Why have GB beef prices fallen?

Thursday, 27 July 2023

GB finished prices for prime cattle and cull cows have been falling over recent weeks. We look at the key market factors at play, and what the trajectory of prices might be going forward.

Key market trends

- Weaker domestic demand (pressured by increased cost-of-living)

- Increased UK cattle slaughter in June

- Declines in Irish cattle prices

- Imports of Irish beef grew in May

Demand

Domestic demand for beef has been under pressure for some time, as consumers grapple with increased inflation. Volumes of beef sold through GB retail have been below 2022 levels since the start of the year, with decline seen in key cuts including mince and roasting joints.

Price is the key driver of lower sales, with consumers buying less per trip and switching to cheaper proteins. Beef performance in foodservice has been positive compared to a year ago, but this has been outweighed by declines in retail. Kantar retail data for the 12 weeks to 9 July suggests that demand has eased further, potentially reflecting variable summer weather.

Lower consumption is a trend that is currently reflected on the continent, with consumers reducing their out-of-home spend. Weaker consumption is expected to persist for the rest of the year, according to European Commission forecasts.

Prices and the European context

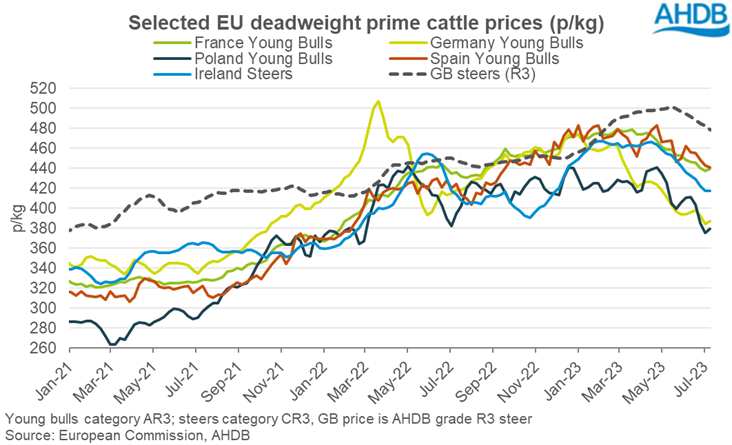

This in turn is weighing on cattle prices. Prices generally across Europe have weakened since the start of the year, despite fewer cattle being slaughtered.

The reliance on export markets means that Irish cattle prices have fallen, widening the discount to equivalent prices in GB, particularly cows. The difference between the average R3 GB steer price and equivalent Irish price in January was about 4p/kg; in the week ending 17 July this had widened to just over 60p. Looking at historical price series, similar differences have been recorded before – but usually towards the top end of the range.

The close nature of the UK and Irish beef markets means that prices for cattle trend quite closely. However, British cattle usually trade at higher prices to Irish equivalents, with some protection coming from the strong presence of homegrown beef in retail. Recent strengthening in sterling against the Euro will have also contributed to the widened gap between GB and EU prices, as shown below.

Supply

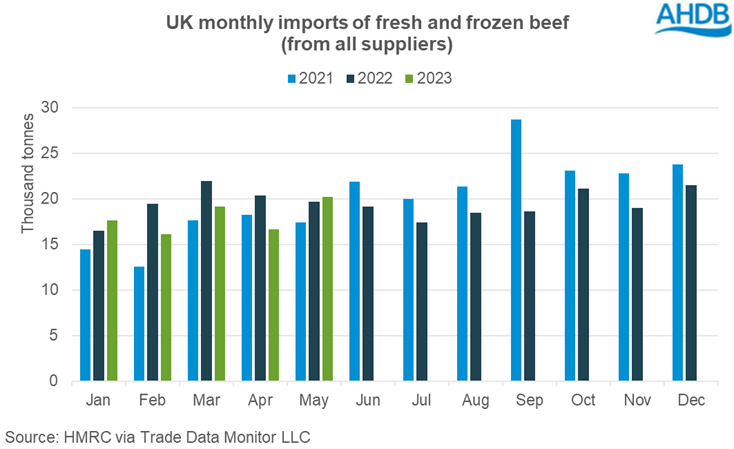

Against the backdrop of weaker consumer demand, supply dynamics may also be weighing on prices. UK imports of Irish beef rose in May compared to a year ago, following several months of lower volumes. Since then, domestic supplies have also risen, with Defra production figures for June showing more cattle slaughtered during the month compared to a year ago. Trade data lags by a couple of months, so it is as yet unclear as to what June’s import trends look like. Industry reports suggest that stocks of VL (visual lean / trim for mince) are sufficient for demand at present.

Meanwhile, Irish cattle slaughter picked up in June, having been below 2022 levels since February (however, Irish cattle kill in 2022 was particularly high). Bord Bia forecasts that overall supplies will remain below 2022 levels, but kill will increase in the final quarter.

What’s the outlook for GB cattle prices?

From a demand perspective, UK beef consumption is expected to remain subdued for the rest of the year, as people restrict their buying. Beef through retail may benefit from some shoppers moving their out-of-home spend in-home to save money, but we predict that reductions in volume and switching to cheaper proteins will contribute to overall consumption decline.

On the supply side, we anticipate that domestic cattle supplies will increase seasonally towards Christmas, but overall cattle slaughter will remain below a year ago. Lower cattle availability may offer some support to cattle prices. However, the differential between the price of homegrown beef and that of imported product will be key to watch. With Irish cattle supplies expected to tick up towards the end of the year, and demand forecast to remain subdued in key export markets, this may point to further pressure on Irish prices.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.