EU Short Term Outlook: Beef and Sheepmeat summary

Friday, 10 May 2024

The latest EU short-term outlook has been released. The outlook is available here or read our summary of the key takeaways for beef and sheepmeat below:

Key Points

• EU beef production is expected to see a production fall of 2.3% in 2024

• EU sheep meat production is estimated to fall by 4.9% in 2024

• Low supplies coupled with inflationary pressures are limiting consumption.

• The EU market remains attractive for imports of beef and lamb, meanwhile a small decline in exports is foreseen.

Beef and veal

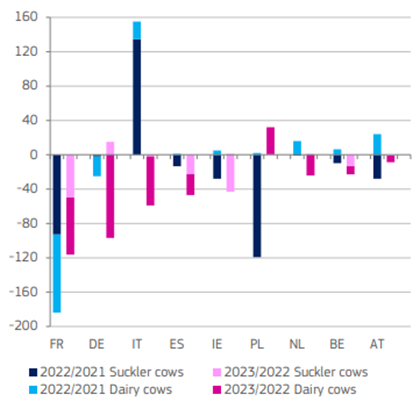

EU beef production decreased by 3.9% in 2023, driven by structural adjustments in the beef and dairy sectors. Beef production in 2024 is anticipated to decrease by a further 2.3%. This has supported high prices; a theme which the European Commission suggests may continue. Of the largest producing countries, Italy saw the steepest decline (-17%) driven by shortages of imported live animals. The December 2023 livestock survey reported a reduction of suckler cows in the EU by -1.6% (160 000 head), whilst dairy cows declined by -1.7% (-344 000 head).

Despite attractive EU prices, imports have not covered the decrease in production, which fell by 1.1% in 2023. The UK had the most downward pressure on EU import levels following a stronger year of trading in 2022. Meanwhile, increased imports arrived from Brazil and Argentina. Meanwhile, increased imports arrived from Brazil and Argentina. Providing that imports are not diverted to other key markets, such as in the US and China, they are set to grow by 2% into the EU in 2024, driven by Brazil. The report warned that an El Niño effect in Australia could alter this projection.

EU exports face high domestic prices but continue to perform well. The reopening of some markets has supported this uplift. Going forward, exports are predicted to experience slight decline by 1% in 2024 due to lower cattle inventories.

EU per capita beef consumption in 2023 has dropped by 4.7% year-on-year. The 2024 outlook is similar, with consumption predicted to fall by a further -2.8%.

Change in number of cows in main EU producing countries (1 000 heads)

Source: DG Agriculture and Rural Development, based on Eurostat

Sheepmeat (includes goat meat)

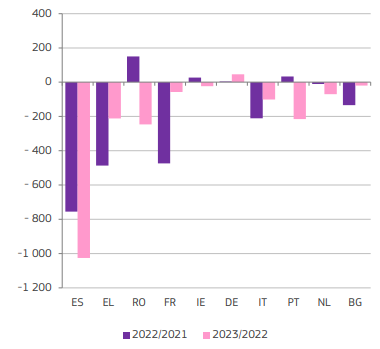

2023 production of sheep and goat meat had decreased by 5%, with the largest declines seen in Spain, Greece and France. Reduced production is predicted to continue and estimated to fall by -4.9% in 2024. The December 2023 livestock survey reported a 2.6% decline in the EU population of sheep and goats, equating to 1.9 million head.

In 2023, EU imports grew by 2.2%, the majority shipped from the UK and New Zealand. As supply tightness continues, higher EU prices are likely to encourage more imports in 2024, estimated to increase by 2.5%.

Whilst exports into the UK were stable in 2023, lowered production drove significantly reduced shipments to the Middle East, resulting in an overall export decline of 13%. The situation is projected to remain relatively unchanged going forward, and exports are expected to decrease by a further 2% in 2024. A watchful eye remains on the uncertainties in the Red Sea, Black Sea and Middle East regions, and implications for trade flows.

EU consumption of sheep meat was in -3.3% decline in 2023. Despite its specific position for religious and cultural events, low availability and high prices are predicted to drive a 3.5% reduction in 2024.

Change in flock size in main producing EU countries (1000 heads)

Source: DG Agriculture and Rural Development, based on Eurostat

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.