UK pork trade: H1 2024 exports lowest in 9 years

Wednesday, 21 August 2024

Key points:

- UK pig meat exports were up 4% year-on-year in June, driven by offal and fresh/frozen product

- For the first six months of 2024, export volumes were at their lowest level since 2015

- Imports of pig meat to the UK were also up 4% year-on-year in June, however, for the year-to-date, volume growth is lower at 1.4%

- There remain some key demand challenges, both domestically and globally, as although price inflation has eased, average prices paid by consumers have risen

Exports

UK exports have witnessed some challenges this year, with tight domestic supplies resulting in higher product pricing compared with other players on the global market, such as the US and Brazil. With consumers globally still wary of their spending amid higher cost of living, affordability is a key market driver in regions such as China.

In June, the UK exported just over 25,100 tonnes of pig meat, an increase of nearly 4% compared with June last year. The bulk of the volume was made up of offal at 12,300 tonnes, with fresh/frozen product accounting for 10,100 tonnes.

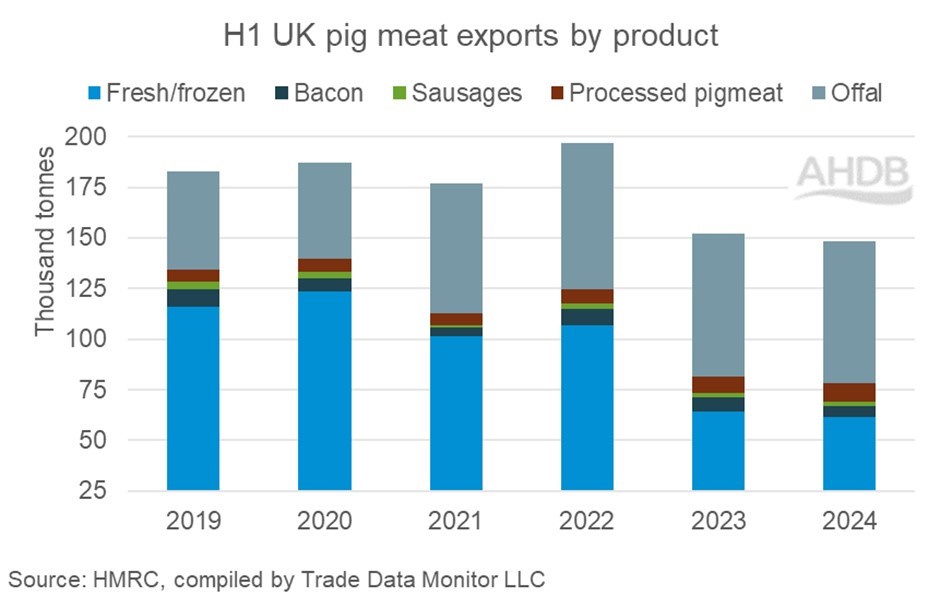

Although this is the second month to record year-on-year growth (with April also seeing volume gains of 4%), larger declines in January, March and May have resulted in year-to-date (Jan–Jun) figures easing. At 148,200 tonnes, UK pig meat exports for the first half of the year are down 2.4% compared with 2023 and were the lowest since 2015.

The year-to-date volume decline is being driven by two product categories, fresh/frozen and bacon, losing 2,500 tonnes and 1,900 tonnes, respectively. Offal volumes have been steady year-on-year, continuing to hold the largest market share (47%). Meanwhile, processed pig meat and sausages have made small gains.

The key destinations have seen little change, which we explored recently. You can read ‘Who are the UK’s major pork trading partners?’ here.

Imports

Similar to exports, UK pig meat import volumes for June were up just over 4% year on year to 71,000 tonnes, with gains across all categories. Fresh/frozen product continues to make up most of the import basket at 29,800 tonnes, however sausages overtook bacon volumes to stand at 16,100 tonnes and 14,800 tonnes, respectively.

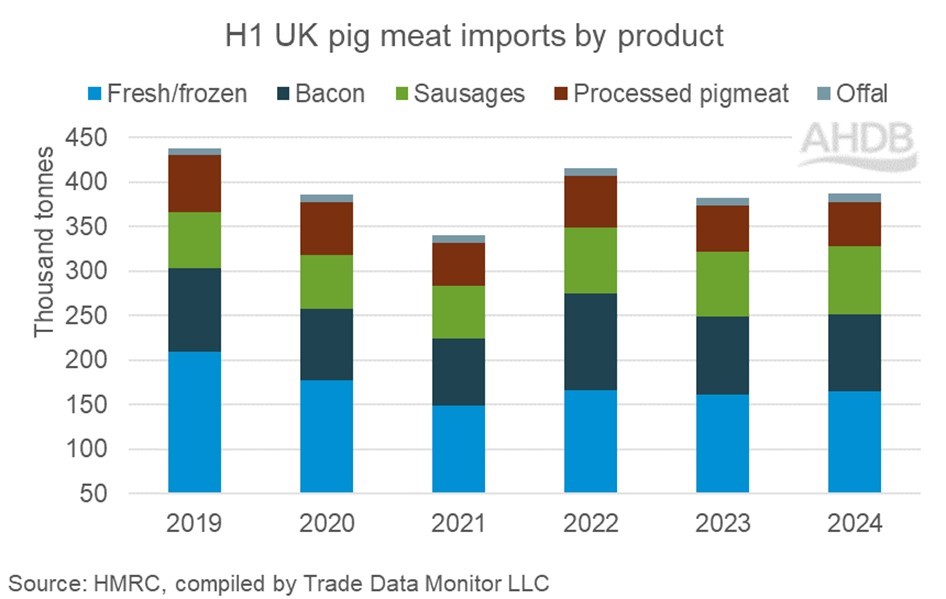

Again, looking at the year to date (Jan–Jun), movements have been mixed across months, with volume declines seen in March and May outweighed by volume growth in other months. Overall, imports in the first six months of the year have grown 1.4% compared with 2023 to 387,500 tonnes.

However, this year-on-year growth is not universal across product categories. Processed pig meat and bacon have both lost import volume in H1 2024, down 3,100 tonnes and 1,800 tonnes, respectively. While fresh/frozen product holds the largest market share at 165,100 tonnes, it is the sausage category that has made the largest gain year-on-year, up 5,300 tonnes to 77,600 tonnes.

Despite overall GB pork volume sales declining year on year (-1%, 52 weeks ending 09 June, Kantar), there is a large difference between retail trends and foodservice. The overall decline is driven by retail losses as it is a considerably larger market. However, with most major retailers continuing to uphold their British product commitments (click here to access our latest country of origin data), there is generally less reliance on imports within this sector.

Foodservice (which includes eating out and takeaways) on the other hand, relies more heavily on imports with less transparency on product/ingredient sourcing. The price differential between the UK and the EU has widened significantly in the first half of 2024 compared to 2023, leading some to view EU product as more attractive on a cost basis. Paired alongside this, a weakening Euro is also likely to have encouraged some buyers to look at the continent.

Looking ahead

There remain some key demand challenges both domestically and globally. Although price inflation has eased, average prices paid by consumers have risen.

Domestic import demand will likely continue to see some volatility in the coming months with buyers closely following movements in price differentials, exchange rates and wider economic indicators.

Export markets are likely to become more competitive.

Increasing geopolitical tensions make work on gaining greater market access for UK products a key priority to maintain carcase balance and value across the whole supply chain. This is an area of work our Export team has a history of great success with, working in partnership with the Government and industry.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.