GB cattle population: July data shows greater beef supply, but fewer youngstock

Friday, 29 September 2023

The latest GB cattle population data from BCMS suggests more prime cattle will be coming forward for beef production vs a year ago.

Key points

- Total GB cattle herd 0.9% smaller than a year ago

- Decline in number of breeding-age females still driven by the beef herd

- More 12-30 month old cattle on the ground than a year ago, youngstock numbers tighter

As of 1 July 2023, the GB cattle herd stood at 7.9 million head, 0.9% smaller (70,400 head) than the same point a year ago.

The number of females aged over thirty months (OTM) fell by 2.4% to stand at 2.7 million head, primarily driven by further contraction in the beef herd.

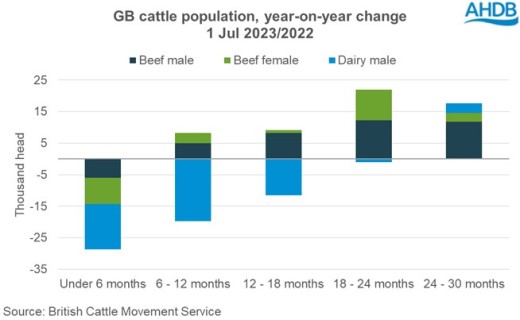

Looking at cattle that would be available for beef production (beef males, beef females and dairy males), the number aged between 12-30 months in GB was 1.8% larger year-on-year. This was particularly driven by older beef males aged between 18-30 months.

By contrast, the population of such cattle aged under 12 months old remained in annual decline. This continues the trend seen in quarterly population figures since October 2022, and still predominantly driven by lower numbers of dairy males.

However, for the first time since 2019, the number of beef males and females aged under 12 months was also lower than a year ago, albeit a marginal change (-0.3%). In previous years, the number of these animals on the ground in GB has been in annual growth (despite the breeding herd continuing to contract in size), potentially due to increased beef crossing of dairy cows (leading to more beef X youngstock, which would be captured in these categories).

The decline was steepest in the under-6-month age group. Our previous analysis showed that calf registrations have been lower so far this year compared to last, driven by fewer registrations to the beef herd.

Does this recent halt in the trend suggest that the decline in cow numbers is starting to outweigh the uptake of beef semen in the dairy industry? Or, has the dairy sector reached maximum output of beef calves? The number of both dairy and beef cows has been in decline for several years, but the rate of decline in the suckler herd has generally been accelerating.

What does this mean for future cattle supply?

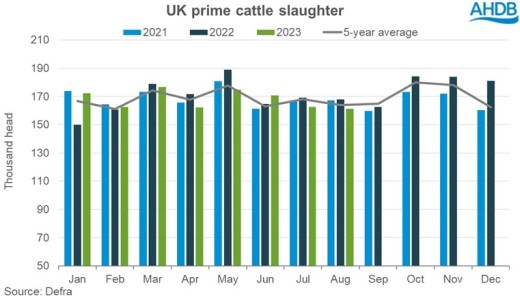

A larger population of 12-30 month old cattle at 1 July would suggest greater supplies for beef production through the remainder of the year. In our beef market outlook (updated in June) we forecast that prime cattle slaughter would grow in quarter three and four, but the final quarter was expected to be lower year-on-year, as kill for this period in 2022 was particularly high.

For the year-to-date, prime cattle slaughter has been below that recorded in 2022 according to Defra figures (particularly Apr-May), likely contributing to maintained strength in cattle prices. June saw uplift in kill, but the trend of lower kill resumed in July and August. AHDB estimated slaughter levels for September so far indicate that weekly kill has been picking up, although off the back of historically low levels through August. Meanwhile finished prices have been appreciating.

BCMS population data, and lower-than-expected kill through July and August may therefore suggest that more cattle could come through in Q4 than we had originally forecast, but whether kill reaches the highs of last year remains to be seen. Indeed, where cattle prices go will of course also depend on how supply balances out with consumer demand heading into the colder months.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.