Biggest Christmas Grocery Spend Ever

Friday, 2 March 2018

Christmas 2017 saw another revenue record set for grocery sector revenue, beating 2016, which had previously been the festive period when spending hit its highest level. A significant contribution was made by the £1.4bn spent on the Friday and Saturday before the big day, with total spend in the week before Christmas totalling £3.5bn. This article describes some influential factors.

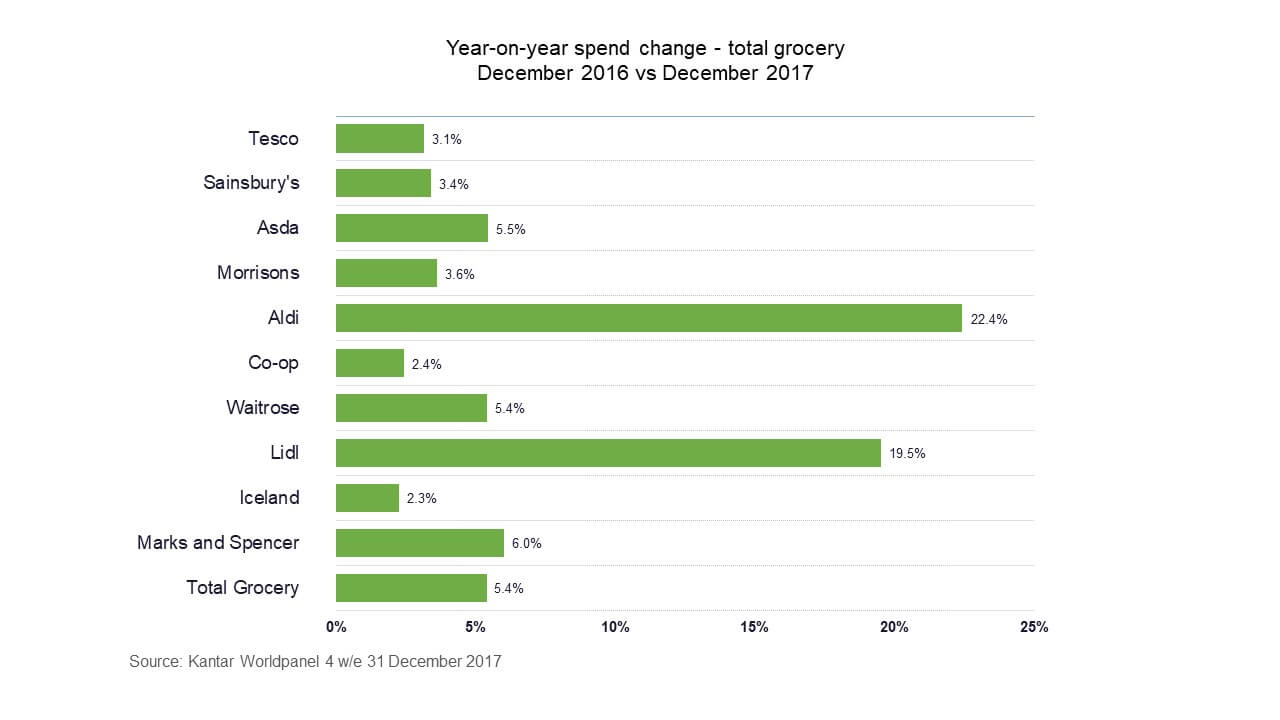

Hard Discounters saw their highest ever combined penetration over the four-week period at 49.5%. Strong sales growth throughout 2017 was built on in the Christmas period, with premium tier meat making a significant contribution. Aldi’s ‘Specially Selected’ meat range grew by almost 50 per cent and Lidl’s premium turkey, gammon and beef offerings also performed very well.