Lamb market update: what’s happening in New Zealand?

Thursday, 16 May 2024

Key points:

- New Zealand lamb production slowing as supplies are tight.

- NZ lamb prices remain lower than Australia and the UK, as Australian prices weigh on the Oceania markets.

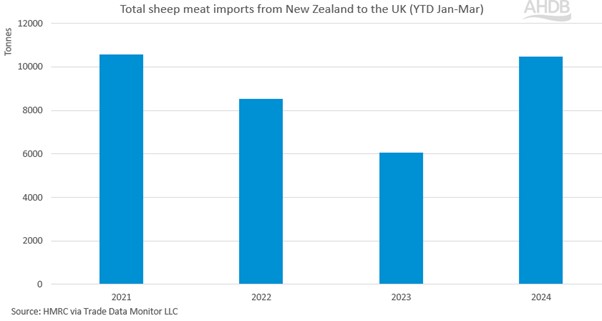

- Imports from New Zealand highest in March since 2021.

- Tight UK domestic production necessitating growth in imports to meet demand.

New Zealand lamb production has seen stability through the past few months, despite weather issues that plagued the beginning of the season. Beef & Lamb New Zealand (B&LNZ) are estimating a slight increase (+0.9%) in the lamb crop to 21.3m head for 2023-24, with better scanning than expected. This improved lamb crop has increased the number of lambs available for export to 17.8m head. Lambs were kept on farm longer earlier in the season as cooler weather impacted carcase weights, driven by a lack of quality forage. This led to more lambs coming forward for slaughter later, despite the higher lamb crop. AgriHQ are now reporting shortages of lambs incoming, as supplies tighten up.

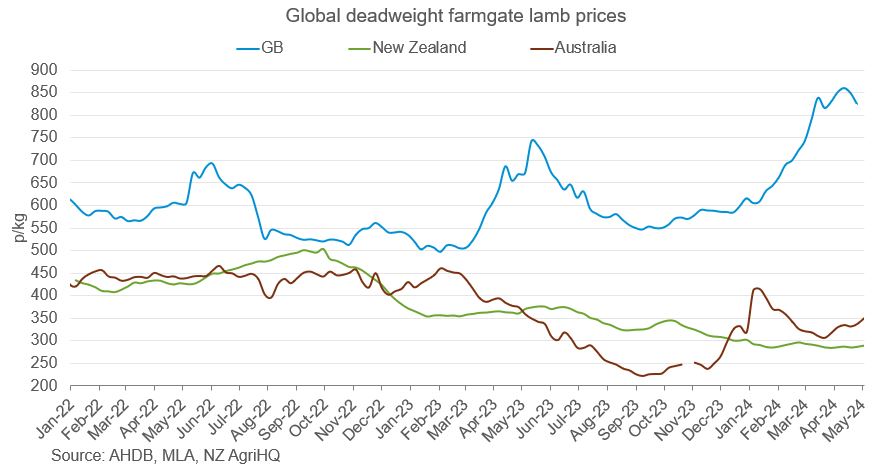

These shortages have gone some way to supporting farmgate prices, which have ticked up in recent weeks, with industry commentary suggesting this is driven by tight domestic supply rather than boosted export demand. However, this increase in the price still has a way to go to benefit margins, given the low base it is starting from. From December 2023, New Zealand prices have been lower than their Australian counterparts, seeing some stabilisation since February, albeit at a low level. B&LNZ estimate that farm profits have fallen by 54% compared to 2022-23, driven by low domestic and export prices.

Global deadweight farmgate lamb prices

Source: AHDB, MLA, NZ AgriHQ

Looking into these exports, the value and volume of product into China has fallen more than expected as Australia dominates the market. AgriHQ report that New Zealand exporters need to see an increase in Chinese export values to flow back to the domestic market in order to raise prices. Total lamb exports out of New Zealand hit a three-year monthly high in March, with the UK seeing elevated imports in the first three months of 2024. This was given our supply shortages, and the run up to Easter increasing retail demand for lamb.

For UK imports from New Zealand, volumes in March 2024 were at the highest level since March 2021. Volumes totalled 5,070 tonnes, growth of nearly 2,000 tonnes from February’s levels, which saw the continuation of demand for Easter. Year to date (Jan-Mar) imports from New Zealand have totalled 10,500 tonnes, growth of 4,400 tonnes from 2023, but closer to 2021 volumes. The total volume of frozen imports Jan-Mar 2024 was 8,400 tonnes, 62% of these were frozen sheep legs. In the run up to Easter procurement, there were reports of air-freighting chilled product to the EU and UK due to short shipping deadlines and a need to fulfil demand.

Total sheep meat imports from New Zealand to the UK (YTD Jan-Mar

Source: HMRC via Trade Data Monitor LLC

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.