- Home

- News

- UK cattle population update – fewer youngstock, while 2023 sees the greatest drop in breeding herd in over 10 years

UK cattle population update – fewer youngstock, while 2023 sees the greatest drop in breeding herd in over 10 years

Friday, 22 December 2023

Key points

- Year-on-year contraction of 0.8% in total UK cattle herd as of 1 June

- 2023 saw the greatest decline in female beef breeding age animals seen in over 10 years

- More recent BCMS data from 1 October shows the number of prime cattle available for beef production was up 1.3% year-on-year

- Meanwhile, the number of calves aged under 6 months old has fallen by 4.3% year-on-year

Defra data shows UK breeding herd remains in contraction

According to Defra livestock population data the UK cattle herd stood at 9.6 million head as of 1 June, a year-on-year drop of 0.8% (76,500 head).

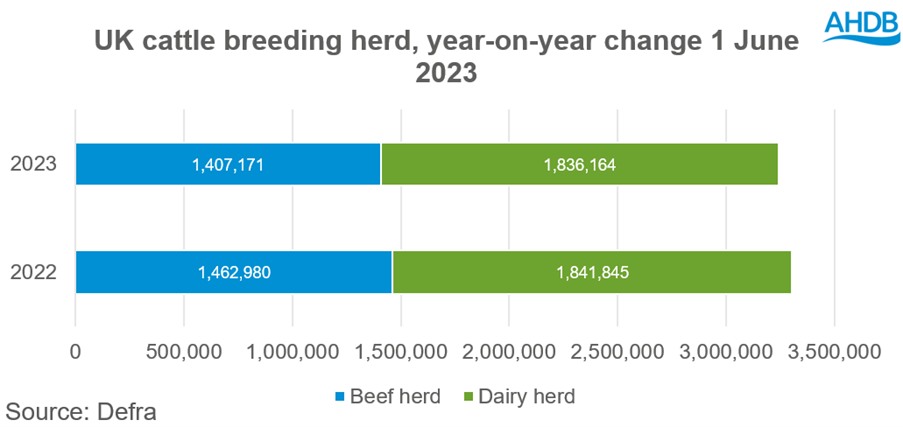

The breeding herd accounts for around a third of the total and has seen a YOY decline of 1.9% to 3.2 million head in 2023, with the steepest YOY decline in numbers seen in Scotland (-2.4%).

The contraction of the UK breeding herd continues to be primarily driven by the suckler herd. From 1 June 2022 to 2023, beef cow numbers fell by 3.8% to 1.4 million animals, being the greatest annual decline seen in over 10 years. This contraction continues the ongoing trend in the suckler herd, with the herd 203,800 head (-13%) smaller versus 10 years ago.

Meanwhile, overall dairy cow numbers showed little YOY change, sitting at 1.8 million head, down 0.3% versus 2022. Consequentially, the dairy herd accounts for a growing share of the UK breeding herd, at 57% as of 1 June 2023.

Growth of the dairy herds in Northern Ireland and Scotland continued, outweighing decline in England and Wales. Contraction in the English dairy herd follows the long-term trend, while Welsh contraction comes after a couple of years of growth.

BCMS data suggests future tightening of GB cattle supply

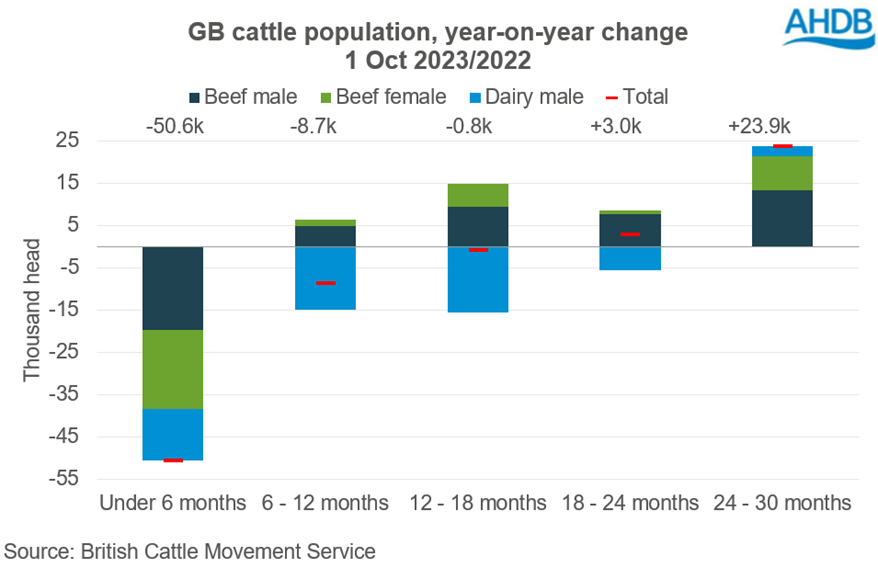

British Cattle Movement Service data from 1 October shows a more recent view of the number of prime cattle (dairy males, beef males and females aged 12-30 months) available for beef production in GB. Numbers grew by 1.3% against October 2022, sitting at 1.99 million head. This rise was largely driven by cattle aged 24-30 months, up by 6.9% year-on-year. Uplift was seen in all categories, but beef males drove most of the growth, up by 12% (13,369 head) YOY.

Meanwhile, the greatest decline was seen in cattle under-6-months old, falling by 50,600 head (-4.3%). This occurred unanimously across categories, and follows trends from previous analysis of calf registrations. Indeed, updated figures to October show GB calf registrations for beef production (beef animals plus dairy males) are down 2.7% year-on-year.

The number of dairy male calves has once again fallen, with a YOY decline of 12,297 head. This has been a continuous occurrence in recent years demonstrating the uptake of sexed semen and beef semen within the UK dairy herd. Interestingly – and continuing the trend from July’s figures – the number of younger beef animals in GB is now in decline, having been in annual growth for the last few years.

With fewer beef calves being born overall, are the contracting breeding herds now beginning to outweigh recent insemination trends, in terms of beef cattle supply? Indeed, looking at birth registrations so far in 2023, the reduction in suckler-born calf registrations has accelerated and is now outpacing growth in dairy-born beef calf registrations.

Across other age groups, contraction of the dairy male calf population has been offset by previous increases in beef animals coming through, resulting in the number of cattle between the ages of 6-12 months retracting by -1%, and animals aged 12-18 months by a marginal -0.1%. Meanwhile, the number of animals aged over 18 months old remained in annual growth.

What does this mean for future cattle supply?

A larger population of 12–30-month-old cattle at 1 October on paper would suggest supplies may be supported into the early months of 2024. However, last year’s forage pressures, persistent high feed costs and industry reports of cattle coming forward generally leaner this year have likely played into finishing times. Indeed, average carcase weights have been persistently lighter through 2023. Looking at current youngstock levels and calf registrations in 2023, supplies may begin to tighten heading towards 2025.

Our detailed expectations for the market and cattle supplies in the coming year will be released as part of our next Beef Market Outlook early next year.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: