Q1 dairy trade review: exports mostly flat and imports on the uptick

Thursday, 23 May 2024

Key trends

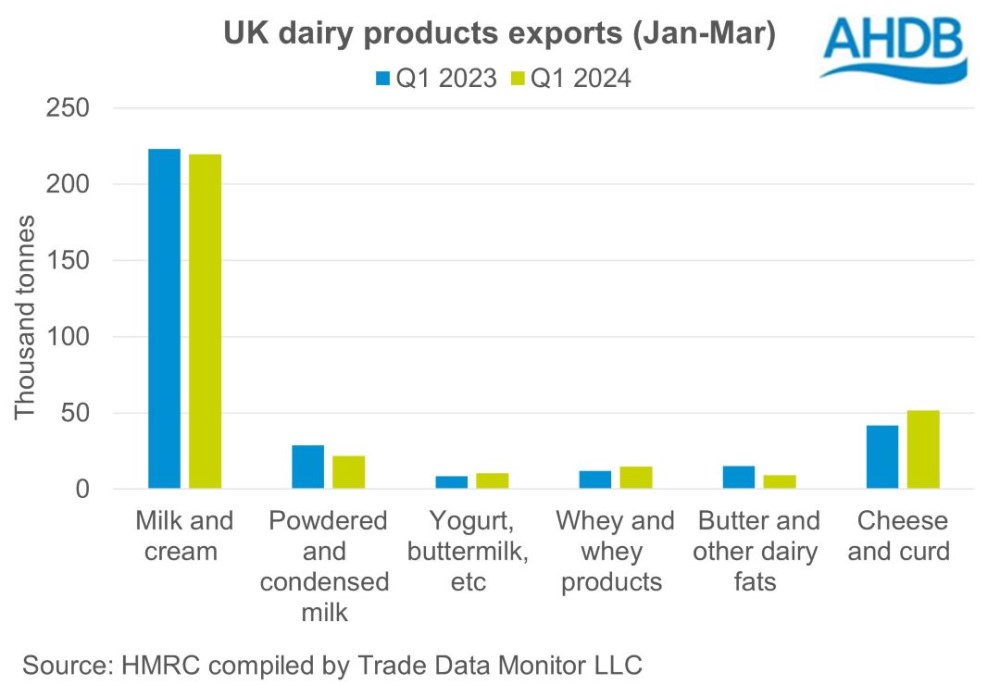

- Total UK dairy export volume for Q1 2024 edged marginally down 0.7% year-on-year at 327.3K tonnes

- Strong growth for cheese and curd, whey and yogurt offset by significant weakening in butter and powders exports

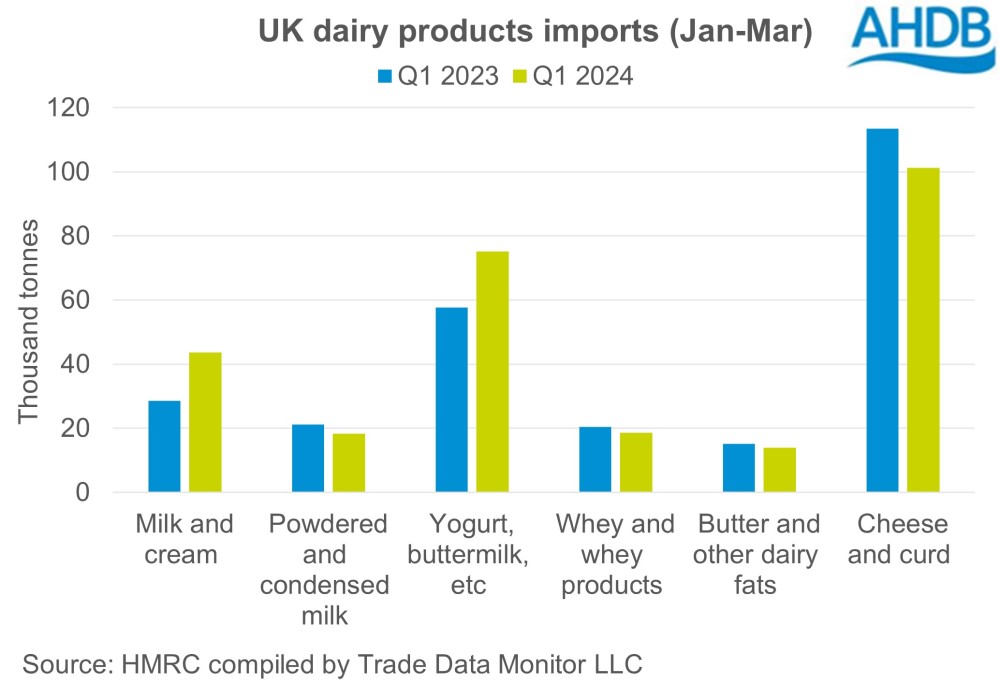

- Total UK dairy import volume for Q1 2024 was up 5.7% year-on-year at 271K tonnes

Cheese exports boom, while butter and powders bust

Total export volumes of dairy products from the UK have declined marginally in Q1 2024. Total export volume for Q1 2024 was 327,000 t, a decline of 2,300 t year-on-year. The level of EU exports remained almost at par, while exports to non-EU destinations declined by 2,300 t.

However, cheese, whey and yogurt saw significant year-on-year growth. This was driven by exports to both EU and non-EU nations. Cheese exports are the highest recorded in a quarter since 2020. Exports of cheese products saw the largest increase of 9,800 t followed by whey and whey products at 2,900 t respectively. Exports of yogurt registered an increase of 1,700 t while exports declined across other products in the basket. Cheese prices have been softening since the beginning of this year, making it attractive for buyers.

EU nations contribute more than 90% of total exports. Ireland (+3,600 t), Netherlands (+1,300 t), Spain (+600 t) were the major contributors to growth. However, exports to Belgium, France and Poland saw significant declines thereby levelling off exports to EU. Exports during the quarter picked up in emerging markets in MENA (Lebanon, Bahrain) and Asia (Singapore, Philippines), though the overall exports to non-EU nations remain in negative territory, following significant declines in Bangladesh (-1,500 t), Algeria (-800 t), Egypt (-600 t), Morocco (-500 t) and China (-500 t).

Imports on the uptick

Total import volumes are up over 14,600 t (5.7%) at 271,000 t in Q1 2024. Imports from EU nations increased by 12,500 t (+4.9%) year-on-year. Imports from non-EU nations increased by 2,200 t during the period.

Import volumes picked up for milk and cream and yogurt, which compensated for declines across other products in the basket in Q1 2024. Imports of yogurt saw the largest increase of 17,500 t (30.4%), followed by increase in imports of milk and cream by 15,100 t (53.0%). Imports of yogurt have been driven by an increase in consumer demand, which is reflected in the latest retail data. Imports of powdered and condensed milk, cheese and curd, whey and whey products, butter and other dairy fats declined by 13.4%, 10.8%, 8.8% and 7.8% respectively compared with Q1 2023.

Imports from EU nations increased by 4.9% to 267,900 t in Q1 2024. Imports from Greece saw the largest increase of 4,800 t to 14,500 t in Q1 2024, compared with the same period last year. Imports from Spain, France and Germany increased by 4,300 t, 4,100 t and 4,000 t at 8,100 t, 37,200 t and 39,100 t respectively. In the non-EU category, imports picked up from New Zealand (+2,200 t), mainly cheese and butter.

The current domestic market is underpinned by an underwhelming spring flush, which would mean lower availability of dairy products in the near term. This calls for more imports in the coming months. However, lukewarm demand from consumers will aid in balancing off imports to a certain extent.

On the export front, in May the Government committed to a new £1 million programme of support to aid British dairy exporters. This calls for focus on exports of more value-added products, like cheese, which have increased during recent months and are gaining a footing in newer emerging markets. Global economic and geopolitical developments and availability of dairy products in the global markets will exert influence on trade flow in the coming months.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.