H1 2025 dairy trade review: exports continue to grow

Thursday, 4 September 2025

Key trends

- Total UK dairy export volume for H1 2025 increased by 2.5% at 688,800t and value for H1 2025 increased by 20% at £1.1bn

- Exports were boosted by a volume increase in exports of milk powders, whey and butter

- Dairy export value grew across the board fuelled by higher-value products.

- Cheese and yoghurt continue to dominate the import basket in volume terms.

- More product is coming in from New Zealand

Exports continue to grow

The value of dairy exports has been growing for the last two years. In H1 2025, value growth was witnessed across the board, led by milk and cream (23.7%), followed by cheese and curd (10.9%), butter (37.8%) and powders (23.7%). Exports of milk powders and whey and whey products were recorded at £122mn and £68mn respectively. The highest value was recorded for the exports of cheese and curd at £483mn followed by milk and cream at £255mn respectively.

Total dairy export volume for H1 2025 was 688,800t, an increase of 16,800t (2.5%) compared to the same period in the previous year.

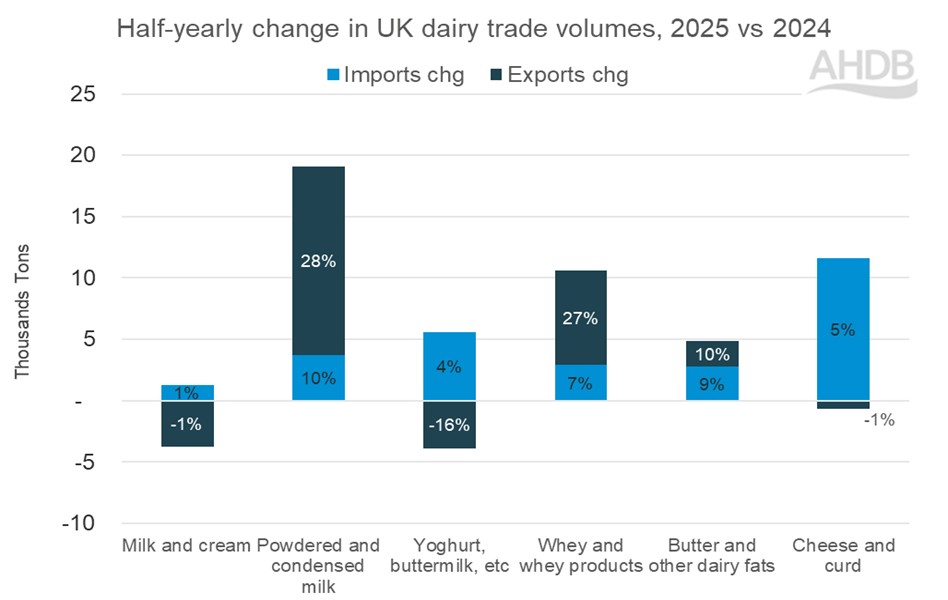

Milk powders saw the biggest half yearly volume increase of 15,300t (28.3%) and were at a two year high: mostly bound for non-EU nations (Algeria, Pakistan, Malaysia, Egypt, Saudi Arabia, United Arab Emirates, Nigeria, Indonesia).

This was followed by increase in exports of whey and whey products and butter by 7,700t (26.6%) and 2,100t (9.5%) respectively. Half-yearly exports of whey and whey products are at 5-year’s high (36,700t), which saw noticeable increases to the EU (Ireland, Denmark, Austria, France) and also some increases to non-EU nations (New Zealand, United States, Philippines and China). However, exports of yoghurt, milk and cream and cheese dropped by 3,900t (16%), 3,800t (0.9%) and 700t (0.7%), respectively.

Exports to the EU (that make up 90% of the total) picked up by 800 tonnes (0.1%). In EU, the major recipients were Ireland (475,300t), the Netherlands (48,700t), France (20,500t), Belgium (16,200t), Germany (10,500t), Spain (8600t) and Denmark (8,600t). However, major increases were reported to non-EU nations (Algeria, Morocco, Pakistan, United Arab Emirates, Egypt, Malaysia, New Zealand Nigeria).

Imports trend up

Total import volumes in H1 2025 are up over 27,000t (4.6%) from 2024 levels to 637,000t. This was predominantly driven by an increase in imports from the EU nations (+22,000t) which constitute the majority of our imports. Major EU nations contributing to the increase are Ireland (+13,000t), Greece (+10,800t), France (+3600t) and Poland (+3100t). In terms of value, imports totalled at £1.8bn (+11.4%) compared to H1 2024.

The most significant increase was seen in cheese imports by 11,600t (5.3%) followed by yoghurt with 5,600t growth (3.7%) and milk powders at 3,700t (9.5%). Whey and whey products, butter and milk and cream contributed to the increase by 2900t (7.3%), 2800t (9.2%) and 1300t (1%) respectively. In terms of value, the greatest contributors were cheese and curd and yoghurt totalling £1100mn and £265mn respectively.

There has been a surge of dairy imports from New Zealand from 2024 onwards with imports increasing by 5900t (81.2%) in H1 2025 compared to the same period in the previous year. Most of the dairy imports from New Zealand constituted of cheese and curd followed by butter and milk powders.

Opportunities for the UK

With the demand for dairy forecast to increase in the next decade, there lies ample opportunities for British exporters. The exports team at AHDB has been organising events and attending trade shows through 2025 promoting British dairy around the world. However, we need to closely watch trade developments with US and other countries, which will displace products from the shelves in the global market.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.