Retail sales of bacon and sausages keep total pork volumes afloat

Wednesday, 16 September 2020

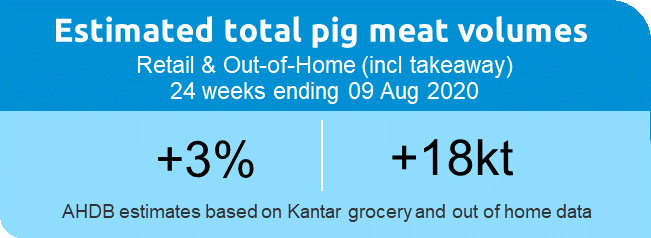

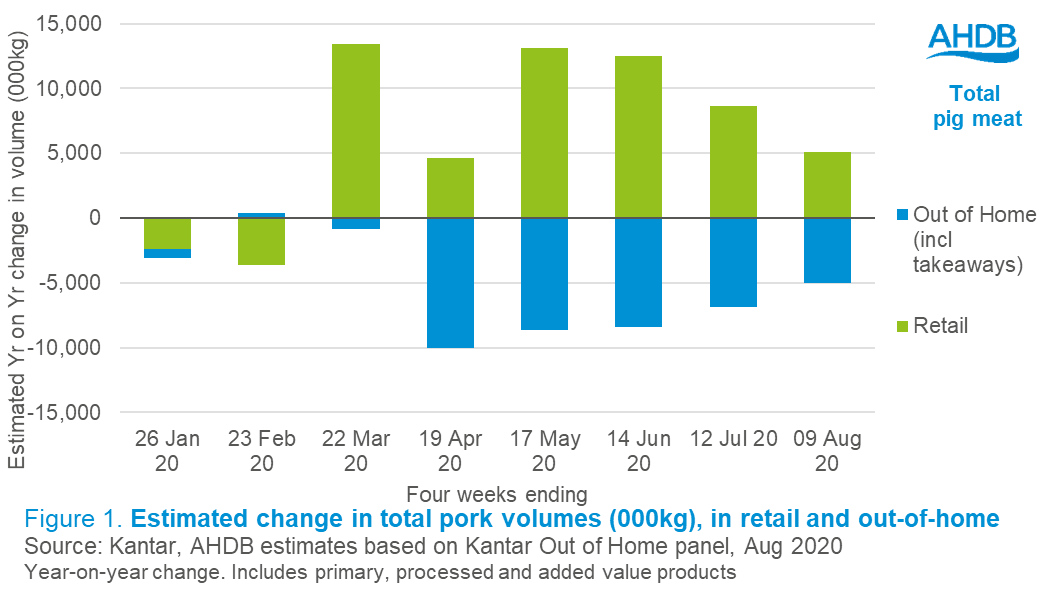

Despite closures in the foodservice market, strong retail sales led to an overall 4% volume increase for pig meat in the six months to 9 August, according to AHDB estimates based on Kantar data.

Retail volumes

Sales of pork/pig meat were up 13% (57kt) in the 24 weeks ending (w/e) 9 August 20, in line with the total food and non-alcoholic drink uplift of 14%.

Over the six-month period, sales of bacon and sausages increased significantly, accounting for almost 60% of the overall increase for pig meat. In the first eight weeks of lockdown, there were an additional 16 million fry ups/cooked breakfasts eaten – an increase of 64% (Kantar Usage, 8 w/e 17 May 20). Health became less important and meals were more about enjoyment – a trend we typically see during times of recession.

Out-of-home volumes (including takeaway)

With cafés shut and big fast food brands temporarily closed, out of home pig meat volumes declined by 55% (-70kt) overall. Breakfasts (mainly full, cooked breakfasts) were the main driver of this, declining by 68%. Despite an uplift in takeaway orders of full English breakfasts, it remains niche and it seems most people instead opted to cook their own at home.

Further losses came from pork-based pastry items (-54%), which includes sausage rolls, pasties and pies, as well as sandwiches containing ham, bacon or sausage (-50%).

The pork sector is not reliant on one main dish, as is generally the case with other sectors. There’s a diverse range of processed pig meat items on offer in the out-of-home market, and therefore there’s a variety of ways where growth can stem from. Primary pork tends to take more of a backseat to processed pig meat, particularly in the out-of-home market. This is especially the case at the moment, where processed pig meat has outpaced primary pork both out-of-home and in-home.

Read more about how pork compares to other categories in our main update.

Notes:

Out-of-home volumes include takeaway, dine-in and on-the-go.

Public Sector (e.g. schools, hospitals) not captured

Related content

Sectors: