Analyst's Insight: China have a need, a need for feed

Thursday, 11 March 2021

Market Commentary

- UK feed wheat futures had small losses yesterday with old crop (May-21) falling £0.55/t, to £205.00/t. New crop (Nov-21) futures closed down £0.35/t, at £170.75/t.

- US wheat futures also weakened slightly yesterday with May-21 down $1.47/t, to $239.75/t. The Dec-21 contract closed down $1.75/t, at $238.56/t. The May-21 maize futures contract had its second consecutive day of loses, down a further $4.63/t to $210.23/t.

- Dryness in Argentina throughout February and into March, has led to Rosario Grains Exchange cutting a further 4Mt off its soyabean production forecast, now at 45Mt. The lack of rains has impacted both area and yields.

- FranceAgriMer have raised their monthly forecast of French soft wheat stocks by over 100Kt, to 2.7Mt. This is due to a cut in exports within the European Union.

China have a need, a need for feed

The rally in the price of feed grains in 2021 has largely been driven by an aggressive import campaign from China. This is because African Swine Fever (ASF) decimated their pig herd, and they are now actively rebuilding it.

The price support looks set to continue with Chinese demand for feed likely to remain into the new crop.

That said, it is important to remember that there are a number of factors that could influence the strength of any price support. Including South American crop development and US plantings.

With a small domestic carry over and likely average production in the UK next season, we are going to be net importers. This means we will have to price at import parity and therefore our prices will be largely influenced by what happens on the global market.

This article will look at the impact of this strong import demand on grain prices so far, and how it could affect prices going into the new crop, and beyond.

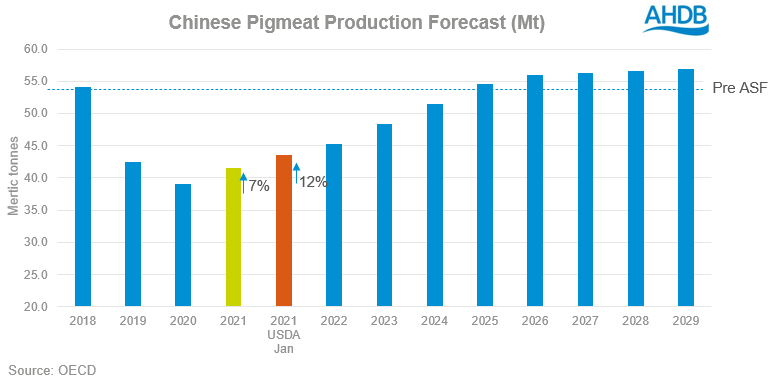

During 2019, ASF wiped out roughly half of China’s 400 million-head pig herd. As the world’s largest pig producers, this left a protein gap of approximately 25Mt, which hugely impacted the trade flows of proteins around the globe. In 2020, China imported 5.6Mt of pig meat (including offal) this is over double the previous 5-year average (2015-19) of 2.4Mt.

China rebuilding its herd

In December 2020, China announced that their pig herd had grown faster than anticipated, reaching 90% of pre-ASF levels.

However, it is anticipated that China won’t have to fully re-build their breeding herd. China are importing sows from Denmark with better genetics. These more prolific sows will increase the average litter size, with less sows needed to achieve the same number of offspring.

In 2020, China imported 1,483t of live breeding sows, compared to 51t in 2019. The previous 5-year average (2014-18) was 436t.

Can we believe data around the rebuild?

There are question marks over the reliability of figures from China. In September, the Chinese Ministry of Agriculture posted a notice flagging issues they have in gathering statistics on animals.

Further to this, the high price of Chinese pork at present, the strong level of Chinese protein imports and the resurgence of ASF, also raise questions about how big the Chinese pig herd truly is.

Changing shape of demand

Alongside growth in the herd itself, the shape of demand could be shifting. We have seen the introduction of large, multi-storey pig units, and a move away from the traditional back yard pig herd.

This has led to increased demand for compound feed, and therefore feed grain straights to produce it. So, this could mean that even if the pig herd doesn’t return quite to its previous size there may still be an increased demand for feed grains.

How has this affected feed grain imports throughout the 2020/21 season?

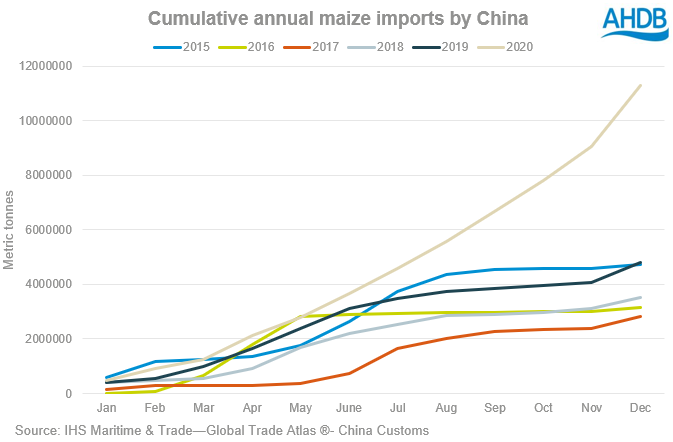

With the expansion of the pig herd comes the need for feed. Chinese maize imports in 2020 reached 11.3Mt. This is over double the 4.8Mt imported in 2019. In December alone, 2.25Mt of the total figure was imported, showing continued strong demand. This coincided with Chinese maize futures hitting record highs.

Wheat and Meslin imports were at 8.2Mt, again more than double 2019 levels (3.2Mt). Soyabean imports hit 100.3Mt in 2020, compared to 88.6Mt in 2019.

This strong buying by China for feed and stock building has supported global grain prices so far. This support has been especially strong since the beginning of 2021.

How may it affect the price of feed grains into next season?

Pig feed production is still increasing. In January 2021 feed production was 8% higher than in December 2020 and 80.21% ahead of the same month in 2020. Although, it is important to note that the Chinese New Year in 2020 fell in the second half of January.

With China’s overall feed demand forecast by the USDA to increase by 15.6Mt in 2020/21, compared with the previous year, there is a 23Mt maize deficit. This will be covered by imports and Chinese maize reserves. As such maize will likely be tight into the new marketing year.

When looking at what imports have been booked for the remainder of this season, for maize there are 11.7Mt of US exports still to deliver in 2020/21, with China’s total commitment at 18.7Mt.

For soyabeans, there is a 1.3Mt commitment still to be delivered for this season. China’s total commitment of soyabeans from the US in 2020/21 is 35.8Mt. There is already 2.3Mt booked by China for next year, the most for this point in the season since 2013/14.

What could change this?

Of course, there are a number of factors that could prevent a continuing rally of feed grains. Firstly, we could see bumper harvests in South America and the US which means supply can cover, or even exceed demand.

Further, China is actively building their own stocks of feed grains, and if they have a good harvest next year, they may not have such a large demand for imports.

Finally, we will also need to watch the ongoing situation with the new strain of ASF, and its impacts on the Chinese pig herd.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.