Irish milk production continues to recover

Wednesday, 23 July 2025

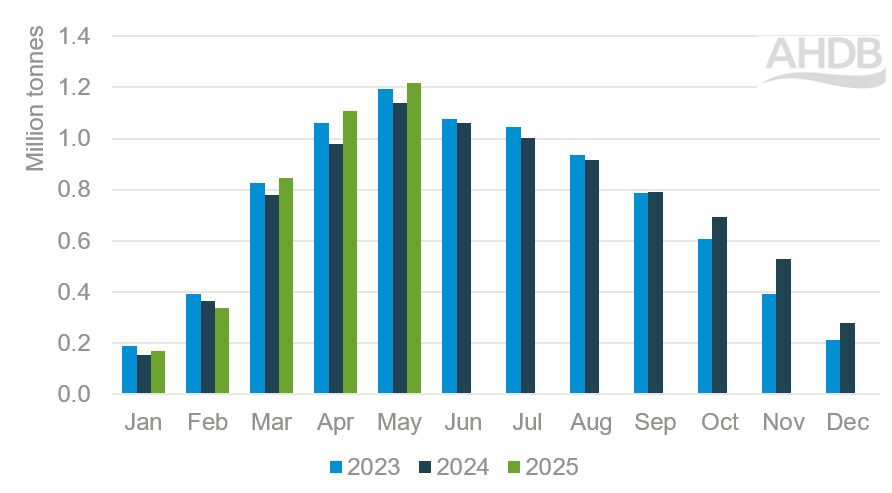

The Republic of Ireland’s milk production has recorded significant year-on-year increases over the past few months, with production volumes also exceeding 2023 levels.

While total deliveries fell overall in 2024, down by -0.3% lower than 2023 (CLAL/Eurostat), Ireland showed significant gains at the end of the year. Q4 2024 volumes were +23.7% higher than in the same period in 2023.

Monthly deliveries have been in growth since September 2024, with the exception of February (down -7% year-on-year).

The largest growth was seen in November, which recorded a 34.4% increase versus the previous year. The jump was supported by an extended grazing period due to mild autumn weather which improved yields per cow, and reduced cost of production.

Additionally, a push on production occurred ahead of nitrate restrictions, which came into place for some areas in January.

Source: CLAL/Eurostat

In 2025, after the small decline in February, milk production in Ireland lifted sharply in March (+8%), April (+13%) and May (+7%).

The 2025 cumulative total so far (Jan-May) puts Irish production 7.6% above the same period in 2024 and 0.6% above 2023 levels.

These were poor years to compare against, but production has now returned to levels comparable to those seen in 2022, which was considered a strong year for the sector.

Production across Europe had been trending below last year’s volumes through 2025, with much of the loss attributed to the spread of Bluetongue, supporting milk prices.

More recently, production has reportedly picked up, driven by a surge of collections in Ireland, France, Romania, and Poland. Demand is currently said to be quiet ahead of holiday season.

Favourable weather has been another factor for increased supply. The Irish dairy sector is particularly reactive to weather conditions, due to its heavy reliance on grass-based systems.

The poor performance in 2023 and 2024 was mainly driven by decline in herd numbers and challenging weather in the spring and summer, environmental and economic pressures.

The volume of dairy feed used in Ireland was estimated to have increased significantly in 2024 on a per head basis mainly due to adverse weather (Teagasc).

However, challenges persist

Increasing environmental regulation is a key concern for Irish dairy producers. Lower stocking rates due to nitrogen restrictions could have a major effect on milk production.

Ireland is the only EU member seeking an extension of its nitrogen derogation after 2025. Ireland’s request to the European Commission to hold its nitrate derogation will be vital for the dairy sector.

Q1 of 2025 saw exports from Ireland to the US more than double in volume to that of Q1 in 2024, ahead of potential US tariffs.

The ongoing negotiations will be an important watchpoint. Ongoing disruption could be a blow if a trade deal is not reached.

China launched an anti-dumping investigation in August 2024 to dairy imports from the EU, which may lead to restrictions or duties to imports to there.

Additionally, the expansion of China’s dairy industry and lacklustre demand has reduced imports generally.

Conclusion

Ireland plays a small but significant role in the European dairy market. Being a major exporter, increases in production have knock on effects to broader market dynamics.

Lower production in the wider EU has meant the Irish contribution has become relatively larger.

For the full year 2025 production is estimated to increase by 2.5% according to GIRA’s mid-year update.

Though a lot of uncertainty revolves around changes to nitrates derogation, Trump tariffs and uncertain Chinese demand.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.