- Home

- News

- Sensible spending and a passion for pigs in blankets: Predictions for Christmas food trends 2024

Sensible spending and a passion for pigs in blankets: Predictions for Christmas food trends 2024

Monday, 2 December 2024

As we head into the festive season, we've gathered data from consumers on their Christmas food plans and mealtime preferences.

This season, we can see consumer positivity returning as 40% think that this Christmas will be more enjoyable than 2023 (Mintel, September 2024) and consumer confidence rising three points in November (GFK Consumer Confidence Barometer powered by NiM, November 2024).

The cost-of-living crisis has dominated Christmas predictions for the past two years and, while the number of consumers concerned about the cost-of-living crisis has fallen this Christmas, 77% of consumers remain concerned (Two Ears One Mouth, November 2024).

As a result, we see polarised spending ability, with more affluent consumers open to increasing their spending, middle-income households being cautious, and lower-income households feeling squeezed.

Christmas predictions

- We predict retail demand will outstrip 2023 as 20% claim they will eat out of home less this December with 90% of consumers eating in this Christmas Day either at home or at the home of a family member or friend (YouGov/AHDB Pulse November 2024). We also see 41% of consumers saying they plan to spend what they want this Christmas (IGD November 2024). The polarised spending ability will drive share for premium retailers, local butchers and farm shops as well as discounters. A total of 38% of consumers claim that good value for money will be important to them for Christmas meat purchases; therefore, we predict promotions will be key to driving share. However, a similar number (37%) claim high quality is key – therefore we predict some trade up in tiers (You Gov/AHDB Pulse November 2024). The growing need for convenience also means that online will be an important channel, with 34% of shoppers using online retailers more this Christmas than they have in previous years (IGD November 2024). As we see that 43% of consumers are planning to do their Christmas shopping in one big hit (IGD October 2024), Sunday 22 and Monday 23 December are likely to be the biggest shopping days for Christmas food.

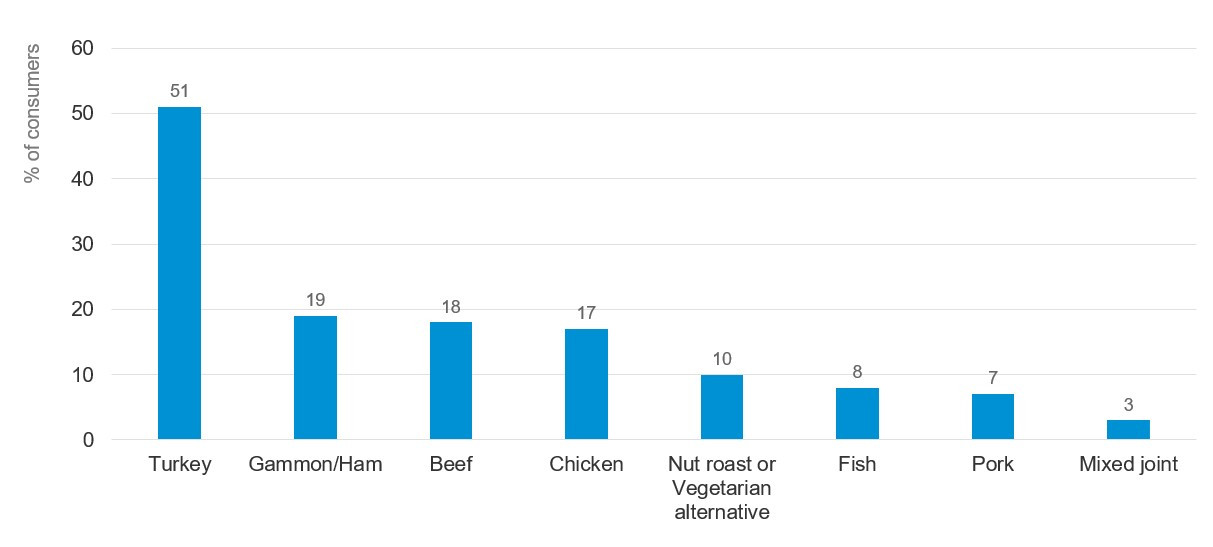

- We predict meat in retail will grow in line with the market, with 17% of consumers claiming that they will spend more on meat this Christmas, outweighing the number of those who claim they are going to spend less (13%) (YouGov/AHDB Pulse November 2024). The study also showed that turkey remains the most popular meat option for Christmas Day, followed by gammon/ham and beef. In total, 23% of consumers plan to buy two meat options for the Christmas meal, and 10% plan to buy three meat options, with turkey and gammon/ham or turkey and beef being the most common combinations. Mixed roasts/bird in bird offerings show lower traction with only 3% of consumers claiming they are going to purchase them for Christmas Day. Meat that is easy to prepare and cook is important for 26% of consumers, indicating that ready-to-cook options will work well this year (YouGov/AHDB Pulse November 2024). In terms of the rest of the Christmas plate, roast potatoes are the most popular element, but 58% of consumers say that pigs in blankets are essential – as important to consumers as stuffing, Brussel sprouts and Yorkshire puddings (Two Ears One Mouth, November 2024).

Percentage of consumers claiming to purchase different options for Christmas Day

Source: YouGov/AHDB Pulse November 2024

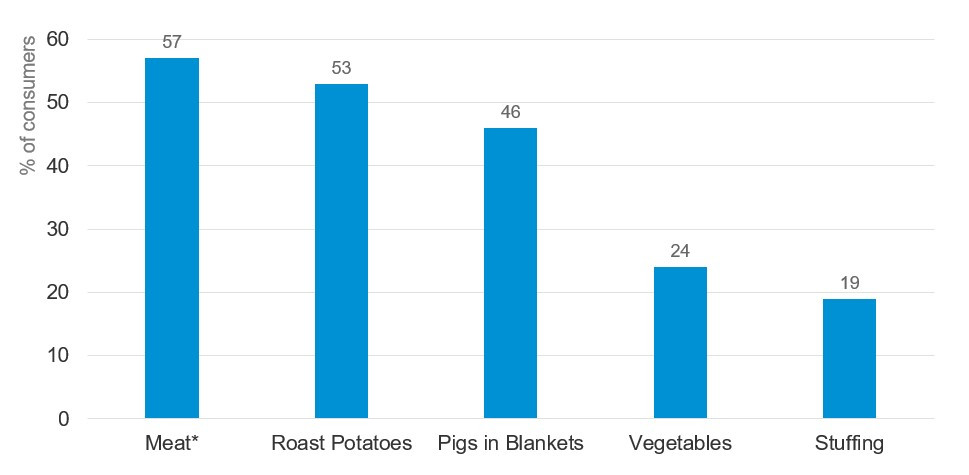

- One in four claim that they will use an air fryer to cook all or part of the Christmas meal. Of those who plan to use an air fryer, 57% aim to cook the meat (of all joint types), 53% the roast potatoes and 46% the pigs in blankets in the air fryer.

Elements of the Christmas meal planned to be cooked in an air fryer

Source: YouGov/AHDB Pulse November 2024, based on consumers who stated they would use an air fryer for part or all of the Christmas meal. *Meat is anyone who coded turkey, beef, pork, lamb, chicken, gammon

- Spotlighting desserts, we predict dairy will also do well, with plain cream, custard and ice-cream seen as essential to accompany traditional Christmas pudding or alternatives such as sticky toffee pudding. Among those preferring flavoured creams or butters, brandy comes out on top (Two Ears One Mouth, November 2024). A total of 38% of consumers think that a cheese board is key to festive celebrations, with brie, Cheddar and Blue Stilton being the most preferred cheese varieties to feature (Two Ears One Mouth, November 2024).

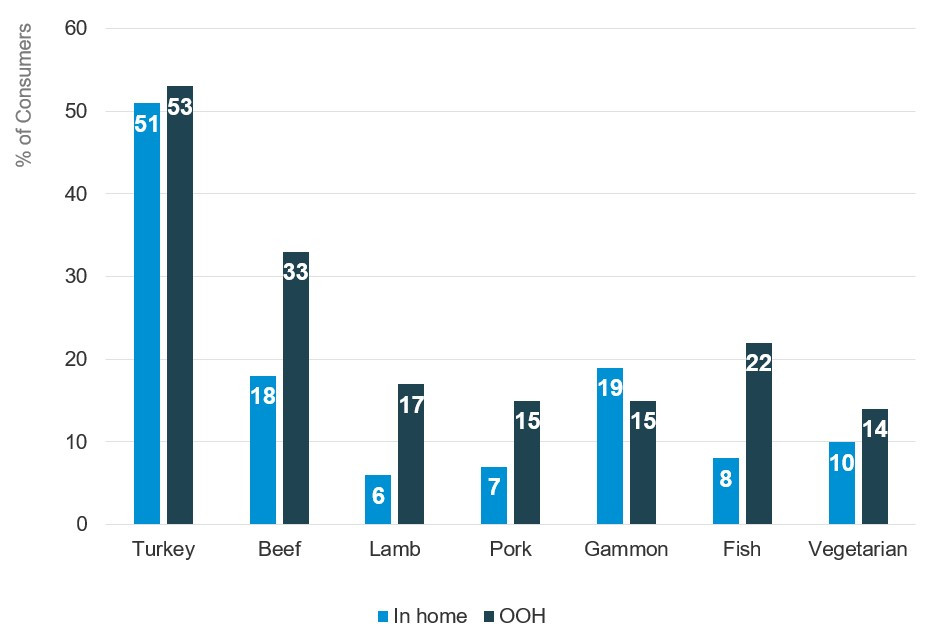

- While just 5% of consumers are planning on eating out on Christmas Day, we predict an uplift in spend out of home in line with previous years, due to people spending more on meat-centred dishes (e.g. roasts) and seasonal offerings (e.g. hot milk-based drinks) (Kantar OOH December vs Average month 2022, 2023). For consumers who were planning on eating out on Christmas Day, red meats are even more popular than for consumers planning to eat in home, potentially because some people feel less confident cooking these joints and would rather leave this job to a professional (YouGov/AHDB Pulse November 2024). Our research shows that dessert choices out-of-home (OOH) are not so traditional, with cheesecake ranking up there with Christmas pudding for a Christmas Day dessert this year and 1 in 4 consumers wanting cheese and biscuits (YouGov/AHDB Pulse November 2024).

Percentage of consumers claiming to eat different options in home or OOH for Christmas Day

Source: YouGov/AHDB Pulse November 2024. Please note that respondents could choose more than one option if desired.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors: