them win market share.

Other strong-performing retailers saw growth through their standard private label offerings, as opposed to premium products seen in previous years. Again, a variety of popular brands also helped boost their performance.

Meat, fish and poultry: Challenging Christmas

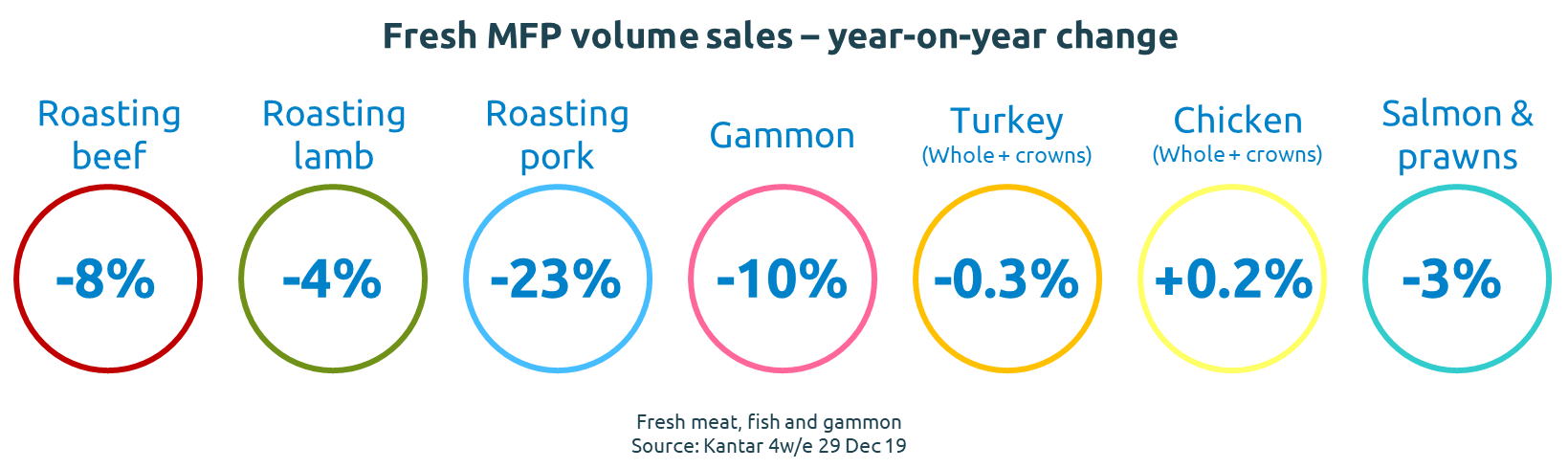

Fresh meat roasting joints add £33m to the category in the two weeks leading up to Christmas. However, this year’s cautious spending behaviour was reflected in the performance of meat, fish and poultry (MFP).

Turkey remained an important part of the Christmas plate, but a continued move towards smaller birds and crowns could be seen. It meant that while people still bought turkey, volumes were down. This was also the case for most roasting joints and, therefore, growth was hard to come by.

Poultry and fish performed better than red meat this Christmas. Like total grocery, brands such as Gressingham and Bernard Matthews helped the white meat category.

Red meat suffered as a result of some shoppers switching to white meat, but volumes were also affected by the move to smaller joints. Also, more households moved away from buying more than one protein, with 57% of shoppers buying only one type of meat this Christmas. Despite this, gammon was still a firm festive favourite. In the two weeks to 29 December, it was bought by more households than fresh turkey. This helped supermarkets gain further sales; as those shoppers who bought gammon or pork roasting joints actually spent more in store in the same shopping trip, than they did when purchasing fresh turkey in the 4 w/e 29 December.

But this doesn’t mean people are giving up on red meat altogether. A staggering 94% still bought red meat (beef, lamb, pork/pig meat) during the four weeks to 29 December. While there was growth in meat-free products (+2.8% volume), that growth slowed compared to last year. Rather than people switching altogether, almost one third of growth for the sector came from shoppers who continued to but MFP this Christmas, but also added Meat Free to their repertoire. This implies that people were catering for new vegetarian/vegan individuals at the table, rather than their entire household.

This means that people are still attracted to the meat category and innovations are one way to grow sales, particularly if they are affordable. Aldi’s two-metre-long pig in blanket is a great example, with over 10,000 people purchasing it this Christmas – two-thirds of whom didn’t buy pigs in blankets last Christmas. Not only were they shoppers who had not previously bought this product, but often younger shoppers.

Image: Aldi's 2m pig in blanket (Source: Aldi)

Opportunities for red meat

- Red meat’s importance to total grocery justifies strong shelf space and support, such as at-fixture inspiration for roasts throughout winter.

- Supermarkets need to provide smaller joints of red meat within their range in the run-up to Christmas, supported with in-store activity from mid-November onwards.

- Give people the opportunity to add interest to their tables with minimal outlay; innovations should be affordable as well as novel.

Potatoes: Fresh affected by deep promotions

The deep promotions seen on potatoes and vegetables during Christmas returned this year. The price cuts often take place in the few days just before Christmas, which is when people are often purchasing their fresh vegetables, and so value is driven out of the category.

Smaller packs were promoted significantly more this Christmas, particularly 2 kg packs. This attracted shoppers to choose smaller bags, but the deep level of discount resulted in overall value decline. The value of the fresh potato category in 2019 was down 6.8% in the 4 w/e 29 December, with promotions accounting for 33% of sales – up from 19% in 2018.

Christmas 2019 was the first year since 2016 that fresh pre-prepared potato products experienced a decline in value, with a decrease of 3.6%. Mash remains the largest part of the category, accounting for 30% of value, and managed to grow sales by 8.9%. Other areas of growth included baby/new, roasts and parmentier.

Opportunities for potatoes

- Encourage people to buy fresh potatoes throughout winter, as deep promotions just before Christmas drive value away from the category.

- Ensure adequate shelf presence is given to pre-prepared mash, to help shoppers looking for shortcuts

Dairy: Decent performance despite less indulgence

We were seemingly less indulgent this Christmas. Sales of Christmas puddings were down by 16%, while seasonal biscuits were 11% lower in the 12 w/e 29 December, according to Kantar’s Grocery Market Update. So it is unsurprising that fresh cream, which is usually served as an accompaniment, achieved only marginal volume growth (+0.1%) in the 4 w/e 29 December. Spend on double cream was down 2.1%, but alcoholic creams were up 6.1%, with more households buying into the sector this year, linked to new products coming through.

Opportunities for cream

- Continue to innovate to attract new shoppers, with alcoholic variants being a key area for this.

- Inspire people to pair cream with relevant desserts, with product placement alongside both traditional and new innovations.

Cheese performed well against the challenging market backdrop, with volumes up 2.1%. Growth mainly came from continental cheese, with Wensleydale and Stilton both struggling. Cheddar fell back as volume-driving deals (e.g. 2 for £3) made way for base price reductions.

Opportunities for cheese

- Focus on British classics in the cheese aisle, with affordable British cheeseboards.

Sources

All data sourced from Kantar (Total Grocery/Meat, Fish and Poultry) for the period ending 29 December 2019