COVID-19: Red meat sales growth slows on anniversary of pandemic

Tuesday, 18 May 2021

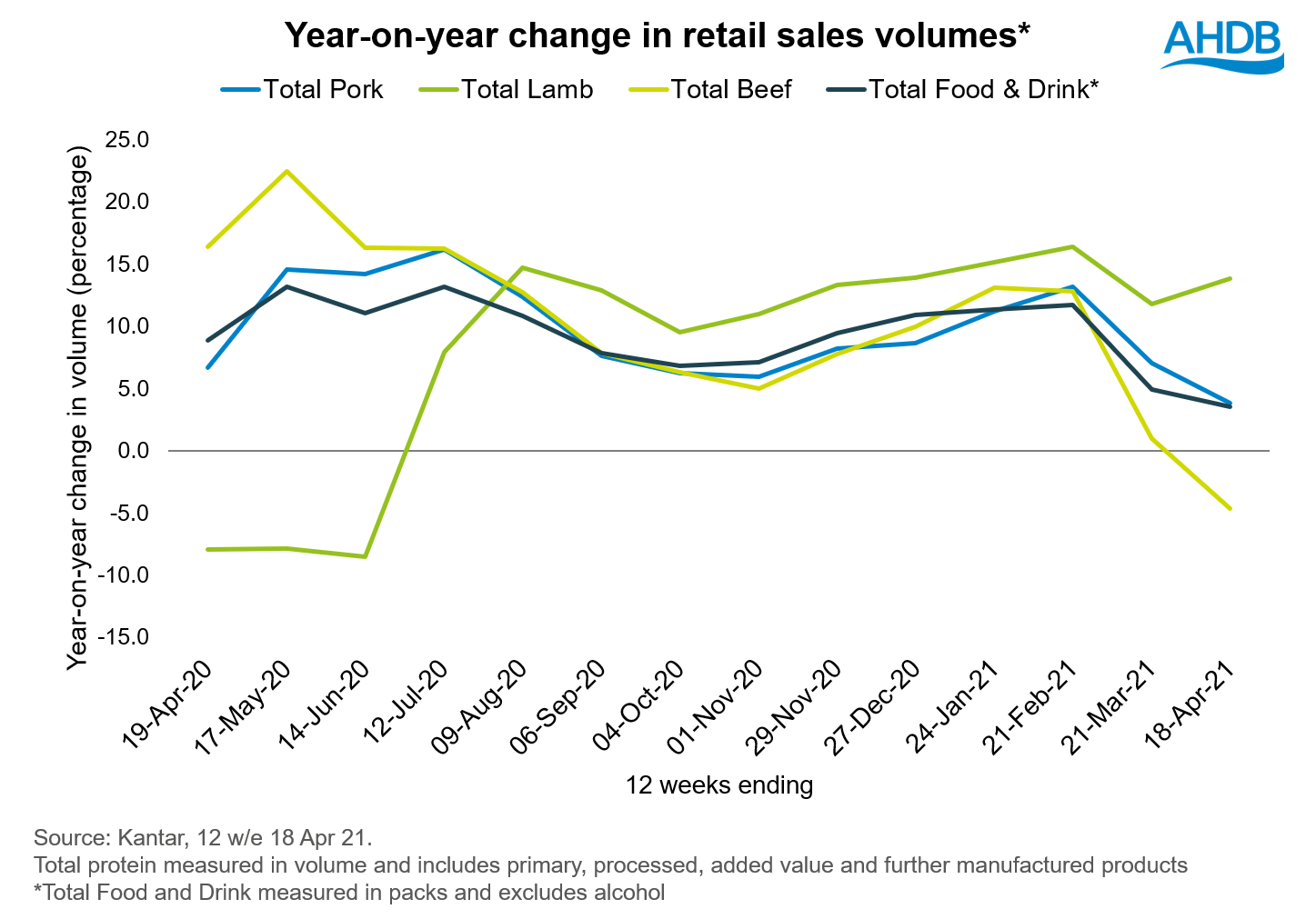

Retail volumes of beef, lamb and pork were up 1.0% over the latest 12 weeks to 18 April 2021. Retail sales have started to slow as figures start to compare to the panic-buying peak seen in March/April 2020, when the nation entered its first lockdown at the start of the pandemic.

Performance varies by protein, however this combined performance is slightly behind total retail food and drink volumes*, which were up by 3.6% in the 12 weeks to 18 April.

March 2020 saw record-breaking grocery sales, therefore comparisons will naturally slowdown. Shoppers had no other option but to buy food from their supermarkets, grocers and butchers. In addition to this, there was a lack of confidence in the safety of takeaways and drive-thrus temporarily closed while establishing safe operations, causing the takeaway market to contract and more home-cooked meals to be eaten.

This year, the national lockdowns have started to ease, meaning that people can start to eat in places other than their own homes, including pubs, cafés and restaurants. There is also greater confidence in takeaways and the major chains are open for delivery and drive-thru. There will therefore be a natural slowdown in retail sales as there are huge contrasts in the external factors, such as these, surrounding the pandemic.

These factors must be taken into consideration when viewing retail sales figures – double-digit retail growth cannot be maintained with COVID-19 restrictions being relaxed, and while year-on-year declines may be seen in some cases, this masks an overall positive picture, with volumes for most categories still higher than they were in 2019.

Understanding some of the key drivers for beef, lamb and pork

|

|

March/April 2020 |

March/April 2021 |

|

Beef |

Huge spike in sales of beef mince, linked to its versatility. This leads to carcase balance concerns, as growth in steaks and roasting joints is behind that of mince. Significant growth for beef burgers as Britain experiences sunniest spring on record and barbecue season starts early. |

Mince volumes move into year-on-year decline but remain up 5% on 2019 (Kantar, 12 w/e 18 Apr 21). Stewing beef also declines year-on-year but volumes are still up 9% on 2019. Steak sales have remained in double-digit growth throughout the past year, potentially linked to people recreating the out-of-home dining experience at home. |

|

Lamb |

Leg roasting joints fall as lockdown sets in just before the Easter holiday, hampering the usual gatherings. Other cuts initially behind the total grocery market. |

A natural recovery in leg roasting joints, although volumes not quite up to 2019 levels (-7%, Kantar, 12 w/e 18 Apr 21 vs 21 Apr 19). However, lamb has been in sustained volume growth since summer 2020, particularly mince and chops, as well as processed and added value products. |

|

Pig meat |

Sales of sausages and bacon rise as consumers have more cooked breakfasts. Most primary cuts experience double-digit growth, including steaks and belly. Leg roasting joints are the main exception. |

Bacon and sausage sales ease, however they remain in significant volume growth vs 2019, up 15% and 12% respectively (Kantar, 12 w/e 18 Apr 21). Pork belly, chops and steak also decline versus 2020 but also remain in growth versus 2019. Leg roasting volumes have bounced back in recent months. |

View the latest retail data for beef, lamb and pork via our interactive dashboards.

Sign up here to receive an email notification when the red meat retail dashboards are updated each month.

Related content

Topics:

Sectors:

Tags: