UK agri-food targeted by US penalty tariffs

Monday, 7 October 2019

One big global trader imposing punitive tariffs on another global trading partners is normally headline news. However, it seems that Brexit trumps everything right now. Therefore, the decision by the USA to add extra, punitive tariffs to a range of European products appears somewhat relegated to the margins. But for those of us that keep a keen eye on the trade policy environment for food and farming, it’s worth a closer look because amongst the targets for extra tariffs are a range of UK agri-food products.

What’s it all about?

In a nutshell, the USA is planning to impose countermeasures of almost $7.5bn on a range of EU products, with dozens of products facing additional tariffs of 25%. This follows the Dispute Settlement Body of the World Trade Organisation ruling where the EU is judged to have fallen short of WTO rules in supporting aircraft manufacturer Airbus. The effective date of the additional duties is October 18, 2019.

Which agri-food products are impacted and why?

The full list of products is available

Some products jump out – the additional 25% of single malt whisky (whisky is one of the UK’s most significant export and the US is a core customer). However, a range of pork and dairy products are on the list, as well as horticultural products. An obvious question that farmers might ask is why are food products caught up in a dispute over aircraft? It is a fair question, but the dispute settlement rulings allow countries to select a range of products up to the value identified, rather than restricting it to a category. This means that the process can be somewhat political, even targeting marque products. Aircraft is on the list, but so are a range of other products, include agri-food. It’s worth remembering that this goes the other way too. In the early 2000s, the WTO ruled in favour of the EU back when George Bush Jr subsidised US steel production. A range of American agricultural products featured on a European hit list that included Florida citrus, cherries, and dried onion powder. In my experience, targets can include the symbolic and strategic – back to the steel dispute, and I recall Europe’s list also featured a product code seemingly targeted at Harley Davidsons!

What happens next?

As it stands, the list of products is for information only. The definitive product coverage will be determined by the US Trade Representative, with USTR saying it would continually re-evaluate these tariffs based on the discussions with the EU. So there is potential for the list to change ahead of implementation on October 18th. Effectively, it makes imports of the identified products in to the US more expensive. What impact this has on volumes and trade of specific products will be seen in the coming months, but economic logic tells us that higher prices curb demand and it’s reasonable that UK exports of these products will be impacted.

In perspective?

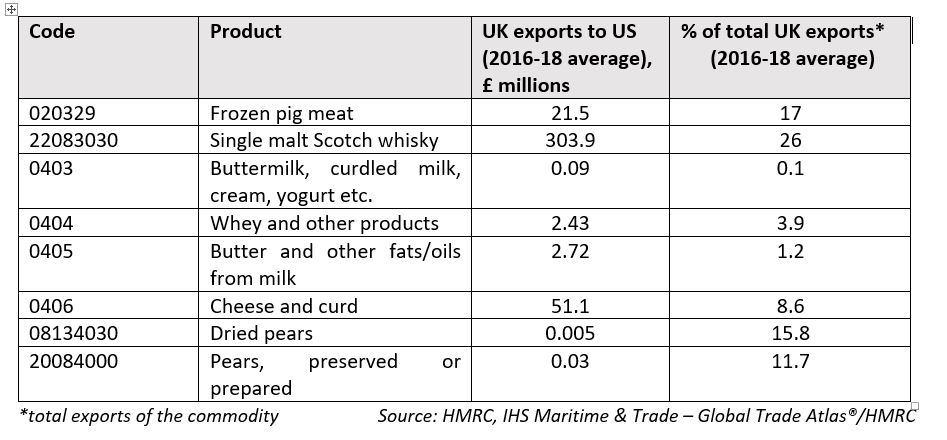

Normally, I’d urge us to keep this in perspective. UK dairy exports to the US are worth an average of £58 million (2016-18), and account for 4% of our total dairy exports (2016-18 average). More details on the effect on UK dairy trade. The table above gives an idea of the potential impact these tariffs could have on UK exports to the US and the relative importance of different products.

As mentioned, the list is not yet finalised. However, we’re not in normal circumstances. The uncertainty of our trading relationship with the EU is a big issue for UK food and farming. It’s currently the main destination for our food products and the potential imposition of what are, in many cases, considerable tariffs on that trade would be detrimental. The switch in trade dynamics means that our attention shifts to global opportunities and the USA has been regularly referenced as a country we’d target in striking new trade deals. Yet the US analysts have clearly identified specific product lines that they want to target in this dispute. In my view, this degree of preparation has relevance for any future trade negotiations, and we shouldn’t be in doubt that US authorities would be targeting UK agriculture as an area where they want improved market access. More widely, it’s a timely reminder that operating in global markets brings with it greater exposure to global geo-political volatility.

Phil Bicknell

Director, Market Intelligence

Topics:

Sectors:

Tags: