Prices rally as Russian crop reduces: Grain market daily

Friday, 16 July 2021

Market commentary

- Grain markets continued to show strength yesterday, with UK feed wheat futures (Nov-21) closing at £170.90/t. UK markets have shown more strength this morning, up a further £4.40/t at the time of writing, at £175.30/t.

- This morning’s move follows the increase in Paris milling wheat futures (Dec-21). French crop conditions have been hit by the wet weather in the week to 12 July, with 76% of soft wheat rated “good” or “excellent” versus 79% the week before. With wet weather having continued in Europe for much of this week, conditions and harvest progress have likely been impacted further.

- Chicago maize, which has been a key leader of grains, paused yesterday. Net sales of new crop US maize in the week ending 8 July came in below industry expectations at 133Kt. Despite this, outstanding sales of the new crop remain strong with 16.1Mt booked so far.

Prices rally as Russian crop reduces

US weather has been a key factor for prices over the past few months, with the northern plains in particular feeling the effects of hot, dry weather. However, alongside concerns about US crop conditions the Russian wheat crop has also begun to be walked lower.

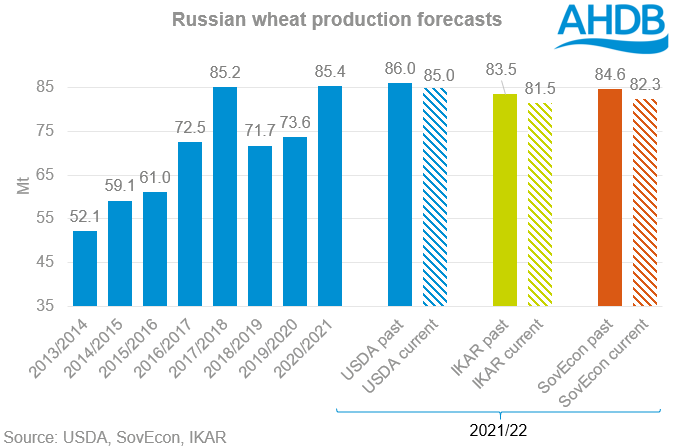

This week has seen the release of three key forecasts for Russian wheat production from the USDA, SovEcon and IKAR. All three reports have begun to walk the Russian wheat crop lower.

Even with export restrictions in place, Russia is once more set to be the biggest global exporter of wheat. As such, reducing crop sizes in the nation will have a significant impact on the price of wheat globally.

The primary reason being cited for the reduction to Russian crop size is reduced yields in Southern Russia following the dry autumn in 2020. While rains were seen through winter it is believed that these were not enough to drive a recovery in yields.

A report published yesterday by SpecAgro on behalf of the Russian Ministry of Agriculture, highlighted that as of 15 July, around 13% of the Russian wheat area had been harvested. The average yield for wheat from that area was 3.4 t/ha.

Rain over the last 14 days had delayed harvest, for the most part harvest in the South of the country should be able to progress with a drier outlook over the next fortnight. The spring wheat region in Russia (to the north of Kazakhstan) may also need watching closely, with vegetation health indices, showing crop condition to be down on the year.

With the margin for error in grain markets small this season, due to low stocks coming out of the 2020/21 season, harvest progress in major exporters needs watching closely.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.