Beef market update: supplies weigh on Irish market

Friday, 7 June 2024

Irish finished cattle prices have been relatively robust through the first few months of 2024. We recap the key trends in the market, the outlook for the rest of the year, and what this could mean for the UK.

Key points

- Irish finished cattle prices have trodden a similar path to last year, but increased supply has kept prices a few cents back.

- Firm beef demand in the UK and EU have boosted Irish export volumes and supported prices.

- Current Irish cattle population data points to lower slaughter cattle availability towards the end of 2024 and into 2025. From a supply perspective, factoring in UK and EU outlooks would suggest underlying support for European cattle prices generally.

Prices following similar trend to 2023, but supply weighing on the market

So far this year, Irish prime cattle prices have trodden a similar path to 2023, albeit consistently being a few cents back on the year. Irish cattle slaughter has been higher than a year ago during the first 20 weeks of 2024, but firm export demand in the UK and EU has offered price support.

In the week beginning 20 May, the average R3 steer price stood at €5.13/kg (£4.38/kg), down nearly 9 cents on the year. However, weekly prices have generally firmed since January.

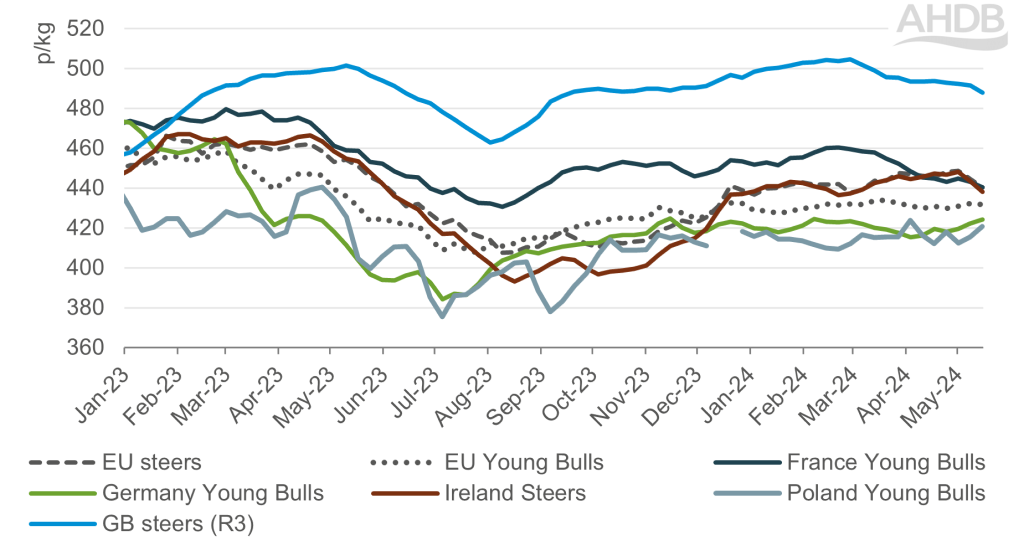

Selected EU deadweight prime cattle prices (p/kg)

Source: European Commission, AHDB. Young bulls category AR3; steers category CR3; GB price is AHDB R3 average steer.

Meanwhile, GB prices have shown a little more softness with increased supply but remain firm on the European stage. The average GB R3 steer price stood at £4.88p/kg (€5.68/kg) in the equivalent week, down nearly 8p since the first week of 2024.

These movements have brought Irish and GB prices closer together . The average R3 Irish steer price was 50p below the equivalent GB measure in the week beginning 20 May. At the start of the year the difference was closer to 60p, and in October 2023 closer to 90p. However, 50p is still on the wider end of historic ranges.

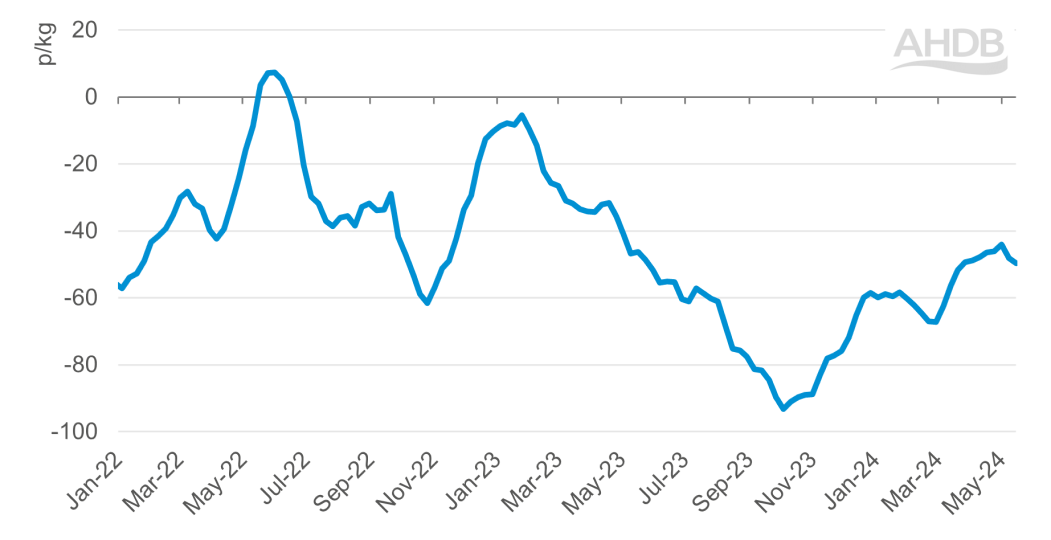

Difference between GB and Irish weekly average deadweight R3 steer prices (p/kg)

Source: European Commission, AHDB. The difference is the GB steer price minus the Irish price.

Strong import levels through the first quarter

The price differential has likely been one driving factor behind recent Irish beef import levels into the UK. Large annual rises were recorded in January and February, at a point when Irish pricing was particularly competitive. The price gap continued to narrow, and March imports were largely flat year-on-year. Nevertheless, the Q1 (Jan-Mar) Irish import total was up 25% versus 2023 (fresh & frozen). Trade data lags by a couple of months, but more recent industry commentary has suggested that Irish import levels have and will persist, especially if pricing remains competitive and demand robust.

Irish beef exports into Europe during the first quarter were up 2% year-on-year, driven by increased shipments to the Netherlands and Sweden in particular. Shipments to non-EU countries have grown too, particularly Hong Kong and the Philippines.

Overall, the EU is facing a tighter supply situation due to structural herd adjustment, and imports are forecast to grow in 2024 for the bloc overall. Indeed, cow slaughter is down so far in 2024 in France and Germany (the EU’s two largest cow beef producers), following the trend of recent years.

Greater Irish supplies on the market, but data points to future reductions

A key factor in the Irish market in 2024 has been greater cattle supply. According to Bord Bia, 494,500 prime cattle have been slaughtered in the first 20 weeks of the year, a 3% (11,500 head) increase against the same period in 2023. Meanwhile, cow slaughter has seen notable uplift (+10%; +18,800 head) to 167,800 head.

The latest cattle population data from 1 April points to cattle supply stabilising year-on-year in the short-term. Indeed, Irish beef kill has fallen closer to last year’s levels in recent weeks. Bord Bia forecast that Irish cattle slaughter could fall by 30-40,000 head (-2%) in 2024 for the year as a whole, suggesting that supply reductions will come into play during the remainder of the year.

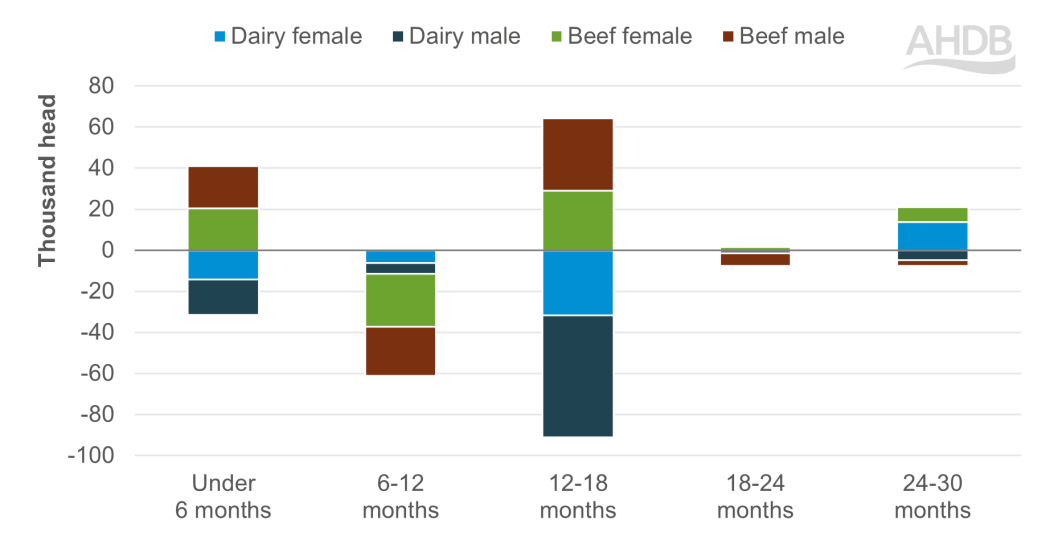

Year-on-year change in the number of cattle on the ground in Ireland, 1 April 2024

Source: DAFM

Looking ahead, population data shows a 2% (-31,200 head) reduction in the number of animals available for beef production under 12 months of age (all cattle excl. dairy heifers). The reduction was particularly driven by animals aged 6-12 months. A combination of strong live exports and lower calf registrations in 2023 have reduced the number of youngstock entering the supply chain, driven by dairy bulls. Increased use of beef genetics in dairy inseminations have contributed to fewer dairy youngstock. During the first four months of 2024, Irish registrations of calves for beef production (all cattle excl. dairy heifers) have fallen by a further 51,700 head (-3.5%), driven by dairy males.

Strong levels of cow slaughter are also feeding into current breeding herd inventories. Population data shows around 5% (-45,500 head) fewer suckler cows in Ireland at 1 April. Meanwhile, the number of dairy cows was down by 1% (15,600 head), suggesting that the growth seen in the herd over recent years has slowed. The number of dairy heifers in Ireland has also fallen sharply.

What does this mean for future Irish supply, and for the UK market?

The above data indicates lower availability of finished Irish cattle may begin to influence the market towards the end of 2024 and into . This outlook could persist out to 2026, depending on this year’s calf registrations and trends in breeding cow numbers. Combined with the tighter EU and UK supply outlooks, by itself this would suggest favourable undertones for European cattle prices in the round looking forward. Consumer demand is the other side of the equation of course, with inflationary pressures still present in the market. From a European perspective at least, cattle supply reductions in 2024 are expected to outweigh demand side challenges.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.