August 2025 dairy market review

Wednesday, 10 September 2025

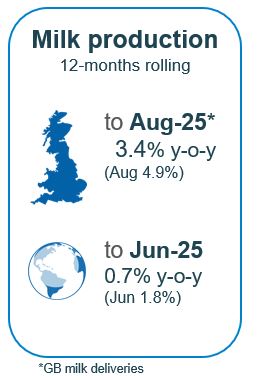

Milk production

Domestic

GB milk deliveries totalled 1,040 million litres in August, an increase of 4.9% compared to the same month last year. Daily deliveries averaged 33.58 million litres per day. Solids in milk remain at high levels.

The milk to feed price ratio (MFPR) continues to be in the expansion zone incentivising farmers to push production. Though recent milk price announcements in September are mixed in direction, on the average prices are more or less steady.

The Met Office reported unsettled weather condition in August with showers, thunderstorm and heat wave noticed during the month although dry conditions returned for most. Grass growth is below last year’s and the 5-year average levels, raising concerns for winter forage. Although growth has been very regional, it is still a challenge for many.

The latest BCMS data shows that births to dairy dams in Q2 2025 increased year-on-year by 3.6% to total 309,000 head, the highest number recorded for this period since 2019. The latest BCMS figures record the GB milking herd at 1.60 million head, as of the 1 July 2025. This is down 0.6% on the previous year, driven by the decline in the under 4 years of age categories.

Global

The latest global production data shows global milk flows now accelerating. Global milk deliveries averaged 795.5 million litres per day in June, an increase of 14.3 million litres per day (+1.8%) across the selected regions, compared to the same period last year. All regions recorded year-on-year volume increases except for Australia and the EU.

US production was up 3.3% year-on-year, with a bigger herd and better margins. New Zealand deliveries were up by a substantial 1.1 million litres per day (14.6%) supported by better milk prices and weather. Argentina’s production also increased in June, up 2.9 million litres per day (10.3%) year-on-year.

Milk deliveries in the EU averaged 409.5 million litres per day in June, a small decline of 0.3 million litres per day (-0.1%) compared to the same month of the previous year. Looking at the EU figure in greater detail, we saw the greatest year on year volume decline from Germany, down by 56 million litres (-2.1%) followed by Belgium, down 31 million litres (-8.1%), year-on-year. However, there were large variances between countries, with Irish milk production up by 51 million litres (4.9%). The short term outlook for the EU is for relative stability at 0.15% growth for 2025 year-on year.

Australia also declined (-5.2%) due to challenging weather conditions.

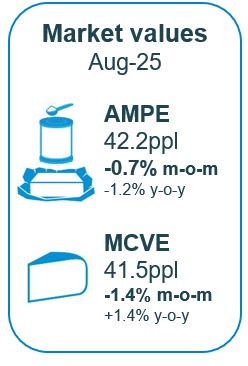

Wholesale markets: August

As peak holiday period took hold, market activity was said to be ‘deadly quiet’ in August. Wholesale prices fell across the board, with the exception of SMP, with butter and cheese now sitting marginally below values seen last year.

Bulk cream prices eased around £40/t month on month with fluctuating demand reported.

Butter prices saw a much larger spread: on average prices dropped £100/t, with lack of export demand. EU production has increased with recovering milk volumes, meanwhile US and NZ product remains very competitively priced for the global market. UK butter stocks are still reported to be running tight, with some deeming it more favourable to trade cream than process butter.

The SMP market was once again reported as stable. Trading volumes were still reported as minimal and the pricing range further contracted this month. This resulted in average prices making a marginal gain of £20/t month on month. SMP pricing has been within a +/- £30 range of £2,000/t for the last 7 months.

Mild cheddar prices continued the gradual decline seen since April, losing £60/t on average in August. Stocks of mild and medium cheddar are said to be building as buying demand remains weak, but milk production continues to strengthen. Elevated milk prices are said to be leaving sellers unwilling to significantly move product prices to ensure costs are covered.

This means that the value of AMPE declines to 42.2ppl, whilst MCVE declined to 41.5ppl - both now down on a year ago.

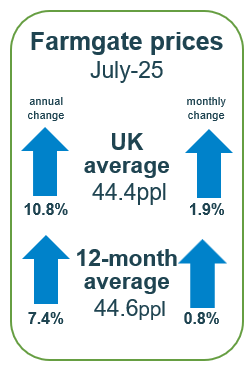

Farmgate milk prices

The latest published farmgate price was for July with a UK average milk price of 44.4, up 1.9% on the previous month.

Latest announced farmgate prices were mixed in September.

Price announcements for retail aligned liquid contracts showed some increases. Tesco saw an increase of 0.50ppl after holding their price for the previous three months. Sainsbury’s saw an increase of 0.03ppl following the 0.13ppl decline announced for August. Meanwhile, Co-op Dairy Group stabilised, and M&S have held on to their price for the last five months.

Non-aligned liquid contracts overall showed another month of stability. Pembrokeshire Creamery and Muller were the only participants of the league table to announce a change, upwards of 0.13ppl and 0.50ppl respectively. Crediton Dairy has held steady for the last nine months after continuous increases over the previous year. Freshways and Yew Tree announced no change to their milk price this month.

Cheese contracts generally showed stability with the exception of an increase announced from Belton Cheese and Wensleydale, up by 1ppl and 0.20ppl, respectively. Most other participants on the league table made no change to their price in September (Barbers, First Milk, Saputo, Leprino, Wyke and South Caernarfon Creameries).

Manufacturing contracts saw some decrease in prices, with UK Arla decreasing their price by 0.87ppl. Pattemores Dairy has held on to their price for the last ten months. Meadow announced no change in price.

Trade

Total UK dairy export volume for H1 2025 increased by 2.5% at 688,800t and value for H1 2025 increased by 20% at £1.1bn. Milk powders saw the biggest half yearly volume increase of 15,300t (28.3%) and were at a two year high: mostly bound for non-EU nations (Algeria, Pakistan, Malaysia, Egypt, Saudi Arabia, United Arab Emirates, Nigeria, Indonesia).

This was followed by increase in exports of whey and whey products and butter by 7,700t (26.6%) and 2,100t (9.5%) respectively. Half-yearly exports of whey and whey products are at 5-year’s high (36,700t), which saw noticeable increases to the EU (Ireland, Denmark, Austria, France) and also some increases to non-EU nations (New Zealand, United States, Philippines and China). However, exports of yoghurt, milk and cream and cheese dropped by 3,900t (16%), 3,800t (0.9%) and 700t (0.7%), respectively.

Exports to the EU (that make up 90% of the total) picked up by 800 tonnes (0.1%). In EU, the major recipients were Ireland (475,300t), the Netherlands (48,700t), France (20,500t), Belgium (16,200t), Germany (10,500t), Spain (8600t) and Denmark (8,600t). However, major increases were reported to non-EU nations (Algeria, Morocco, Pakistan, United Arab Emirates, Egypt, Malaysia, New Zealand Nigeria).

Imports trend up

Total import volumes in H1 2025 were up over 27,000t (4.6%) from 2024 levels to 637,000t. This was predominantly driven by an increase in imports from the EU nations (+22,000t).

The most significant increase was seen in cheese imports by 11,600t (5.3%) followed by yoghurt with 5,600t growth (3.7%) and milk powders at 3,700t (9.5%). Whey and whey products, butter and milk and cream contributed to the increase by 2900t (7.3%), 2800t (9.2%) and 1300t (1%) respectively. In terms of value, the greatest contributors were cheese and curd and yoghurt totalling £1100mn and £265mn respectively.

There has been a surge of dairy imports from New Zealand from 2024 onwards with imports increasing by 5900t (81.2%) in H1 2025 compared to the same period in the previous year. Most of the dairy imports from New Zealand constituted of cheese and curd followed by butter and milk powders.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.