Prices down, trade stable but ASF set to test market stability: EU pork market update

Wednesday, 10 December 2025

Key points

- Average EU pig prices have continued to fall sharply as increased production is met with weaker demand

- EU pig meat production has continued to strengthen year-on-year, up 3% between January and August

- EU pig meat exports increased by 1% in the first nine months of the year, totalling 2.9 million tonnes

- EU pig meat imports have declined by 3%, totalling 99,600 t

- African swine fever was detected in Spain on 27 November, which is depressing market sentiment

Prices

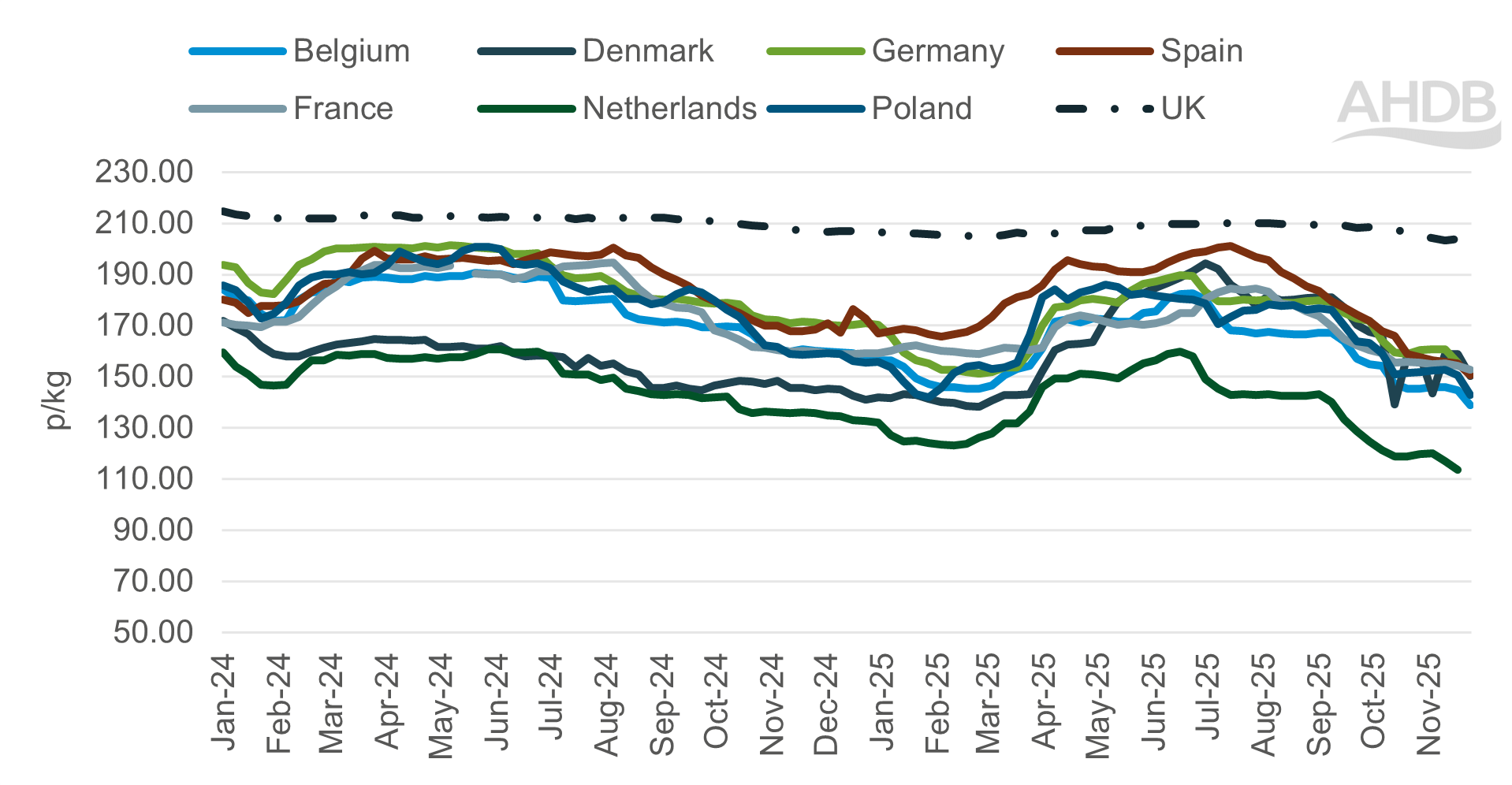

EU grade S reference pig prices have been declining since the end of June, reaching 149.24p/kg for the week ending 30 November. This is the lowest level since March 2022 where the price averaged 138.03p/kg. Since the start of November, prices have fallen 5.35p, including a 3.40p drop in the most recent week (30 November).

Downward pressure on EU pig prices has been driven by higher supplies and weaker demand.

The difference between the UK reference price and EU average stood at 53.33p in the week ending 30 November.

Since 2014 the gap between UK and EU price has exceeded 50p on only five occasions, all of which took place in 2025. This widening gap between prices may make EU pork appear more attractive on a cost basis to buyers.

Spain has experienced the largest price drop, with values falling by 47p from their summer peak.

Select EU27 grade S pig reference prices

Source: European Commission

Production

Full production data for the EU27 is currently only available up to August, as the Netherlands and Italy are yet to submit monthly data for September.

For the period Jan-Aug EU pig meat production totalled 14.4 million tonnes, a year-on-year (YoY) increase of 3% (415,600 t).

Spain was a key driver of the overall growth in the EU27 increasing production by 6% (203,530 t) Jan-Aug. Looking at national data for the month of October, Spanish pig meat has continued to perform strongly up 5% compared to the same month last year.

Other key producing nations showing strong production gains are Poland (5%, +59,100 t), Denmark (6% +49,070 t), and Italy (4% +30,500 t). Germany recorded more modest growth YoY of 1% (+28,900t).

However, production declines were recorded in France and the Netherlands, with both countries posting a 1% decrease, with Belgium down 2% YoY.

Production trends have been driven by a combination of slaughter numbers and heavier carcase weights.

EU pig slaughter reached 148.6 million head between January and August, up 1% YoY.

Again, Spain drove slaughter growth with a 4% increase (1.5 million head), and October volumes continued to rise, gaining 3% compared to the same month last year.

Poland also showed strong slaughter growth up 4% (458,900 head) totalling 13.5 million head. Germany and Denmark remained broadly stable YoY.

On the other hand, slaughter fell in the Netherlands and France by 1%. While Belgium posted a steeper decline of 3% (179,600 head).

Pig meat production of select EU27 countries (YTD Jan–Aug)

72.png)

Source: European Commission

Exports

EU pig meat exports totalled 2.9 million tonnes (January to September) this was an increase of 1% (25,500 t) YoY. Overall, export volumes have remained relatively stable since 2023.

Only three of the EU’s top ten pig meat export destinations have recorded growth in 2025 – Vietnam, Ivory Coast and Republic of Congo – primarily driven by increased offal shipments.

All of the top five countries (China, UK, Philippines, Japan and South Korea) recorded volume decline.

China remained the largest export destination for EU pig meat, totalling 820,100 t. However, exports to China have fallen by 2% (-20,300 t) YoY, driven by lower shipments of fresh/frozen pork, which decreased by 6% (-22,400 t) YoY, totalling 338,600 t. This is the lowest volume of fresh/frozen shipments to China by the EU since 2015.

The introduction of anti-dumping duties on EU has led to a sharp drop in shipments to China in September. Offal exports that month were the lowest since April 2014, while fresh/frozen pork volumes fell 30% from August, marking their weakest performance since August 2014.

The UK remains the second leading destination for EU pig meat exports, totalling 560,500 t for the year to date, however, volumes are down 5% (-29,400 t) YoY.

The overall decline is a result of lower exports at the beginning of the year due to FMD in Germany. UK imports from Germany have now recovered, with September volumes back in line with previous years.

Shipments to Japan had the largest decrease YoY, down 20% (-49,000 t). This is the lowest the year-to-date shipments have been since 2013.

This decline was driven by a fall of fresh/frozen pork, which decreased by -20% (45,700 t) YoY. This stark decrease is due to lower domestic demand, extreme hot weather and the cost of rice increasing, according to Rabobank.

EU exports to Vietnam increased by 22% (18,900 t) YoY totalling 193,800 t. Both offal and fresh/frozen drove this, with an increase of (12,400 t) and (6,000 t), respectively YoY. This increase has potentially been caused by outbreaks of ASF in Vietnam.

Spain holds the largest share of EU exports at 67%, followed by Germany at 44%.

Other key contributors include Denmark (28%), Belgium (18%), Poland (16%) and France (14%).

Exports of pig meat (including offal) from the EU27 to non-EU countries between 2021 and 2025 (YTD Jan–Sep)

from the EU27 to non-EU countries between 2021 and 2025 (YTD Jan–Sep)72.png)

Source: Eurostat compiled by Trade Data Monitor LLC

Imports

EU pig meat imports have totalled 99,600 t so far in 2025 (January to September,) a decrease of 3% (-3,600 t) YoY. The UK remained the biggest supplier at 76,400 t.

Chile is the second largest supplier to the EU for the second year running, shipping 6,600 t of pig meat. This volume is however down by nearly half compared to 2024.

Switzerland, which has historically stood in second place, also saw a notable decrease, with shipments declining by 22% (-1,800 t) YoY. This was partially counterbalanced by an increase of shipments from Norway, up 19% (725 t) YoY to 4,600 t.

EU pig meat imports have declined due to higher domestic production paired with softening consumer demand.

Imports of pig meat (including offal) from the EU27 to non-EU countries between 2021 and 2025 (YTD Jan–Sep)

from the EU27 to non-EU countries between 2021 and 2025 (YTD Jan–Sep)72.png)

Source: Eurostat compiled by Trade Data Monitor LLC

African swine fever

The announcement of African swine fever (ASF) detected in wild boar in Spain on 27 November will have meaningful implications for the EU pork market.

Spain is the EU’s largest producer and exporter of pig meat and is globally significant as the second largest exporter and third largest producer. Catalonia, the region in Spain where ASF is currently present, accounts for around 40% of Spanish pig meat production.

Although regionalisation has been granted for some key export markets (EU, UK, and China), Spanish product can no longer enter most established export channels. This will lead to substantial volumes being redirected into the domestic EU market, likely at heavily discounted prices.

The resulting oversupply will depress market sentiment, pressuring prices downward, and may lead to Spanish product displacing other EU producers from their traditional market base.

While Spain faces trading constraints, other EU producers may see some uplift in global demand as buyers seek alternatives. However, the volume loss from Spain is unlikely to be offset from other European countries due to differing trading agreements. For example, Germany, the second largest EU producer, remains excluded from the Chinese market.

Likewise, although there is opportunity for the UK to increase global exports, our smaller supply base is a limiting factor. This means the large global exporters such as Brazil, the USA and Canada are likely to capture most of the demand.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: