EU pork market update: EU prices plummet as production continues to increase

Thursday, 22 January 2026

Key points

- Average EU pig prices have fallen sharply due to ongoing disease outbreaks and weaker demand

- EU pig meat production has continued to strengthen year-on-year, up 4% between January and October

- EU pig meat exports increased by 3%, totalling 3.68 million tonnes (Jan–Nov), while imports declined by 2.8%, totalling 121,900 tonnes

- Recent cuts to Chinese anti-dumping rates offer some relief but risks remain for traders, especially on fifth-quarter products with limited alternative markets

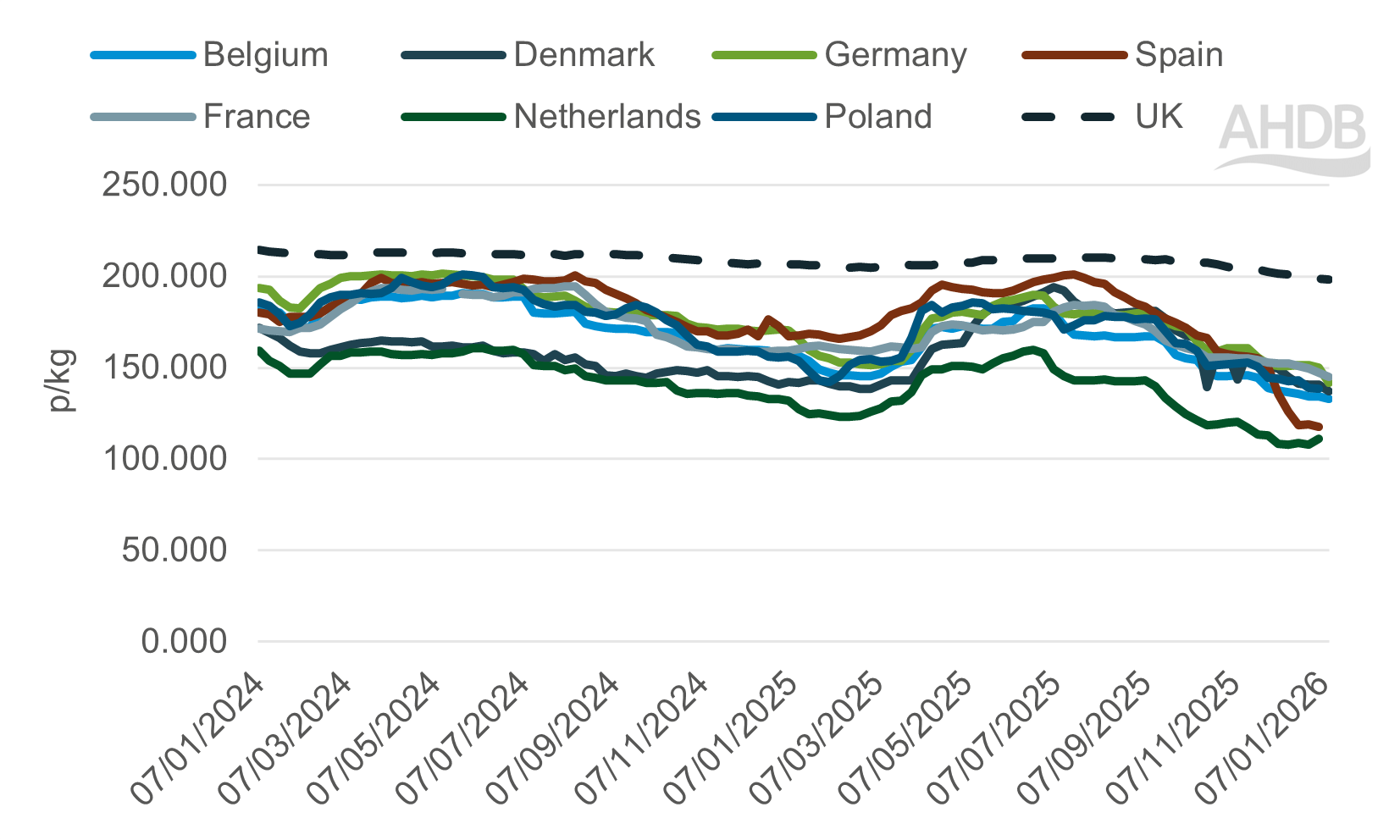

Prices

Significant pressure remains on EU pig prices, with the African swine fever (ASF) outbreak in Spain accelerating the existing downward trend.

The EU grade S reference pig price has been falling since June and stood at 132.68p/kg equivalent in the week ending 11 January, the lowest level since March 2022. Since the start of November alone, the measure has dropped by 23.14p/kg.

Spanish prices have seen particularly sharp declines. Prior to the ASF announcement on 27 November, prices averaged 155.30p/kg (week ending 23 Nov) but had fallen to 117.57p/kg in the week ending 11 January, a drop of 37.73p/kg in just six weeks.

As a result, the gap between UK and EU prices has widened considerably. In the week ending 11 January, the differential stood at 65.46p/kg, the widest in over ten years.

Sustained weakness in EU pig prices is pressuring the UK market.

The widening price gap increases the risk of substitution, as EU pork becomes more price competitive. The country-of-origin data for November shows that British retail facings held relatively stable, but how subsequent data reflects the market will be a key watchpoint.

Select EU27 grade S pig reference prices

Source: European Commission

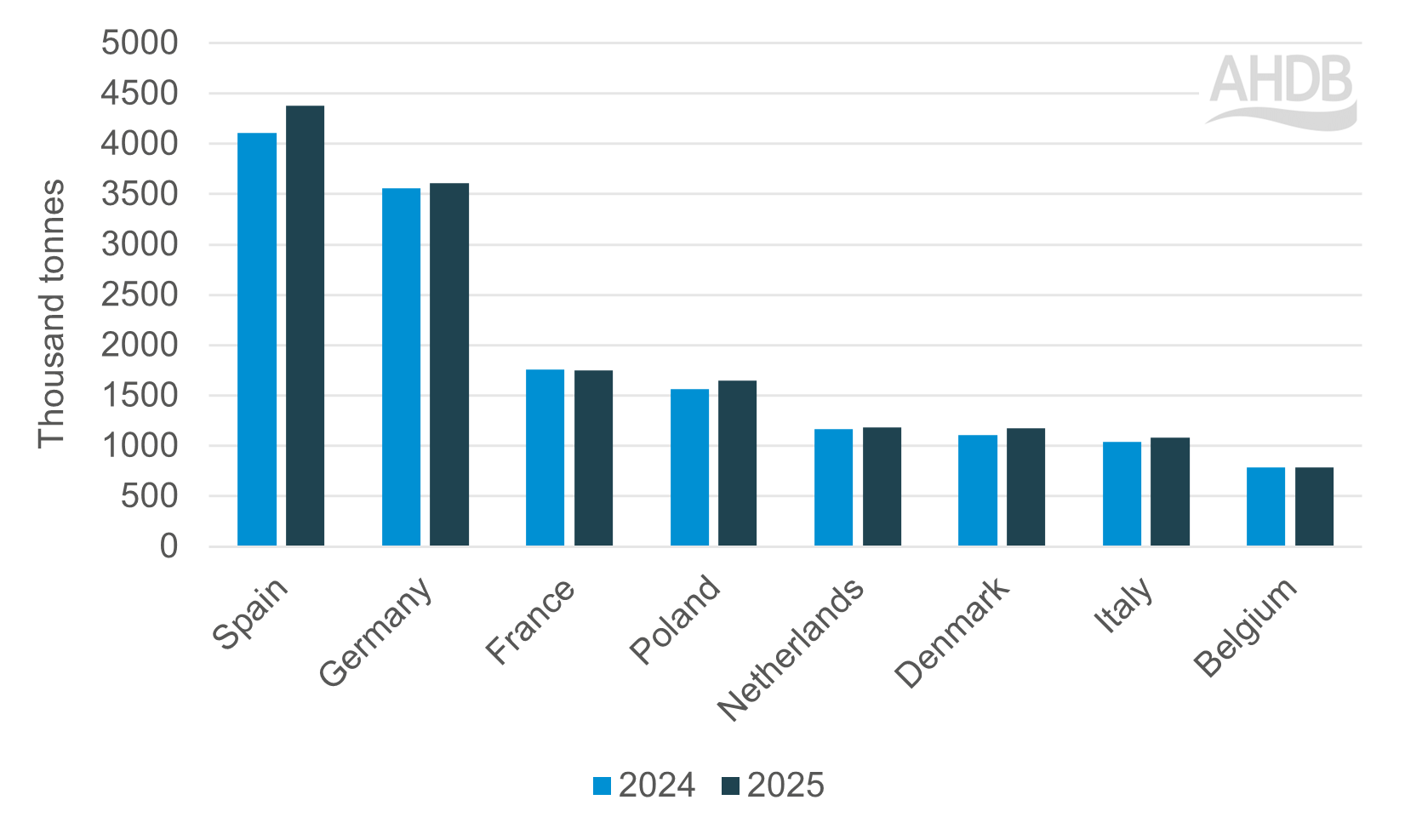

Production

EU pig meat production totalled 18.2 million tonnes from January to October, up 4% year-on-year (YoY), supported by higher slaughter levels and heavier carcase weights.

Growth was largely driven by Spain (+7%; +269,900 t). Other key producing nations showing strong production gains included Poland (5%, +83,000 t), Denmark (6% +70,000 t), and Italy (4% +45,900 t).

Pig meat production of select EU27 countries (YTD Jan–Oct)

Source: European Commission

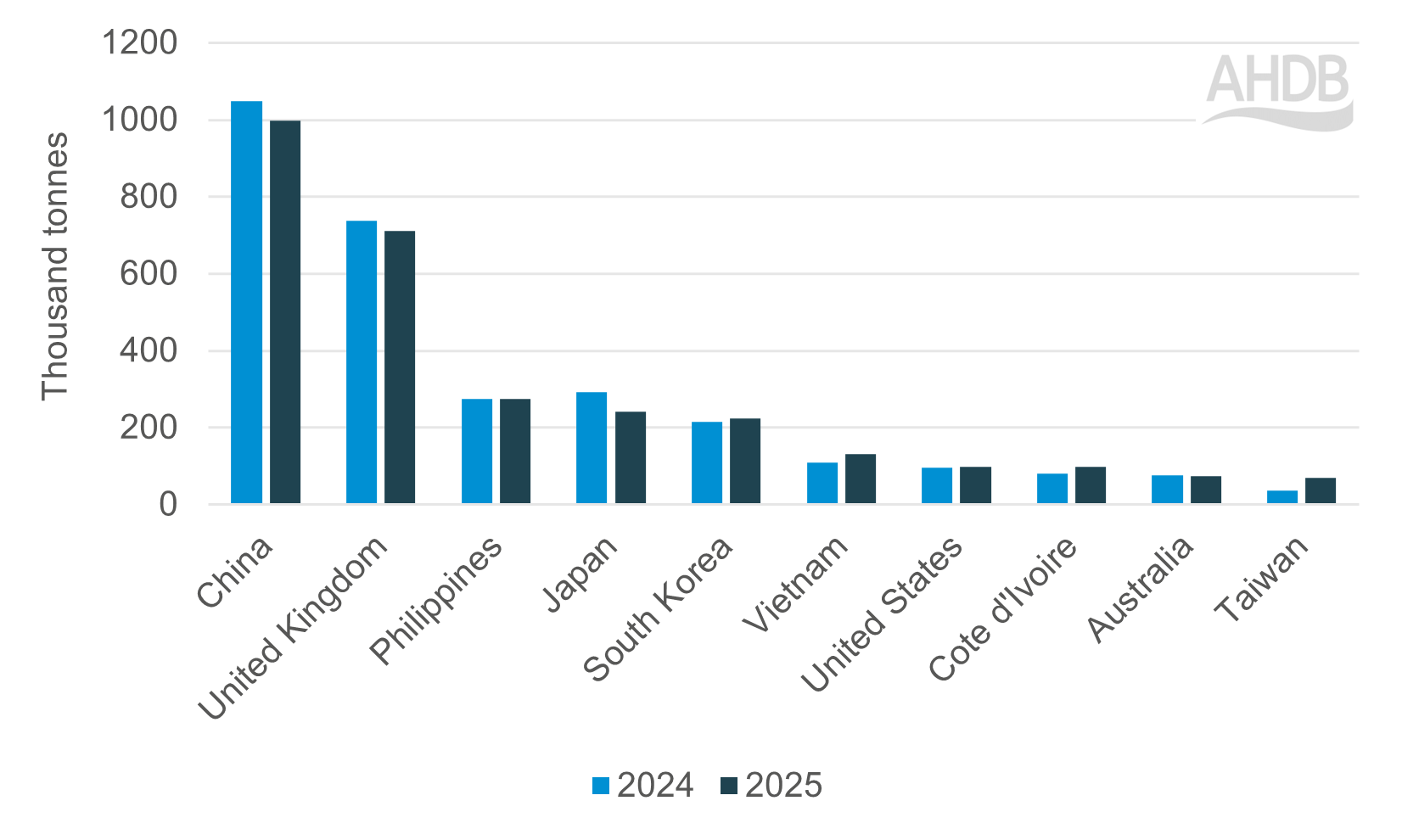

Exports

EU pig meat exports totalled 3.7 million tonnes (Jan–Nov), an increase of 3% (96,600 t).

Exports to China totalled 998,000 t over the period, down 5% (51,000 t) YoY, driven by weaker fresh/frozen pork shipments. Offal exports remained subdued, down 11% YoY in November, likely linked to anti-dumping duties, despite some month-on-month recovery.

Exports to Japan fell by 17% (49,900 t) YoY (Jan–Nov), while exports to Vietnam rose by 21% (23,200 t) YoY, likely reflecting tighter domestic supply linked to disease.

Exports of pig meat (including offal) from the EU27 to non-EU countries between 2024 and 2025 (YTD Jan–Nov)

Source: Eurostat compiled by Trade Data Monitor LLC

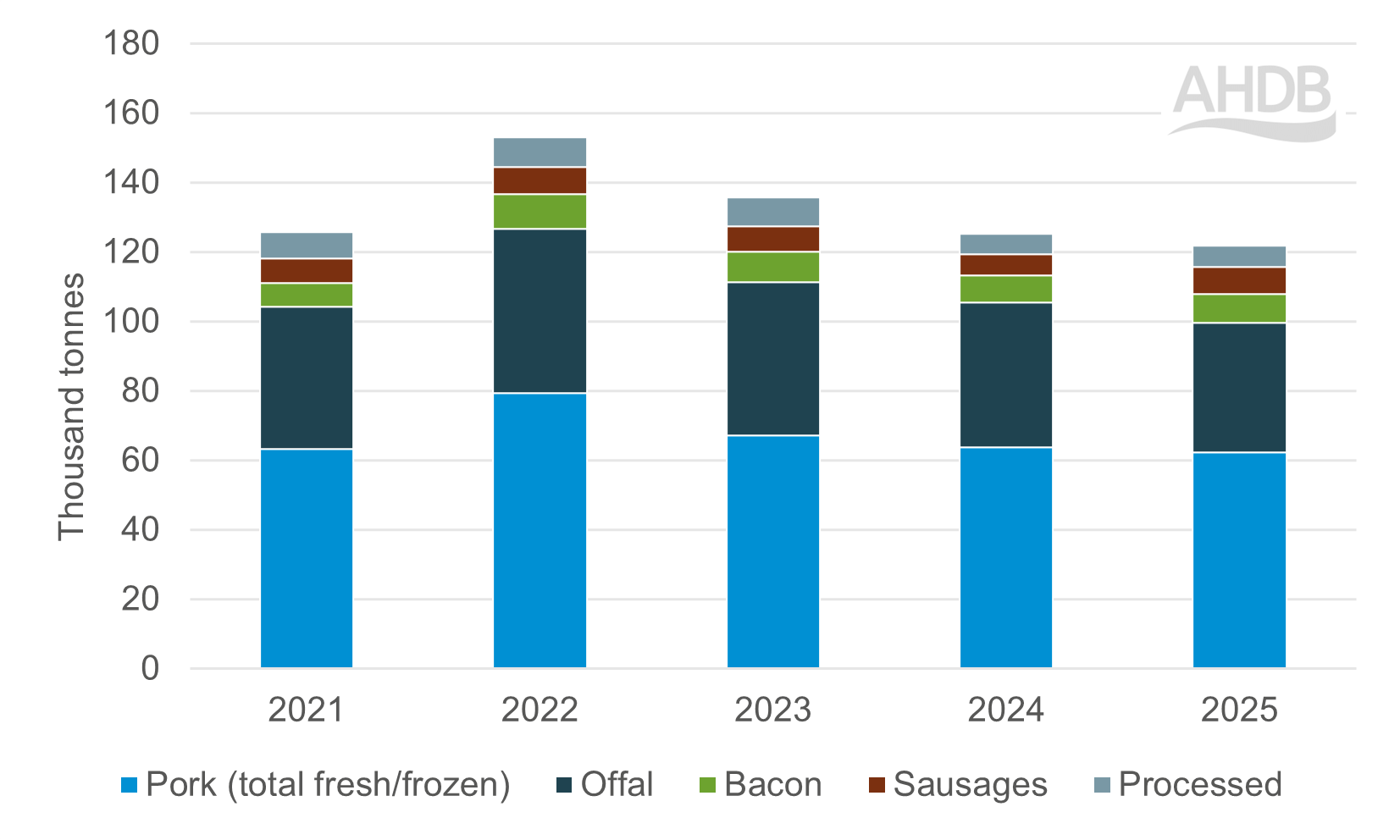

Imports

EU pig meat imports totalled 121,900 tonnes (Jan–Nov) a decrease of 2.8% (3,500 t) YoY. The UK was the still the biggest supplier at 93,800 t.

Imports from Switzerland and Chile declined by (20%; -1,990 t) and (40%; -5,300 t), respectively.

Imports of pig meat (including offal) from the EU27 to non-EU countries between 2021 and 2025 (YTD Jan–Nov)

Source: Eurostat compiled by Trade Data Monitor LLC

Outlook

ASF will remain a key risk for EU pig markets. Spain’s rapid response to the recent outbreak, including strict regionalisation and movement controls, appears to have limited wider disruption.

Spain’s experience reinforces the need for continued UK preparedness.

Expanding regionalisation agreements with trading partners would be critical in maintaining trade should a disease incursion occur. Ongoing industry initiatives, including our biosecurity webinar and best-practice guides, play an important role in raising awareness and reducing disease risk across the supply chain.

On 17 December 2025, China confirmed its final anti-dumping duties. The lower rates improve EU competitiveness into China (and thus against the UK) but structural risks remain for EU producers, especially for fifth-quarter products with limited alternative markets.

The impact of tariff reductions has yet to be fully reflected in the available data and any meaningful shift in trade flows is unlikely to become clear until more up-to-date figures are released.

In the near term, EU pig prices are expected to remain under pressure due to higher supplies, weaker demand and ongoing uncertainty around disease and trade developments.

Sign up for regular updates

You can subscribe to receive Potato Weekly straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

Topics:

Sectors:

Tags: