EU short-term outlook: Growth in cheese and whey to continue

Thursday, 7 August 2025

Key points

- Milk deliveries forecast to remain stable (+0.15%, without leap year adjustment in 2024), due to higher yield levels

- Milk prices will continue to remain above the 5-year average and lower feed costs translate to favourable margins

- Growth in cheese and whey production to continue

- Exports of fresh dairy products, cheese and whey powders to remain in growth

Raw Milk

In the latest EU short term outlook, the European Commission expects milk deliveries in the region to remain stable due to an increase in yields and prices above significant historical levels. However, there are regional differences following disease outbreaks on the continent. Milk deliveries are expected to decline in Germany, France, the Netherlands and Belgium as Bluetongue impacted production and cow numbers fell. Conversely, production is expected to increase in Ireland and Poland following favourable grassland conditions and increasing yields, respectively.

Average raw milk prices in May 2025 remained 28% above the 5-year average. In most countries in EU, weather remains favourable for grassland conditions. This, coupled with overall stability in input costs is likely to support margins for farmers through 2025. Fertilizers prices are stable, however energy prices are more volatile following tension in the Middle East. Demand is more questionable as consumers are spending more cautiously following increasing food inflation from Jan-Apr 2025.

Following a significant decline of 3.5% in 2024, the size of the dairy herd is likely to continue the trend. However, the rate of decline is expected to slow down to another 1% in 2025. The trend of declining cow herds has been offset by higher yields (+1.2%).

Dairy Products

Milk solids have continued to increase for another consecutive year, up by 0.2% for fats and 0.1% for proteins. Increase in milk fat content is relatively more following strong domestic demand and good availability and quality of forage.

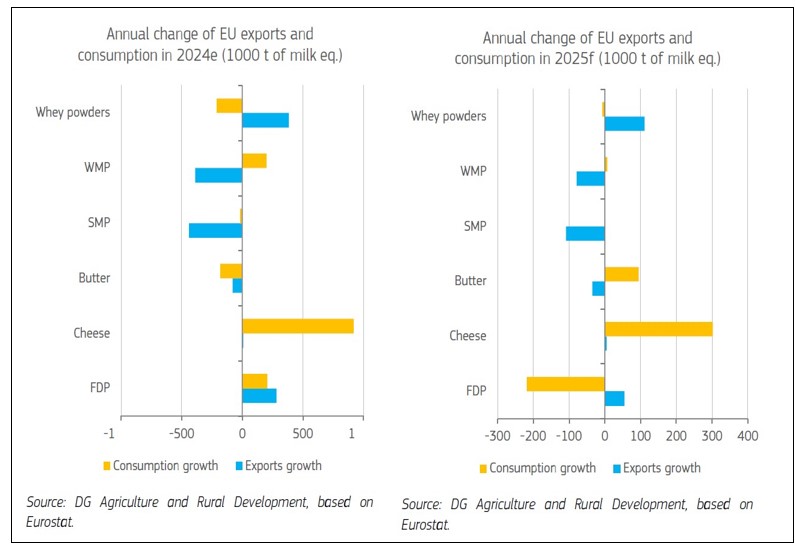

The increased availability of fats and proteins will be utilised more heavily in cheese and whey production, which are expected to increase 0.7% each respectively in 2025. However, the economic slowdown in export destinations and competitiveness in the global markets as well as increased tariffs on the US market is likely to limit cheese exports. In 2025, the year began with dwindling cheese stocks in EU following lower production and more exports. According to the EU commission, exports of cheese and whey are forecast to increase 0.1% and 2% respectively in 2025.

Growth is also likely to be seen in fresh dairy products though domestic demand for the same is likely to decline following lower usage of drinking milk. Exports of butter, SMP and WMP are likely to decline 2%, 2% and 5% respectively following price competitiveness in the global market and subdued demand from China.

The recent EU-US trade deal, structural and environmental policy changes, disease outbreaks and global geopolitical factors will be key watch points driving the dairy sector.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.