Analyst's Insight: How could maize prices in 2021/22 affect UK wheat prices?

Thursday, 15 April 2021

Market Commentary

- UK old crop (May-21) feed wheat futures firmed by £2.00/t yesterday to close at £201.00/t. This is the first time it has closed over £200.00/t for almost a month. New crop also firmed, up £2.55/t to close at £172.05/t. Again, the first time it has closed over £170.00/t in a month.

- Chicago maize was the leader of yesterday’s rally. May-21 was up $3.48/t to close at $169.90/t and Dec-21 up $1.55/t to close at $146.23/t. Concerns over cold weather damage to crops is currently driving markets up.

- A severe frost in France has caused some concerns for grain crops in the central and southern parts of the country, although it’s too early to tell the exact damage.

- India’s palm oil imports in March were up 57% year on year. This is because it is currently an attractive alternative to sun oil, which is very expensive.

How could maize prices in 2021/22 affect UK wheat prices?

Firm global maize prices throughout the 2020/21 season have lent support to global wheat prices. This has also helped sustain historically very high UK wheat prices. In this Analyst’s Insight, I am going to look at how the price relationship between US maize and UK wheat futures could affect our domestic wheat price in the 2021/22 season.

The impact of US maize prices on UK wheat values

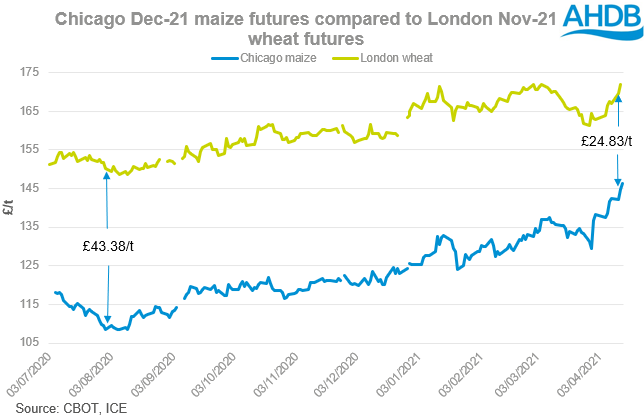

Throughout the 2020/21 season, the nearby futures discount of maize to wheat started at £51.98/t. It moved to a maximum of £71.29/t at the beginning of August 2020, but since then has narrowed to £31.10/t at the close last night.

Although this narrowing was due to maize rallying harder than wheat, the firming maize price also helped keep the wheat price supported.

The US maize Dec-21 discount to UK Nov-21 feed wheat currently stands at £25.82/t. On this day last year, the maize Dec-20 discount to wheat Nov-20 was at £56.85/t.

When looking at new crop futures (Nov-21 for wheat and Dec-21 for maize) over the same period, the discount has been a lot more stable than the nearby relationship, trading between a range of £24.84/t and £43.38/t.

This narrower trading range for new crop would suggest that wheat prices are following maize prices relatively steadily, and maize prices could well continue dictating wheat prices into next season.

With the UK looking set to be a net importer of wheat next season, our prices will once again be heavily influenced by the global market.

Factors affecting US maize price direction

A large factor in US maize prices in the coming season with be production in major exporters.

US production

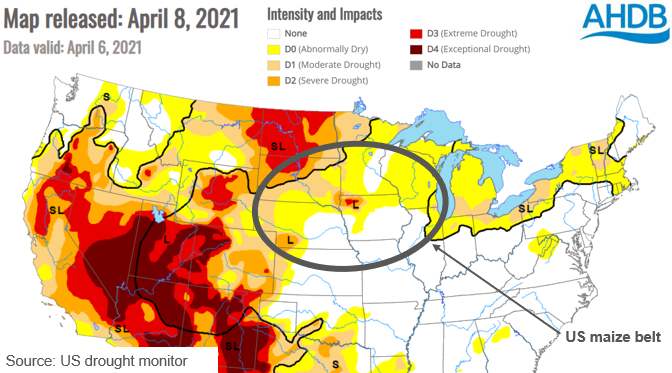

Maize plantings are currently underway in the US. As of the latest crop progress report, on Monday, 4% had been drilled. This is slightly ahead of the previous 5-year average at this time of year, which is 3%. Topsoil moisture levels currently have 33% of US area rated as “short” or “very short”, this is well ahead of this time last year when just 10% of topsoil moisture levels had these ratings. While these dry conditions will help US farmers advance rapidly with their maize plantings, this will be a key watch point as we move through the growing season. As with Brazil, without ample rains to alleviate these dryness concerns we could see production in both major exporters hampered for harvest 2021.

The 31 March stocks and acreage report proved bullish for maize. The prospective plantings were pegged at 91.1Mac, well below the average pre-report trade estimate of 93.2Mac. Stocks were pegged at 195.6Bn bushels, again below the pre-report average trade estimate of 197.3Bn bushels. This will indicate tighter stocks moving into 2021/22 and likely lower production.

The US drought monitor currently has conditions in parts of the Midwest, which makes up much of the US maize belt, as abnormally dry. Some areas could be likely to cause a long-term impact. Recent rains have missed the particularly dry areas; however, colder conditions of late have prevented conditions getting too much worse in the short-term. Rains will be needed soon, with July the key growing period for maize.

South American production

In Brazil, all of the Safrinha maize area has now been planted. For this not to have been achieved until the first week of April is highly unusual, usually the latest plantings take place in the first half of March. The delayed plantings were caused by heavy rains impacting the harvesting of the soyabean crop, which the maize follows. However, now dryness concerns are the biggest worry for this late planted crop. As with the US, ample rains are needed to alleviate these dryness concerns and improve yield prospects.

This said, in the most recent USDA GAIN report, production for 2021/22 is currently forecast at 114Mt, 10Mt higher than in 2020/21. This is largely led by increased area; current high prices acting as an incentive to increase plantings. If realised, this would be the largest production on record.

What impact might this have on UK wheat prices?

To summarise, although there are currently some weather concerns in a couple of the key exporters, this is already priced into the markets. Rain will be vital in the coming weeks and months, but we could see ample production in 2021/22. This could pressure maize prices, and in turn, our domestic wheat price.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.