Analyst Insight: Will China need to import as much maize next season?

Thursday, 22 April 2021

Market commentary

- UK feed wheat futures continue their climb yesterday, with May-21 futures closing up £3.95/t to £205.30/t. This is the largest daily gain in 3 weeks on the May contract. Whereas new-crop UK feed wheat futures for November-21 saw smaller gains, closing £1.75/t up, to £179.75/t. This was the seventh day of climbs.

- Chicago maize futures gains are at the heart of these climbs, with nearby prices rising to the highest since 2013. Gains have been made over Brazil’s declining Safrinha crop conditions and US cold weather concerns threatening global supply.

- China have reportedly bought 500-600Kt of new-crop French wheat, for shipping from July to September. This suggests China may continue to be an important destination for French wheat in 2021/22. There are also speculations of China buying Ukrainian maize.

- The AHDB Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. Play a part in creating accurate data for your industry by completing the planting survey form. Five minutes of your time can provide huge value to our great industry.

Will China need to import as much maize next season?

Throughout 2020/21, China played a key global role in supporting maize prices and in turn wheat prices. Chinese buying of grains contributed to the tightening of global supply and demand.

A relationship exists between US maize pricing and UK feed wheat pricing. The narrowing trading range suggests UK wheat prices are currently following maize prices, which could continue into 2021/22. So, understanding the global picture for maize could be significant to UK price direction.

Today I am looking at the Chinese maize supply situation, to understand what level of imports might be expected next season.

What can we expect from Chinese maize demand and supply next season?

China’s total maize demand in 2021/22 is forecasted by the International Grains Council (IGC) to rise 5.5Mt to 301.4Mt. Previous analysis predicts continued demand through the expanding pig herd. Recent figures show China’s Quarter 1 (Jan-Mar) pork production rose 31.9% year-on-year, to 13.7Mt. Importantly, China’s pig herd rose 29.5% year-on-year to 416.0M so demand could remain strong next season.

Reports of African Swine Fever (ASF) continue to emerge. Also, official guidance released this week recommends changes to pig and poultry rations to reduce usage of soyameal and maize. It is uncertain to what extent these may impact demand for maize.

For 2021/22 Chinese maize production, IGC forecast a rise of 6.6Mt to 267.3Mt and imports to fall 3.0Mt to 22.0Mt. These predictions would ease the strain on world supply marginally; though not when compared to 2019/20, as imports were only 9.4Mt. To note, the US attaché in Beijing forecasted higher imports for 2020/21 and lower imports for 2021/22. But overall, Chinese imports will still play into global maize prices next season, it is the extent that is to be determined.

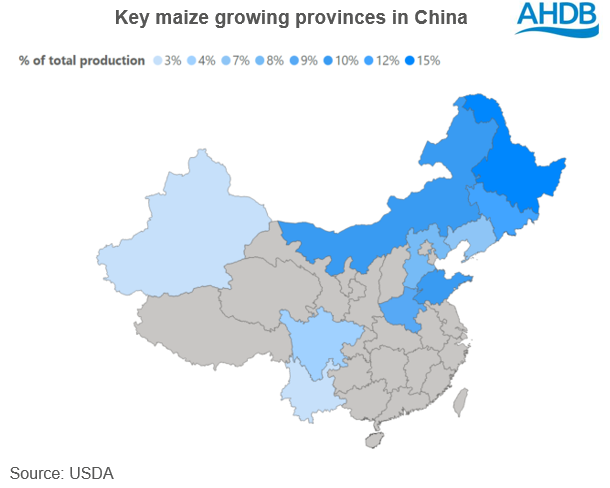

China’s key maize growing provinces form a belt across the country, with a high proportion in the North East corner. Planting spans late-April to June for harvest in September and October.

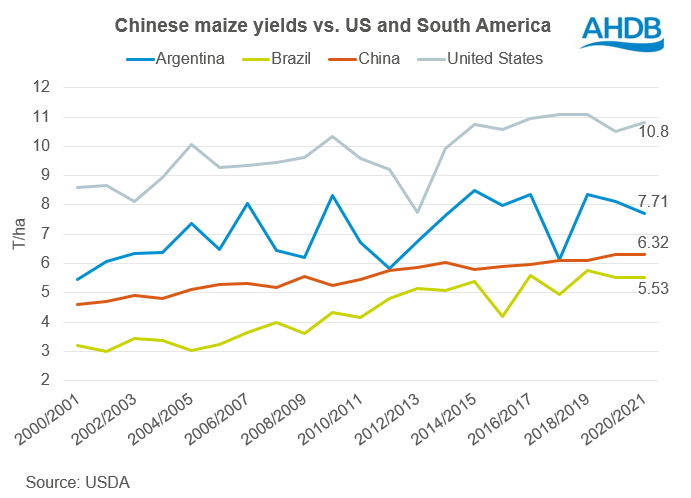

Maize yields have been increasing. In 2010/11, the average yield stood at 5.5t/ha whereas in 2019/20 and 2020/21 it stood at 6.3t/ha. Chinese yields are above Brazil’s, though below Argentina and US.

Over the past decade, Chinese production has fluctuated but has been increasing. Last year, a typhoon flattened some crops in the North East before harvest. Yet yields are estimated the same as 2019/20 and production remains above 260.0Mt, despite analysts forecasting crop losses at the time. Imports rose at an exponential rate in 2020/21, perhaps to extend potential crop loss.

What can we expect from the 2021/22 crop?

Planted area

Recent Chinese government documents have made it clear that food security is a top priority, and more grain needs to be produced. Government policies proposed to help include reducing waste, connecting production to marketing, subsidies, minimum purchase prices (for wheat and rice) and pilot insurance programmes by cost and income base (for wheat, rice and maize).

Maize planting is forecasted to rise in line with this new policy this year. In 2020, the planted area was estimated as 41.3Mha by official sources. This year, acreage is predicted to increase by at least 667Kha in the North East and Yellow, Huai and Hai rivers areas according to Refinitiv.

This could boost production by 4.1Mt if realised, using a 5-year average yield (2016/17-2020/21). It suggests China will need to achieve a record yield to meet the IGC production forecast. Should farmers opt to grow other grains, this would also impact on planted area.

Weather

This year has seen some extreme weather in China. In February, the key maize growing province Heilongjiang (China’s most northerly and coldest province) recorded the coldest temperatures in 50 years.

Currently, North West and West China are dry. Beijing has reported three sandstorms in the last five weeks, with one the worst in a decade. Though for most key maize growing provinces, soil moisture looks adequate or better and vegetation indexes are relatively positive.

Weather forecasts for the upcoming weeks look close to average in temperature and climate, across the main maize producing provinces. Though, weather is one to watch going forward.

What does this mean for the UK?

Chinese maize demand is still forecasted to exceed domestic supply in 2021/22. This means imports will be required, though how much is not yet clear.

There are many factors playing into maize imports next season. This includes feed inclusion rate changes, political relations, ASF, and Chinese policy towards grain imports and level of ending stocks, plus domestic production.

Current production forecasts are seemingly based on Chinese farmers achieving record yields. So, weather will be a key watch point going forward to monitor any potential crop damage/loss.

Should production not rise as expected this year, that could mean higher imports. This could strengthen global maize prices and lend support to UK wheat prices. Whereas, if China’s domestic production meets or exceeds forecasts, this could pressure global grain prices. Either way, eyes continue to be on China.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.