UK pork trade: Q3 import volumes back despite falling EU prices

Tuesday, 3 December 2024

Key points:

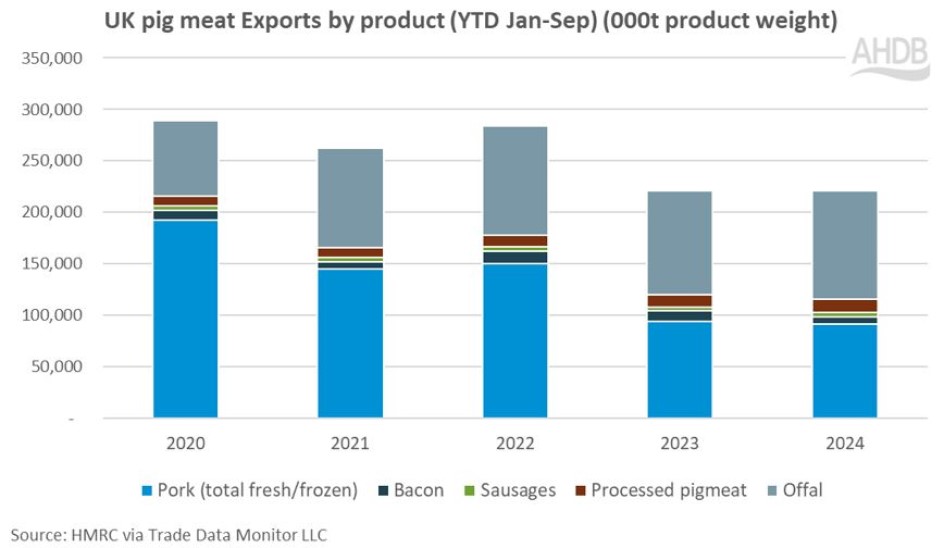

- Export volumes grew 4.5% year on year in Q3 2024, but are stable for the year to date

- Shipments of offal have continued to grow, while fresh/frozen pork and bacon have declined

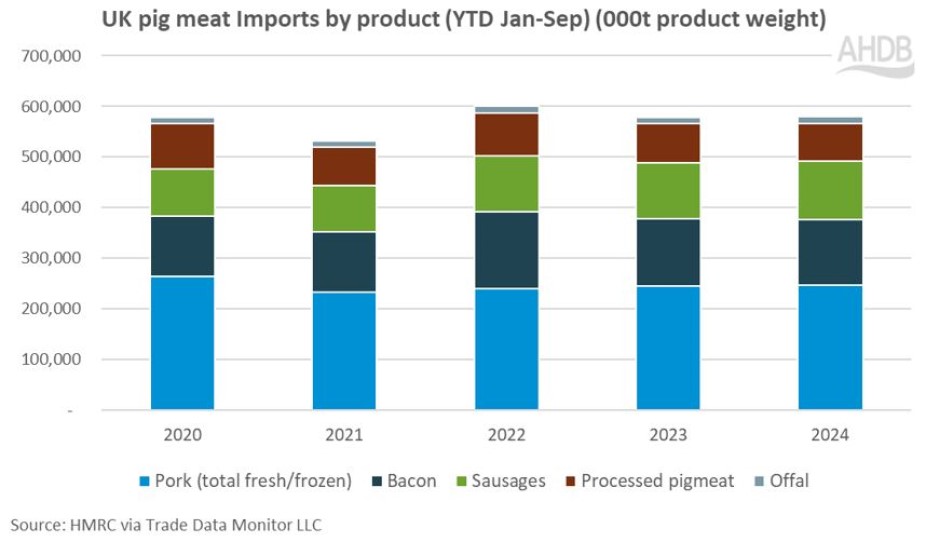

- Total imports fell 2.0% year on year in Q3 2024, but are in-line with 2023 for the year to date

- Sausage imports continue to gain strength, while bacon and processed pig meat decline

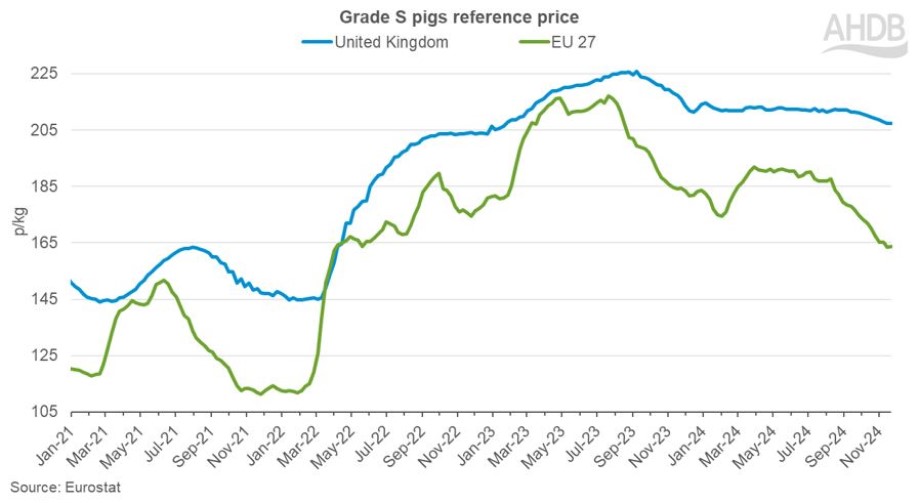

- The price differential between the EU and UK has grown to 44p (week ending 24 November)

Exports

UK pig meat exports (including offal) totalled 72,500t in three months of July to September. This was an increase of 4.5% (3,100t) compared to the same time last year. Growth was not consistent across each month, with July and September recording strong year on year improvements, but August was marginally lower. Higher domestic slaughter and pig meat production has been the main driver for larger export volume. Defra data shows that in Q3 2024, UK pig meat production was over 7% high year on year.

For the year to date (Jan-Sep), total pig meat exports stood at 221,000t, stable year on year with only a 200t difference. Movement has been mixed across product categories, with volumes of fresh/frozen pork and bacon declining by 3,000t and 2,700t respectively. However, shipments of offal continued to surge, up by 4,400t, nearly catching the record volumes recorded in 2022. Processed pig meat and sausages also continued to make good gains, albeit from a smaller base.

All of the UK’s key trading partners, except the EU27, have recorded volume growth in 2024.

Imports

UK pig meat imports (including offal) totalled 192,900t in the third quarter of 2024 (Jul-Sep), a 2.0% decline (4,000t) compared to the same period last year. Volumes were lower year-on-year in all three months of the period, driven by losses in fresh/frozen pork, bacon and processed pig meat.

For the year to date (Jan-Sep), like exports, total pig meat imports stood almost in-line with volumes recorded over the same period a year ago, at 580,700t, a marginal uplift of just 1,800t. Shipments of processed pig meat and bacon have been in decline since the start of the year, down 5,100t and 3,600t respectively. Sausages on the other hand have seen consistent volume growth year on year, up 6,400t. Monthly volumes of fresh/frozen pork have seen mixed movements in 2024 so far, but overall, they have edged up.

The UK will always import relatively high volumes of pig meat due to being unable to meet required volumes for consumer preferences domestically. Loins and bellies are particularly popular. Some support for imports is driven by the foodservice sector which is more likely to use non-British product than the retail sector. Although foodservice volumes have been gaining strength (Kantar, 52 weeks ending 01 Sep), the volume of pig meat purchased in this sector is far outweighed by retail and many major retailers hold commitments to British product. Find out what percentage of retail facings are labelled as British.

Product from the EU27 makes up over 99% of UK pig meat imports. Historically, market behaviours in the EU and UK have tracked very closely to one another. However, since mid-August, EU pig prices have been falling sharply, while UK pig prices have been relatively stable. This has led to the price differential between the EU and UK grade S reference price growing to 44p/kg in the week ending 24 November, compared to a gap of 24p/kg w/e 11 August.

Usually import volumes are price sensitive, meaning that when the difference between EU and UK prices grows, import volumes increase as buyers look to agree purchases on a cost basis. But this trend is not currently being seen. One driver of this market behaviour could be increased domestic production. Improved product availability may have lowered import demand during the period.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.