Beef cuts – opportunities and consumer views

Wednesday, 18 December 2019

We have covered a lot in the last year on the changing consumer landscape and how this is affecting the total beef market. Volumes have declined by 1.4% in the year (Kantar); however, over the last five years, volumes for beef have been fairly flat at -0.4%.

This is not across all categories, however, with mince seeing spend and volume increases but steaks and roasting seeing steady declines. To read more about changing consumer trends affecting beef as a whole, see our article on beef category trends.

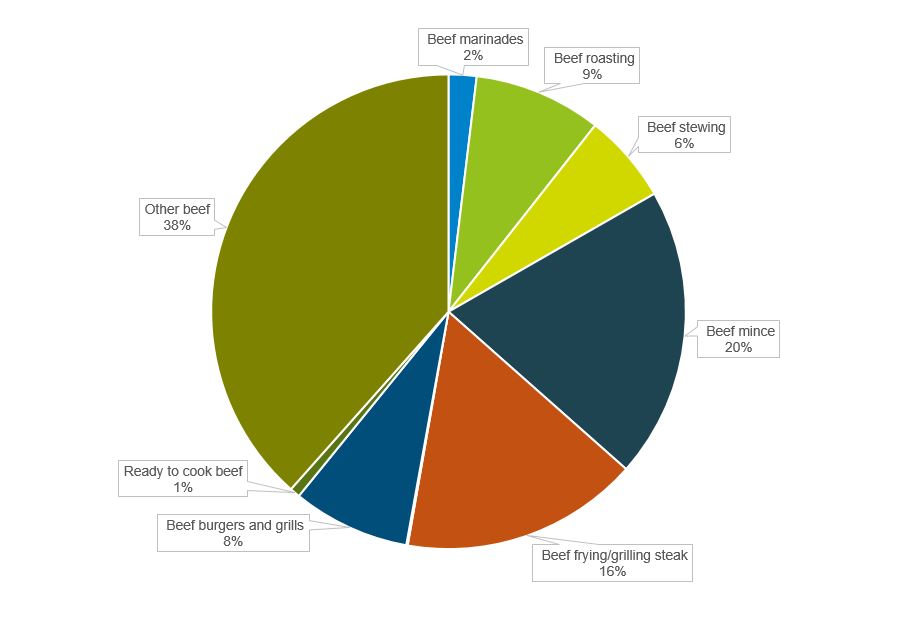

Spend share of beef by cut

Source: Kantar | Spend share | 52 w/e 06 Oct 19

* Other beef includes beef ready meals, pies, pasties, chilled main meals and all other beef products, but excludes pizzas containing beef

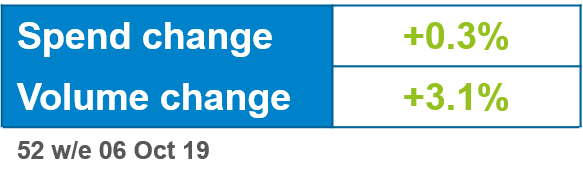

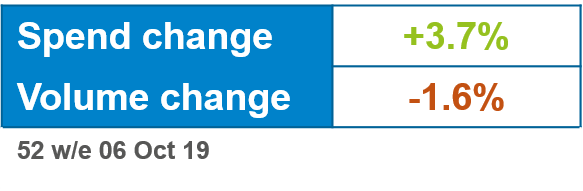

Mince

Average price for mince has reduced by 2.7% to £5.44/kg, which has helped to boost sales overall, with a small increase in spend. Mince is viewed as good value and considered by consumers as one of the cheapest and most versatile of all cuts. Healthy mince (up to 5% fat) is now the largest share of the market, accounting for 48% of spend, and is still showing the most growth, up 26% year on year, driven by consumers looking for healthier options. Higher-fat (over 15% fat) options have also grown in the short term (+19% year on year), driven by those on a tighter budget being £2.60 cheaper per kg than 5% fat options. Find out more about health trends in our health report.

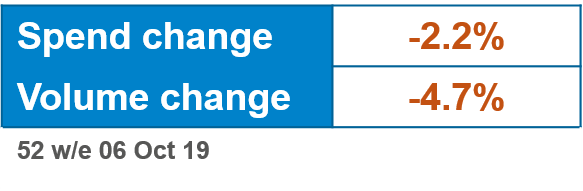

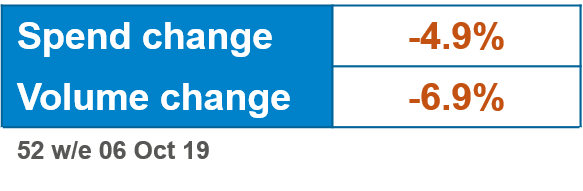

Burgers and grills

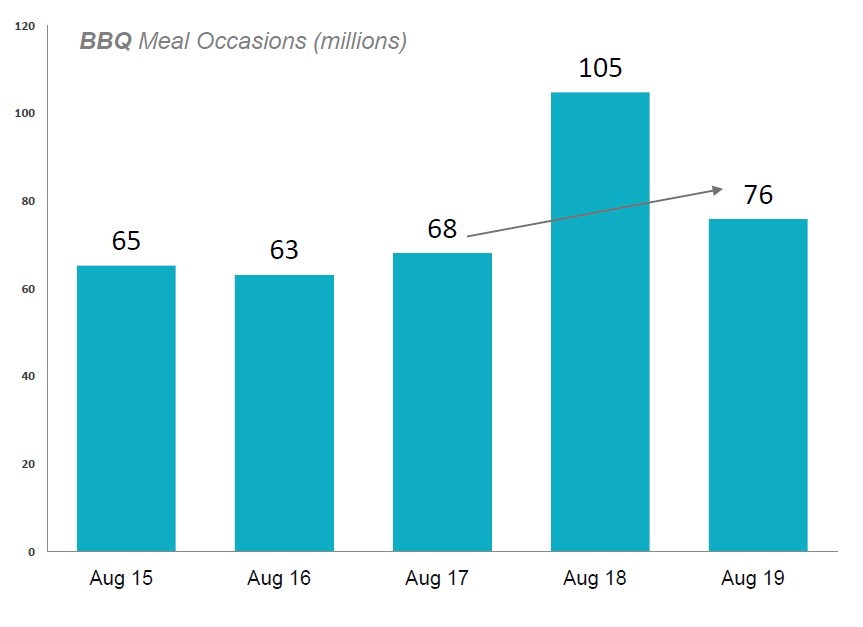

Last year was the barbecue anomaly, having seen increased occasions due to weather and sporting events in 2018. Promotions are the key contributor to declines this year, but this could be due to less impulsive purchases as the weather was not as good, rather than less effective promotions. Despite being down on last year, barbecue occasions are still up on the five-year average. Burgers are important to barbecues, with burgers featuring at 31%. But only 11% of burgers sold actually end up on a barbecue, so instructions on oven cooking are also important. See our summer review article on how meat, dairy and potatoes fared over summer 2019.

Source: Kantar | BBQs | Millions occasions | 52 w/e

Marinades

Marinades incorporates primary meat which is packaged in a flavouring, rub or sauce. This format appeals to consumers who are looking to be experimental but also save time and effort. Marinades are much more likely to be premium tier than total beef, but there are still opportunities to engage upmarket shoppers with premium options. Many shoppers are moving in to the marinade category, especially from primary chicken. There is a lot of new product development (NPD) within marinades as new flavours appeal to consumers who want to try different tastes, but focusing on the right trends is key. Flavours which are successful over the summer are making it into the main ranges and are increasingly an all-year-round option.

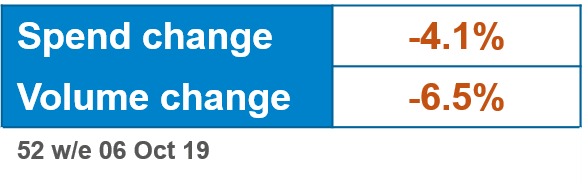

Roasting joints

Christmas and Easter dominate sales for beef but falling everyday sales are driving the declines in volume and spend. Beef roasting joints are seen as expensive by over half of consumers. Roasting beef is are being swapped for cheaper pork joints, as well as healthier fish and more versatile chicken breasts and beef mince.Overall roast occasions have seen growth in the last year but this was predominantly driven by chicken. After months of decline, August saw an increase year on year for beef roasting occasions. These were mainly weekday roasts, as the Sunday roast is still falling out of favour.

Steaks

Valentine’s Day is a significant event for steak, but the spend has been falling each year. Steaks are considered the most expensive beef cut and 32% of consumers think they are not good value for money. However, consumers are more engaged with steaks than total beef, saying it is the tastiest and most enjoyable cut. Therefore, capitalising on these multiple desires, as well as communicating the health benefits of steak, will give consumers permission to eat. To see more about how occasions influence meat sales, see our eventing report.

Note: Here ready to cook products are split out from all cuts and is not included in primary.

Related content

Topics:

Sectors: