Chinese maize supply to weigh on prices? Grain market daily

Wednesday, 7 July 2021

Market commentary

- UK feed wheat futures (Nov-21) moved a further £2.05/t lower yesterday, closing at £165.35/t. This is the lowest position for the contract since 7 April. The Nov-21 contract has now lost £7.45/t since 1 July.

- Chicago maize futures (Dec-21), the leader of recent grain market movements, moved sharply lower yesterday. The move wrote off last Wednesday’s gains.

- Yesterday’s USDA crop condition report was largely positive for maize, with the percent of the crop rated “good” or “excellent” stable at 64%. There was a marginal decline of 1 percentage point in the rating of soyabeans and winter wheat, down to 59% and 47% “good” or “excellent”, respectively.

- US spring wheat crops continue to suffer. In the week ending 4 July, just 16% of the crop was rated “good” or “excellent”. You can read more on the UK impact of this here.

- The AHDB Planting and Variety survey will be published in tomorrow’s GMD at 2pm.

Chinese maize supply to weigh on prices?

Over the course of at least the last six months, China has been if not the main, then unquestionably one of, the most dominant factors in commodity market inflation. The vast buying of commodities to shore up stocks and feed livestock drove considerable increases in prices.

The uncertainty that has surrounded Chinese data for so long, has resulted in China often being excluded from statistics around global grain supply and demand. However, that is a challenging precedent to continue to follow now.

While US weather has been a base for the recent fall in maize prices, data around Chinese maize import demand may also be softening the global demand picture, and so prices.

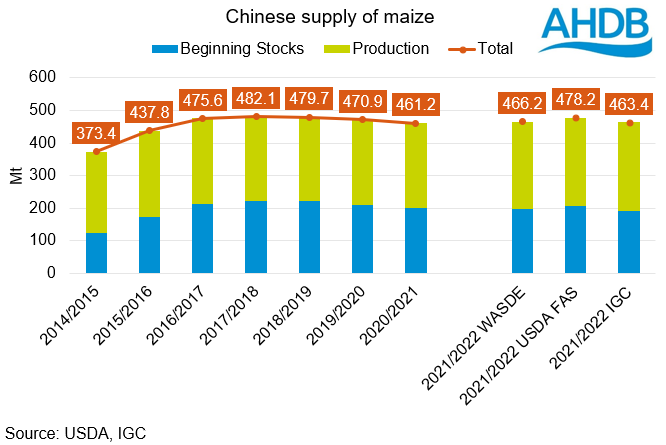

As yesterday’s market commentary highlighted the USDA Foreign Agriculture Service has pegged its estimate of Chinese maize production 4Mt higher than the USDA official figures, at 272Mt. Following a 3% rise in planted acreage, Chinese maize production is expected to increase by 11.4Mt year-on-year.

Opening stocks are also seen rising after a 28Mt import campaign in 2020/21, to 206Mt, taking total availability to 498Mt, almost 9Mt up year-on-year.

The rise in maize availability in China may not be capped at these levels either, a report from Refinitiv suggests that high Chinese maize prices could have driven an increase in maize acreage of 4% to 6%.

Of course, we still cannot take figures from China as read. However, we equally cannot factor them out of the global supply and demand picture altogether. Chinese imports will continue to play a dominant role in global grain supply and demand. Revisions to estimates from a variety of forecasters will need watching just as closely as data from the West over the next 12 months.

If Chinese maize production does increase, nullifying import requirements to an extent, and US weather continues to be favourable, are we in the early throes of a move to a more bearish market?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.