Weather adds uncertainty to global grain markets: Feed market report

Thursday, 29 July 2021

By Alice Jones

Grains

Global grain markets began to slip at the start of July but have since generally climbed. At this time of year, weather is a big driver of grain market movements; this year is no exception. At the beginning of the month, rain and milder temperatures in the US, coupled with favourable Chinese maize supply eased prices. However, adverse weather news in the US, Canada and South America have all played a role in global price rises of late.

The July USDA world agricultural supply and demand estimates (WASDE) cut global wheat ending stocks by 5.1Mt. The cut was driven by falls to US, Canadian and Russian production. This offset rises to Australian, EU and Ukrainian production. The first estimate of US spring wheat production came in at 8.3Mt, a 33-year low.

Dryness in the US and Canada continue to add to concerns, also causing early worry for the US maize crop. Reductions to the Russian crop estimates supported global wheat prices as well.

Markets have remained tense towards the end of the month, with uncertainty over global supply. Until Northern hemisphere harvests are further along, prices will remain sensitive. The coming weeks will also be key for domestic grain prices, as our own harvest progresses.

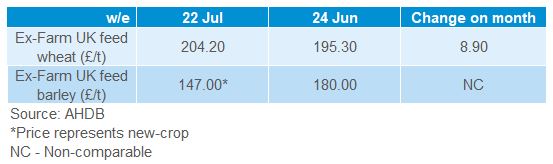

With the barley harvest underway in the UK, prices have dropped as new crop supply becomes available.

Proteins

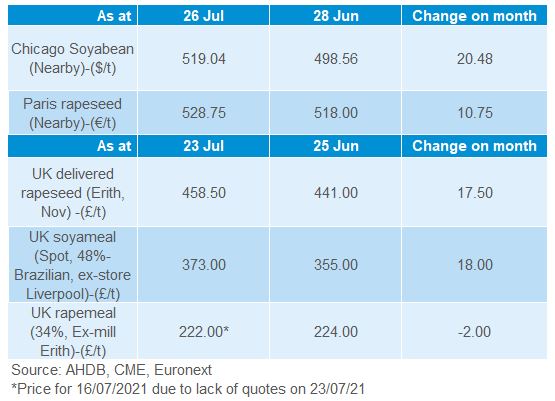

Last Friday (23-Jul), delivered rapeseed (Erith, Nov-21) prices showed an increase of £17.50/t on the month, at £458.50/t. That said this is a drop from the previous week (£479.50/t), where rapeseed was quoted at the highest level on digital record (since Jan 2005).

The driving force behind much of the high oilseed rape price is Canadian weather causing concerns for the canola (rapeseed) crop. This is pushing up the global rapeseed futures markets. It is key to note that Canada is the world’s leading canola producer, hence the big impact that news of struggling crops has on global markets.

Domestic oilseed rape prices tend to follow Paris rapeseed futures closely. Paris futures have followed the sharp rises in Winnipeg canola futures. So, although the UK does not directly import Canola from Canada, news from here heavily impacts domestic pricing.

Soyabean markets have also been moving on the back of weather, particularly in the US. Over the month prices have been volatile, generally falling with the rain, and rising on drier weather. Improved weather in key states such as Iowa and Minnesota, where conditions have been dry, could certainly ease prices back somewhat.

Chinese demand is another factor to keep an eye on. Chinese imports are set to slow in late 2021, after a record 48.9Mt was imported in the first half of 2021, up 9% year-on-year.

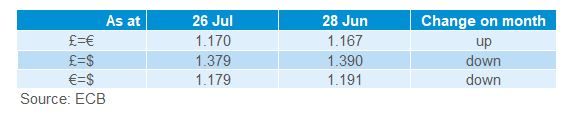

Currency

On 20 July, the pound dropped to its weakest level since 25 May against the euro and 18 January against the US dollar, following “Freedom Day” in the UK. With coronavirus infections rising in the run up to restrictions being lifted, caution from investors saw liquidated long positions, causing a sharp drop for sterling. Since then, sterling has recovered, but to a lesser extent versus the dollar than the euro.

Generally, the US dollar has been strengthening against the euro and the pound since the end of May. Coronavirus concerns have spread, and the US dollar is deemed a “safe-haven” currency.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.