Mixed Q1 performance for EU beef and sheep meat production

Wednesday, 12 July 2023

Production of beef and lamb has been mixed among EU member states during the first quarter of 2023. We explore the current market conditions for both sectors, and the potential impact on the UK.

Beef

Beef output has fallen overall across the EU-27 during the first quarter of 2023 versus a year ago (-4%). This has largely been driven by lower production in Italy, followed by Spain, Ireland, and France. Meanwhile others including the Netherlands and Germany have seen output increase, with the Netherlands driven by an uptick in cow slaughter.

This follows the wider trend of declining cattle numbers on the continent. Census figures from 1 December 2022 showed a reduction in nearly all categories of cattle within the EU, particularly cattle aged 1-2yrs old. The breeding cow herd also remained in contraction, particularly in France and Poland.

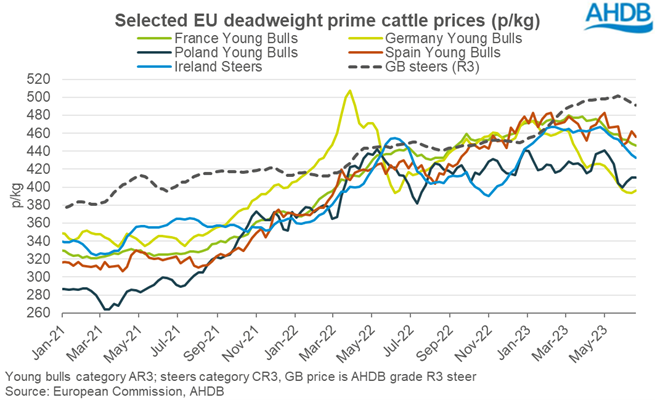

Despite lower production levels, cattle prices in the EU have softened slightly since the start of the year (but have generally remained historically firm). GB prices have moved back to the top-end of the European scale, but like others have pulled back in recent weeks. Industry reports point to sluggish demand for beef on the continent, on the back of high inflation and cautious consumer spending.

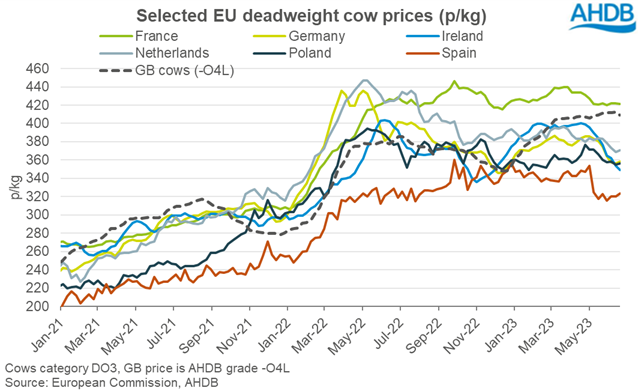

Cow prices have seen a similar movement to prime, fluctuating through the first few months of the year followed by a general easing from May onwards. French cow prices have held particularly firm around the level seen at the backend of 2022, bucking the wider trend seen moving into 2023. GB prices have generally moved against the grain, being now towards the top end of the range.

Thinking closer to home, Irish cattle prices have been easing since the end of April, despite fewer cattle forward. With GB cattle prices staying relatively firm, the discount of Irish cattle has grown notably. So far this year, (Jan-May) Irish adult cattle kill is down around 4% (-30,000 head) year-on-year. Again, industry reports attribute price falls to softening demand in export markets. This is borne out in trade figures; the UK has imported less Irish beef so far this year (-7%), and Irish exports have reduced into countries like the Netherlands, Spain and Sweden.

Bord Bia expect Irish cattle supplies to increase in the second half of 2023, particularly the final quarter . This may point to current pricing trends continuing, especially if consumer demand remains under pressure.

Sheep meat

Production of lamb and mutton has been mixed during the first quarter of 2023 among the top EU producers. Countries including Spain, France, and Greece have seen output decline on the year, while others like Ireland, Italy, and the Netherlands have produced more. Overall, from the top five producers, output is up 1% year-on-year.

The EU sheep population has been falling since 2017, with the rate of annual decline accelerating during this time. Breeding ewe numbers have been falling particularly sharply in Greece and Spain, whereas other countries like France, Ireland and Germany have seen relatively more stability.

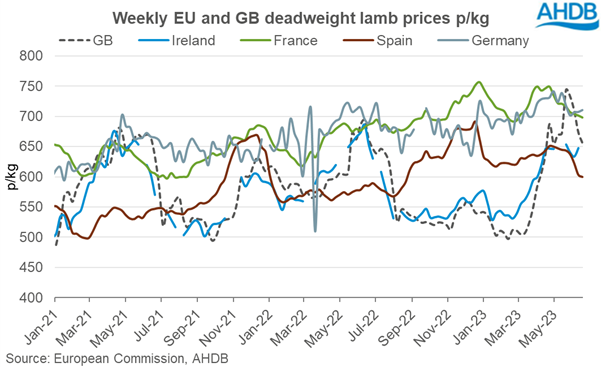

Lamb prices in continental EU have stayed relatively buoyant since January. Meanwhile, like GB, Irish prices were particularly pressured earlier in the year, before appreciating strongly from March onwards. Market conditions in Ireland echo those in the UK; Bord Bia report that spring lambs have generally been slower to come forwards, while a larger carryover has meant hogget numbers have persisted later into the season.

GB prices are now sitting in a more midfield position following the spring rally. However, returns have been on a seasonal downwards trajectory for a few weeks. Similarly, Spanish prices have taken a downwards turn.

Market commentary suggests that as well as new season supplies growing, European consumer demand for sheep meat is somewhat lacklustre at present. Inflationary pressures are likely to be playing a part. New Zealand analysts AgriHQ report that European supplies are ample for requirements currently, following a relatively strong first quarter of exporting. Indeed, EU27 trade figures showed a marked annual increase in imports from Jan-Mar as UK and Southern Hemisphere product was particularly competitive, but April volumes were back substantially. Elsewhere, reports suggest that fifth quarter material returns are depressed currently, weighing further on supply chains.

Overall, the outlook for EU sheep meat production in 2023 is for levels to decrease by just over 1% from 2022, influenced by ongoing contraction in the breeding flock (EC Spring Outlook). Imports are expected to remain supported by lower production and competitive overseas product. But of course, a lot will depend on EU consumption levels, especially considering current macro-economic conditions. Elsewhere, China has been taking more product from New Zealand and Australia so far this year, but uncertainty remains about China’s recovery post-COVID.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: