- Home

- News

- Beef and lamb market update: lamb imports fall away after Easter, and beef imports see a shift in new suppliers

Beef and lamb market update: lamb imports fall away after Easter, and beef imports see a shift in new suppliers

Friday, 21 June 2024

Key points:

- Lamb imports in April fell by 2,000 tonnes from March, following the Easter demand period

- Imports of New Zealand lamb declined as the country tackles falling production levels

- Beef imports see shifting suppliers as Southern Hemisphere countries increase their volumes

Sheep

Sheep meat trade saw some significant shifts in the volumes of imports and exports for April. Total fresh and frozen sheep meat imports fell by nearly 2,000 tonnes from March to 5,000 tonnes, as we have moved past peak demand periods. Imports do remain elevated compared to April 2023 but sit around 1,200 tonnes lower than 2022.

New Zealand continues to supply the majority (58%) of the UK’s lamb imports, sitting at 2,900 tonnes for April. Volumes imported from New Zealand have fallen nearly 2,200 tonnes from March, as their production has declined, and our domestic demand has softened following Easter. Most of this decline came from a fall in frozen sheep legs, which fell by 1,700 tonnes from March to 760 tonnes in April. In the year to date (Jan-Apr), imports from New Zealand have totalled 13,400 tonnes, which is growth of 5,200 tonnes from last year. New Zealand production and export capacity was impacted by Cyclone Gabrielle in 2023, reducing their exports. When comparing year to date imports with a more typical year such as 2022, imports from New Zealand have only grown by 800 tonnes.

Sheep meat imports from Australia remain elevated compared to 2023, with April’s levels sitting at just over 1,000 tonnes. This was a decline of 85 tonnes from March, but 260 tonnes higher than the same time in 2023.

UK fresh and frozen sheep meat exports totalled 5,500 tonnes in April, which is a decline of around 1,700 tonnes from both March 2024, and April last year. This decline can be partially attributed to tighter domestic production, which limits our capacity to export. More information can be found in our updated Lamb Market Outlook report. Similarly, record-high domestic lamb prices may be impacting on exporting decisions, given that we have seen the differential to France fall away.

A decline in the volume of lamb carcases exported has driven the majority of this fall from March, sitting 1,100 tonnes lower at 4,300 tonnes for April. Bone-in fresh cuts also saw a decline on the month of around 480 tonnes, to 600 tonnes. However, March volumes of this product have been elevated in both 2023 and 2024.

UK imports of fresh/frozen sheep meat from New Zealand

Source: HMRC via Trade Data Monitor LLC

Beef

UK fresh/frozen beef imports totalled 19,300 tonnes in April, as volumes grew by nearly 1,000 tonnes from March. The majority of this growth came from increases from outside the EU, with Brazil, Uruguay, and Australia boosting imports albeit from smaller bases than EU countries.

Ireland remains the largest supplier of beef into the UK, with volumes sitting at 14,600 tonnes for April, with minimal movements from March. These movements on the month may be minimal but have contributed to a 24% growth in Irish imports in the year to date (Jan-Apr). Poland is the second largest supplier and saw growth of around 180 tonnes from March to 1,500 tonnes. Looking into products shipped, Ireland supplied around 8,000 tonnes of fresh, boneless beef and 4,800 tonnes of frozen boneless beef in April. April also saw growth in imports of processed beef, as volumes from Brazil totalled 1,900 tonnes mainly in the form of corned beef. This is the largest volume of processed beef imported from Brazil since January 2023.

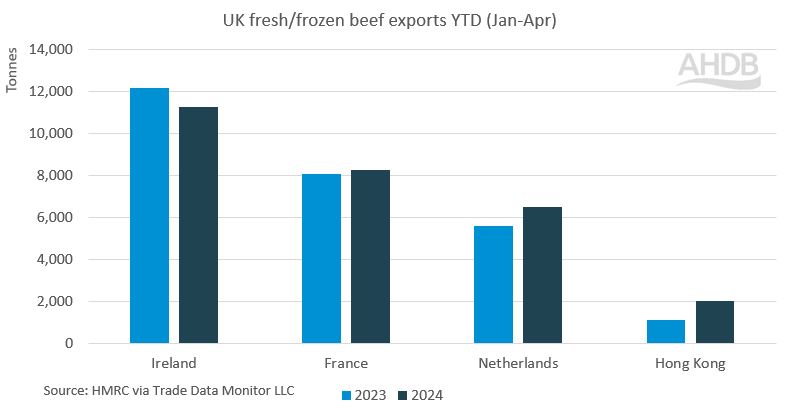

Looking into UK exports of fresh/frozen beef, volumes totalled 9,700 tonnes in April. This is growth of 500 tonnes from March, and 1,900 tonnes from 2023. Volumes in the year to date (Jan-Apr) have risen by 2,900 tonnes to 36,900 tonnes in 2024. Monthly volumes have seen small changes, as exports to Ireland and Hong Kong saw the largest increase of 150 and 115 tonnes respectively. Compared to April last year, volumes into Ireland have grown by 200 tonnes, with larger increases into Hong Kong of 265 tonnes, France of 300 tonnes, and the Netherlands at 360 tonnes.

UK fresh/frozen beef exports YTD (Jan-Apr)

Source: HMRC via Trade Data Monitor LLC

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.